Microsoft investors will be far from alone in closely watching what the software giant has to share about software and cloud services demand amid growing worries about macro pressures.

Among analysts polled by FactSet, the consensus is for Microsoft to report June quarter (fiscal fourth quarter) revenue of $52.38 billion (up 13.5% annually) and GAAP EPS of $2.29 (up 6%) when it reports on Tuesday afternoon.

Microsoft typically provides quarterly sales guidance during its earnings call. For the September quarter, the company’s revenue consensus stands at $51.44 billion (also up 13.5% annually).

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging Microsoft’s reports, which is expected after the close, along with an earnings call scheduled for 5:30 P.M. Eastern Time.

(Please refresh your browser for updates.)

6:42 PM ET: That's a wrap for Microsoft's earnings call. Shares are up 4.6% AH to $263.60 after Microsoft slightly missed FQ4 sales and EPS estimates, but reported strong bookings/backlog growth and (importantly) issued better-than-feared guidance on its earnings call.

On the call, CFO Amy Hood forecast Microsoft's business segments would collectively post September quarter revenue of $49.25B-$50.25B (compares with a $51.44B consensus). Quarterly sales guidance for the More Personal Computing segment (Windows, Surface, Xbox, ads) and the Productivity & Business Processes segment (Office, Dynamics, LinkedIn) was below consensus, but guidance for the Intelligent Cloud segment (Azure, server software) was in-line.

Hood also said Microsoft expects to see double-digit revenue growth in FY23 (ends in June 2023), in both dollars and constant currency (consensus was for 13.4% growth). In addition, operating margin is expected to stay roughly flat in FY23, even after excluding the positive impact from a depreciation accounting change.

Thanks for joining us.

6:32 PM ET: Last question is about Azure consumption.

Hood: We've seen deceleration happen across customer segments and geographies. We see customers continuing to optimize their Azure spend. The Azure guidance accounts for this. Also, it takes times for the large new Azure contracts we've signed to translate into revenue.

6:30 PM ET: A question about SMB spending.

Hood: We did see some weakness in new deals, particularly in the SMB segment, outside of E5. We have to make sure we're fine-tuning our value prop for SMBs. Also, the SMB market is an area where macro weakness tends to present itself.

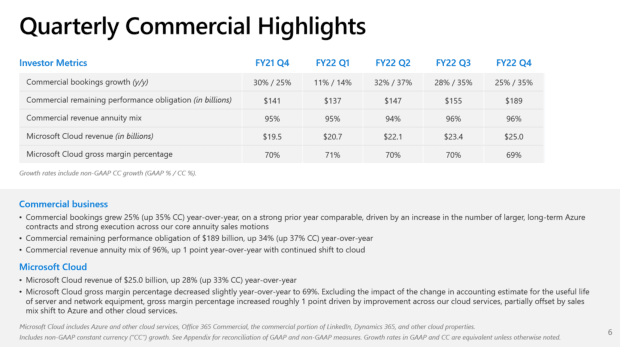

6:25 PM ET: Hood: We've been adding more value to the Office E5 suite, and that's resonating with customers.

6:23 PM ET: A question about Azure, which is expected to see constant-currency revenue growth drop by 3 points sequentially in FQ1.

Hood: We did see some Azure deceleration last quarter. Companies are thinking about which new workloads to prioritize. Our guidance assumes some consumption deceleration. But I still feel very good about the patterns we're seeing. Our larger focus is on helping companies get the most of their investments than the consumption number.

6:21 PM ET: A question about the macro assumptions baked into Microsoft's FY23 guidance.

Hood says the guidance is based on the macro conditions Microsoft is seeing right now. Also takes into account forex, Microsoft's plans to slow opex growth, etc.

6:19 PM ET: Nadella: We're working with customers to help lower their Azure bills. The public cloud will be an even bigger winner coming out of this macro environment. People are writing applications on a completely different frontier of efficiency using cloud services. That also helps productivity.

6:16 PM ET: The Q&A session is starting. First question is about FQ4's strong deal activity.

Nadella: IT spend is going to keep increasing as a % of GDP. Companies are investing in tech to help deal with this macro environment. Also, we have "best-of-suite" solutions that are driving share gains.

6:13 PM ET: FQ1 segment revenue guidance:

Productivity & Business Processes - $15.95B-$16.25B vs. a $16.91B consensus

Intelligent Cloud - $20.3B-$20.6B vs. a $20.58B consensus

More Personal Computing - $13B-$13.4B vs. a $13.8B consensus

Shares are now up 5.8% AH.

6:06 PM ET: Forex is expected to have a 5-point impact on FQ1 growth. Weaker PC/advertising trends are also expected to remain a headwind. However, bookings growth is expected to remain healthy. Capex is expected to be down Q/Q.

Microsoft shares are now up 4.9% AH.

6:05 PM ET: Hood says Microsoft is extending the estimated useful life of its servers from 4 to 6 years, which stretches out their depreciation expenses. This is expected to have a $3.7B impact on op. income in FY23.

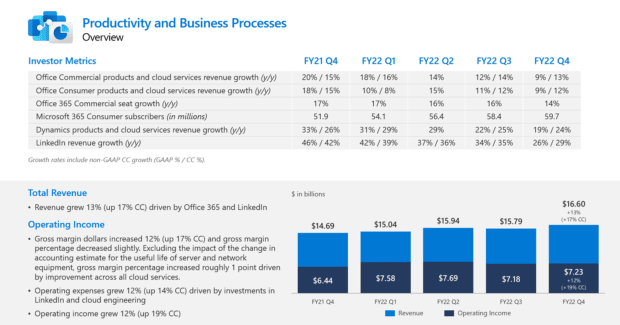

On the flip side, forex is expected have a 4-point impact on FY23 revenue growth.

Hood says Microsoft expects double-digit revenue growth in FY23, in both dollars and constant currency. Operating margins in constant currency are expected to be roughly flat, excluding the depreciation change.

6:02 PM ET: More than $46B worth of capital returns (buybacks/dividends) were carried out in FY22.

6:01 PM ET: Hood: Windows OEM revenue (down 2%) was hurt by softer PC demand, but benefited from share gains. Windows commercial revenue (up 6%) was hurt by softer deal activity among small businesses.

5:57 PM ET: Hood notes Dynamics revenue was impacted a bit by weaker new business activity, and that LinkedIn's ad sales and Talent Solutions revenue also saw some demand headwinds during the quarter.

She also says Azure saw a "slight moderation" in consumption growth during the quarter.

5:55 PM ET: Hood is going over the performance of Microsoft's business segments. Notes Office commercial sales benefited from strong enterprise demand for E5 plans (now 12% of the Office commercial base), while seeing some headwinds among SMBs.

5:54 PM ET: Headcount rose 22% Y/Y (16% exc. the Nuance and Xandr acquisitions).

5:52 PM ET: Hood notes the FQ4 headwinds Microsoft saw from forex, China's COVID lockdowns and softer PC and ad spend, while adding the quarter was Microsoft's best ever for long-term business commitments. Says bookings benefited from strong activity for large Azure and Microsoft 365 deals, as well as good sales execution for renewals.

5:50 PM ET: CFO Amy Hood is now talking.

5:49 PM ET: Nadella says the Xbox Series X/S has been the share leader for next-gen consoles in North America over the last 3 quarters, and that more than 4M people have used Microsoft's cloud gaming platform to stream a game.

5:46 PM ET: LinkedIn saw record engagement in FQ4. LinkedIn Talent Solutions revenue topped $6B over the trailing 12 months, up 39%.

5:45 PM ET: Security revenue rose 40% Y/Y. Nadella asserts Microsoft is taking share across every major security category it participates in.

5:44 PM ET: Seats for Microsoft's relatively costly Office 365 E5 plans are said to have risen more than 60% Y/Y.

5:42 PM ET: Nadella: Teams is taking share across every category and seeing higher usage-intensity. More than 100K companies have deployed custom line-of-business apps in Teams.

Also says Microsoft now has 12M users for Teams' PSTN (telephony) solution.

5:39 PM ET: Nadella says more than 400K people have subscribed to the GitHub Copilot solution for AI-assisted code writing, and that the Power platform now has more than 25M monthly active users (up from ~20M last October).

5:37 PM ET: Nadella says transactions and data volumes for Microsoft's Cosmos DB cloud database rose over 100% Y/Y again.

5:36 PM ET: Nadella highlights recent Azure wins with AmEx, Telstra, Fujitsu, Unilever, etc., as well as partnerships with SAP and Oracle.

5:34 PM ET: Nadella once more starts off by talking up Microsoft's strategic value to businesses. Says Microsoft won a record number of $100M+ and $1B+ Azure deals during FQ4.

5:33 PM ET: Satya Nadella is talking.

5:31 PM ET: Microsoft is going over its safe-harbor statement.

5:30 PM ET: The call is starting.

5:28 PM ET: The call typically features prepared remarks from CEO Satya Nadella and CFO Amy Hood, followed by a Q&A session with analysts. Hood has been sharing guidance towards the end of her remarks.

5:26 PM ET: Hi, I'm back to cover Microsoft's call, which should start in a few minutes.

5:01 PM ET: I'm taking a short break, but will be back to cover Microsoft's earnings call, which starts at 5:30 ET and should contain quarterly guidance and commentary about FY23 expectations.

Shares are currently up 0.2% AH after Microsoft slightly missed FQ4 sales and EPS estimates, albeit while reporting strong commercial bookings and backlog growth.

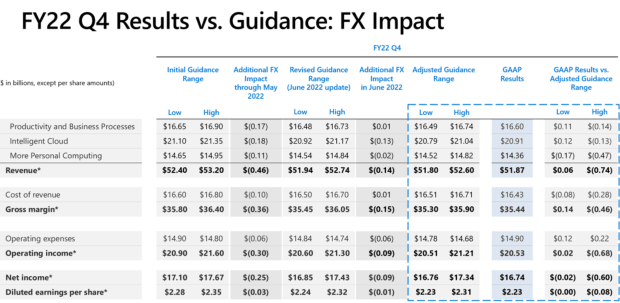

4:58 PM ET: Microsoft's slide deck includes a slide detailing the impact forex had on its top and bottom lines in FQ4. The company notes forex had an additional $140M revenue impact and $90M op. income impact in June following the guidance cut that came early in the month.

Given where the dollar currently stands, forex will likely have an even larger impact on FQ1 results.

4:51 PM ET: As usual, Microsoft's earnings report is accompanied by a Word doc going over all of its quarterly product releases/updates.

By my count, about 60 Azure features/updates arrived during the quarter. Drives how just how much Azure R&D remains a priority as Microsoft tries to gain more ground against AWS (also no slouch when it comes to R&D spend).

4:45 PM ET: Microsoft's stock is now down just 0.3% AH. While guidance (due on the call) remains a big wild card, markets are for now taking the FQ4 miss in stride, given subdued expectations and strong bookings/RPO numbers.

4:41 PM ET: Free cash flow totaled $17.8B in FQ4 (+9% Y/Y), and amounted to more than $65B for the whole of FY22. That helped Microsoft end June with $104.8B in cash/equivalents in spite of ongoing buybacks and M&A, partly offset by $49.8B in debt.

4:37 PM ET: Due to both organic investments and the Nuance acquisition, operating expenses rose 14% Y/Y to $14.9B, after growing 15% in FQ3. With Microsoft reportedly slowing hiring, opex growth might slow in the coming quarters.

4:32 PM ET: Of note: Microsoft spent $8.7B on capex in FQ4, much of it undoubtedly on Azure data centers. That's up from $6.3B in FQ3 and $7.3B a year earlier.

4:29 PM ET: Office continues humming along for now. Office commercial and consumer revenue each rose 9% Y/Y, with CC growth similar to FQ3's. Office 365 commercial seats rose 14% Y/Y and Microsoft 365 consumer subs rose by 1.3M Q/Q to 59.7M.

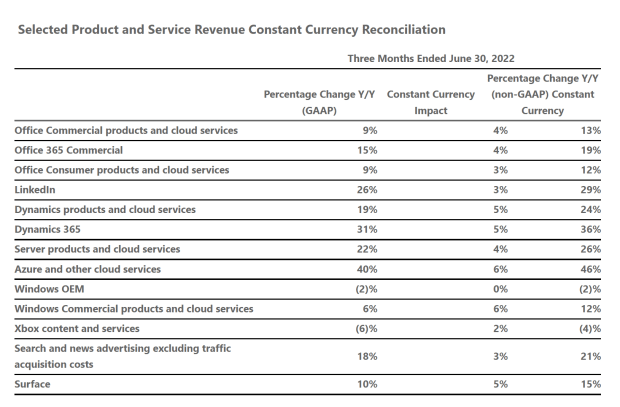

4:23 PM ET: FQ4 revenue growth (in dollars and CC) for various Microsoft products and services. Two businesses with heavy consumer exposure (Xbox content/services and Windows OEM) saw revenue declines, but all of the others grew. LinkedIn's 26% growth is notable given recent ad market pressures.

4:18 PM ET: Hurting FQ4 EPS: Microsoft recorded $126M in operating expenses related to its decision to "significantly scale down" its Russian operations, and $113M in severance expenses as part of a "strategic realignment" of business groups.

Boosting EPS: $7.8B was spent on buybacks (even with FQ3).

4:13 PM ET: Perhaps helping the stock: Microsoft's bookings numbers are pretty healthy. Commercial bookings rose 25% Y/Y in dollars and 35% in CC, and commercial remaining performance obligation (RPO - revenue under contract that hasn't been recognized yet) rose 34% to $189B.

4:09 PM ET: Microsoft has pared its losses a bit: Shares are now down 1.5% AH. Expectations for this report were relatively low. But as a reminder, Microsoft shares its guidance on its earnings call (starts at 5:30 ET).

4:08 PM ET: In its slide deck, Microsoft says its Windows OEM revenue (down 2% Y/Y) saw a $300M+ hit from China production shutdowns and a weakening PC market, and that weaker ad spend had a $100M+ impact.

4:06 PM ET: "Azure and other cloud services" revenue rose 40% Y/Y (46% in CC), which compares with 46% growth (49% in CC) in FQ3.

4:04 PM ET: Forex was a 4-point headwind to revenue growth: Revenue rose 12% Y/Y in dollars and 16% in constant currency.

4:02 PM ET: Results are out. FQ4 revenue of $51.87B is below a $52.38B consensus. GAAP EPS of $2.23 is below a $2.29 consensus.

Shares are down 2.7% AH.

3:59 PM ET: Microsoft shares have fallen 2.9% today, amid a 1.9% Nasdaq drop. In an apparent sign of how jittery many investors are about Microsoft's report, a number of cloud software stocks have fallen more than 5%.

3:56 PM ET: Microsoft's stock is down 25% YTD heading into its report, nearly matching the Nasdaq's 26% drop. In early June, the company slightly lowered its June quarter guidance on account of forex swings (since then, the dollar has strengthened further against various foreign currencies).

3:53 PM ET: Given macro worries and some recent, cautious commentary from software firms such as ServiceNow, SAP and Qualtrics, both Microsoft's numbers and demand commentary are bound to be closely watched. Along with its sales/EPS figures, the company's commercial bookings/RPO numbers (typically shared in its slide deck) are bound to get attention.

3:48 PM ET: The FactSet consensus is for Microsoft to report FQ4 revenue of $52.38B and both GAAP and non-GAAP EPS of $2.29.

For FQ1, the consensus is for Microsoft to guide for its business segments to collectively post revenue of $51.44B.

3:46 PM ET: Hi, this is Eric Jhonsa. I'll be live-blogging Microsoft's earnings report and call.