Valued at a market cap of $15.8 billion, Mid-America Apartment Communities, Inc. (MAA) is a real estate investment trust (REIT) that owns, manages, acquires, develops and redevelops quality apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the U.S. The Germantown, Tennessee-based company is scheduled to announce its fiscal Q3 earnings for 2025 after the market closes on Wednesday, Oct. 29.

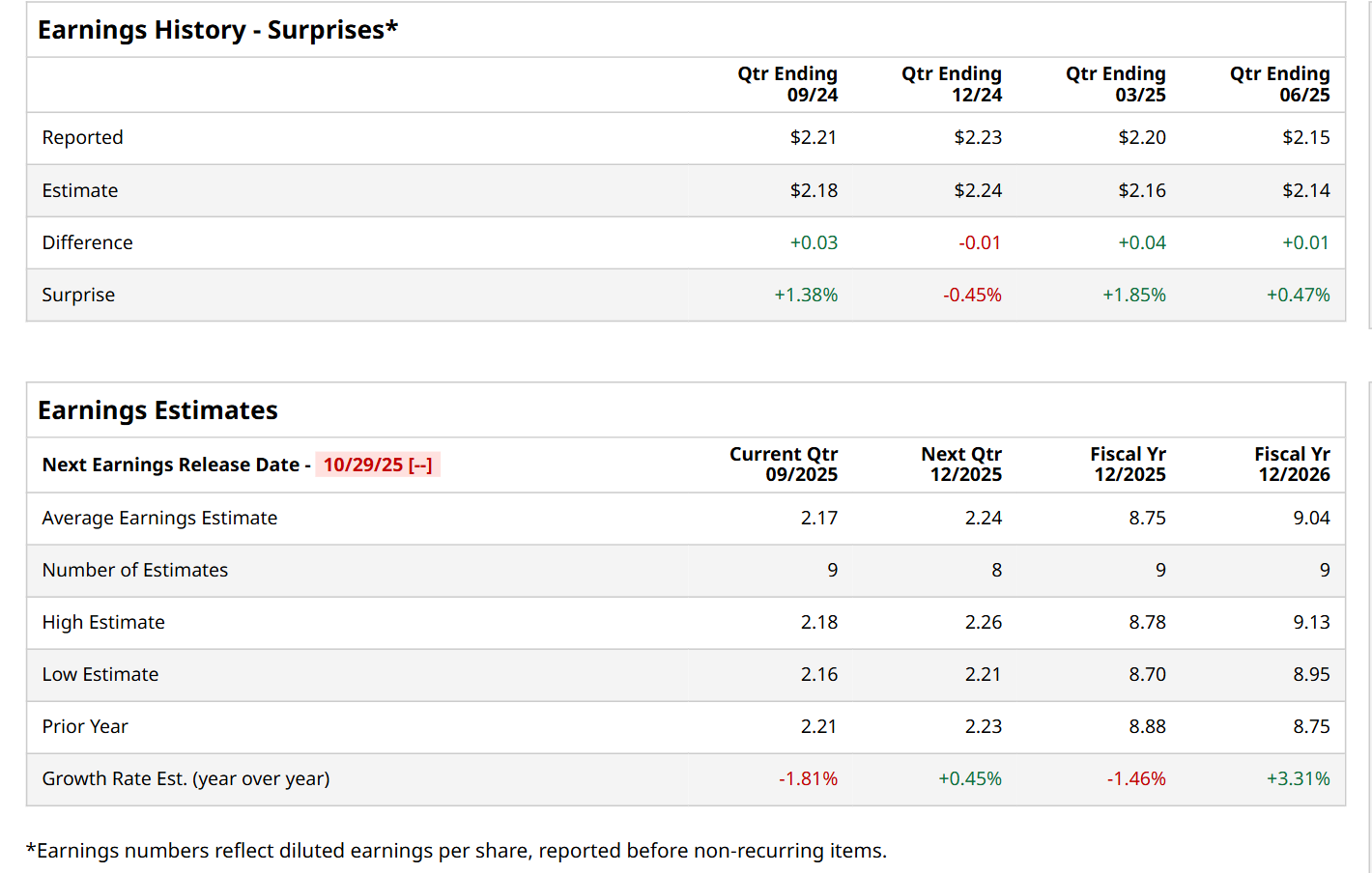

Ahead of this event, analysts expect this residential REIT to report an FFO of $2.17 per share, down 1.8% from $2.21 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. In Q2, MAA’s FFO of $2.15 exceeded the forecasted figure by a slight margin.

For fiscal 2025, analysts expect MAA to report an FFO of $8.75 per share, down 1.5% from $8.88 per share in fiscal 2024. Nonetheless, its FFO is expected to grow 3.3% year-over-year to $9.04 in fiscal 2026.

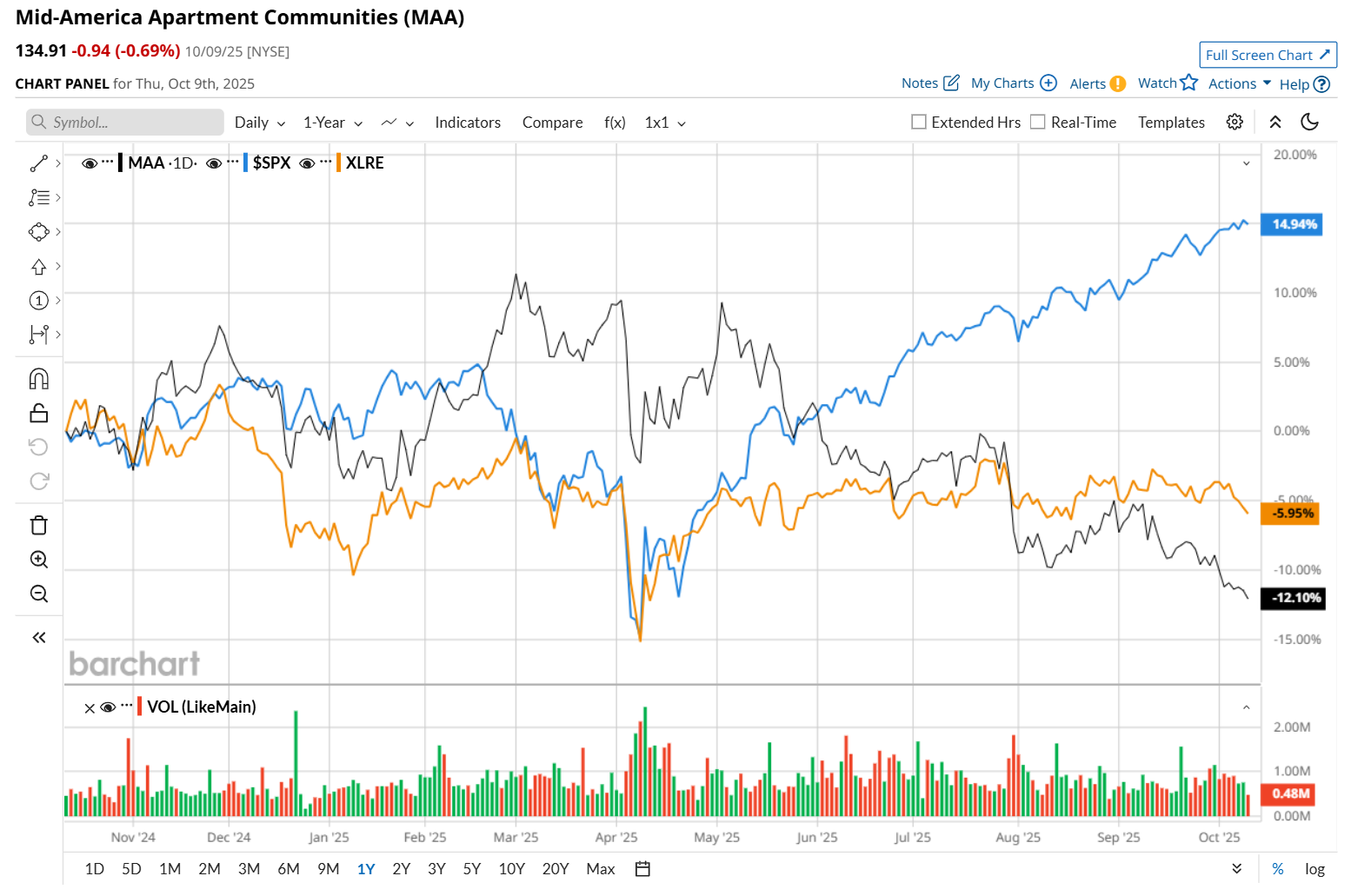

MAA has declined 12% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 16.3% return and the Real Estate Select Sector SPDR Fund’s (XLRE) 4.2% downtick over the same time frame.

On Jul. 30, MAA delivered mixed Q2 results, and its shares tumbled 4.3% in the following trading session. While the company’s rental and other property revenues grew marginally year-over-year to $549.9 million, it missed analyst expectations by a slight margin, which might have unsettled the investors. On the other hand, its core FFO of $2.15 declined 3.2% from the prior-year quarter, but exceeded the consensus estimates by a penny.

Wall Street analysts are moderately optimistic about MAA’s stock, with a "Moderate Buy" rating overall. Among 28 analysts covering the stock, 10 recommend "Strong Buy," two indicate "Moderate Buy," 12 suggest "Hold,” and four advise “Strong Sell.” The mean price target for MAA is $157.68, indicating a 16.9% potential upside from the current levels.