/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

Microsoft (MSFT) delivered stronger-than-expected fiscal fourth-quarter financials, getting a boost from the solid demand for its cloud computing services and its artificial intelligence (AI) offerings. The market responded swiftly to the upbeat earnings, with MSFT shares jumping more than 8% in the pre-market session.

Microsoft’s strong financials show that the tech giant has strengthened its competitive positioning in two of the fastest-growing areas in techA. It has built a comprehensive AI tech stack that spans infrastructure, tools, and applications. On the cloud front, Azure continues to grow, strengthening Microsoft’s leadership in enterprise IT as more organizations shift to digital-first strategies.

The positives are reflected in MSFT stock. Notably, Microsoft stock has witnessed a strong run, rallying sharply over the past three months. While its valuation is undoubtedly less of a bargain after the recent run-up, Microsoft’s long-term growth outlook remains compelling.

Microsoft is benefiting from current AI and cloud demand and also laying the groundwork for sustained future growth. Its large backlog of enterprise contracts points to a steady stream of recurring revenue, while its AI tools are quickly becoming essential for businesses looking to improve productivity and modernize their operations.

The solid demand environment and the tech giant’s significant capital investments suggest that the rally in MSFT stock is far from over.

Microsoft to Maintain Its Upward Trajectory

Microsoft delivered record-breaking fourth-quarter results, driven by surging demand for its cloud and AI services. Microsoft’s commercial bookings surpassed the $100 billion mark, up 37% from the prior year. This growth was powered by strong performance in long-term cloud contracts, including a significant increase in $10 million and $100 million-plus deals for both Azure and Microsoft 365.

Cloud remains the centerpiece of Microsoft’s growth story. Total cloud revenue reached $46.7 billion for the quarter, growing 27% year-over-year.

Microsoft’s Productivity and Business Processes segment also performed strongly, generating $33.1 billion in revenue, an increase of 16%. That growth was fueled by both commercial and consumer cloud products under the M365 umbrella.

M365 commercial cloud revenue rose 18%, topping internal forecasts. Average revenue per user (ARPU) continues to benefit from the adoption of premium offerings like E5 and the AI-powered M365 Copilot. Microsoft also saw a 6% year-over-year increase in paid commercial seats, with expansion especially strong among small to mid-sized businesses and frontline workers.

Looking ahead to the first quarter, Microsoft expects M365 commercial cloud growth to land between 13% and 14% in constant currency, with ARPU growth again supported by premium tier adoption and AI tools. On the consumer side, M365 cloud revenue grew 20%, driven by both subscriber growth (up 8%) and higher ARPU following a recent price increase. The company anticipates continued momentum, projecting low-twenties percentage growth in the coming quarter.

The Intelligent Cloud segment, which includes Azure, saw revenue climb to $29.9 billion, a 26% increase. Azure itself grew revenue 39%, thanks to strong demand from large enterprise customers for core infrastructure services. While Microsoft is steadily adding data center capacity to meet demand, the appetite for Azure’s AI and cloud capabilities still exceeds available supply.

Looking ahead, Microsoft projects Intelligent Cloud revenue of $30.1 to $30.4 billion in Q1, with Azure expected to grow around 37% in constant currency. Continued strength in demand for Microsoft’s comprehensive cloud portfolio positions Azure to remain a key driver of growth.

Wall Street Recommends a ‘Strong Buy’ on MSFT Stock

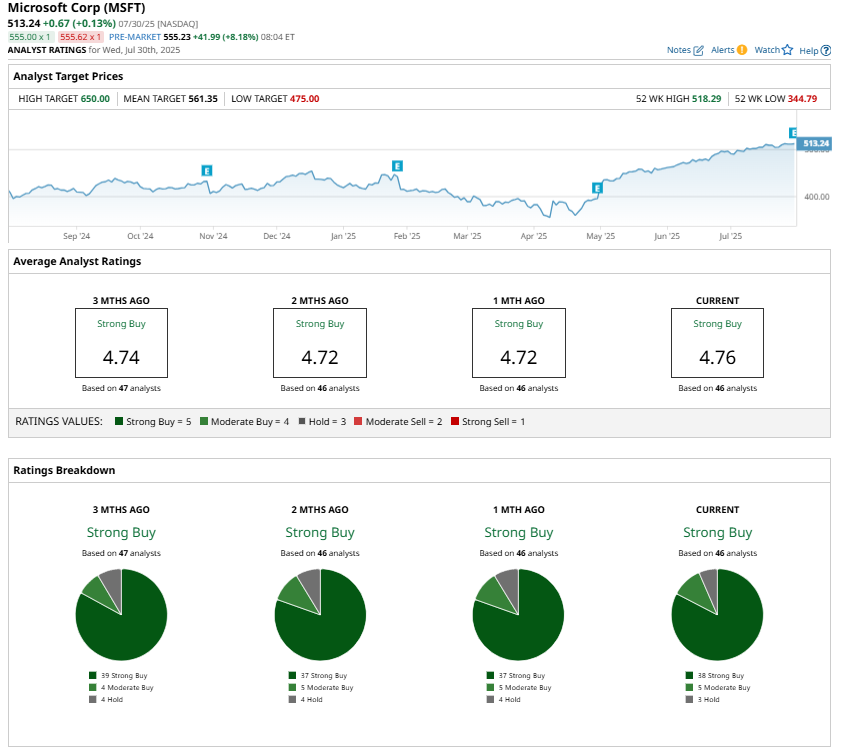

Wall Street analysts remain bullish on Microsoft, with a consensus rating of “Strong Buy.” While the Street has an average price target of $561.35 on MSFT stock, the latest earnings beat and positive guidance suggest that analysts will revise their price targets upward.

In short, Microsoft’s AI and cloud momentum provide a solid foundation for durable growth. With strong fundamentals, expanding enterprise adoption, and significant scale, Microsoft appears well-positioned to maintain its upward trajectory. While the stock may not be cheap, MSFT still looks like a solid bet.