Micron Technology stock rose Monday after the memory-chip maker raised its guidance for the current quarter.

The Boise, Idaho-based company now expects to earn an adjusted $2.85 a share on sales of $11.2 billion in its fiscal fourth quarter ending Aug. 28. That's based on the midpoint of its outlook. Analysts polled by FactSet were looking for earnings of $2.51 a share on sales of $10.75 billion.

"This revised guidance reflects improved pricing, particularly in DRAM, and strong execution," the company said in a news release. DRAM stands for dynamic random-access memory.

Micron had previously guided to adjusted earnings of $2.50 a share on sales of $10.7 billion for fiscal Q4. In the year-ago quarter, Micron earned an adjusted $1.18 a share on sales of $7.75 billion.

On the stock market today, Micron stock rose 4.1% to close at 123.75. Micron is in a cup base with a buy point of 129.85, according to IBD MarketSurge charts.

Mizuho Securities analyst Vijay Rakesh reiterated his outperform rating on Micron stock and raised his price target to 155 from 150.

Micron's improved outlook likely stems from strong demand for the company's high-bandwidth memory for data centers running AI applications, Rakesh said.

Intel, Nvidia, AMD Also Making News

Other chip stocks moving on news Monday included Intel, Nvidia and Advanced Micro Devices.

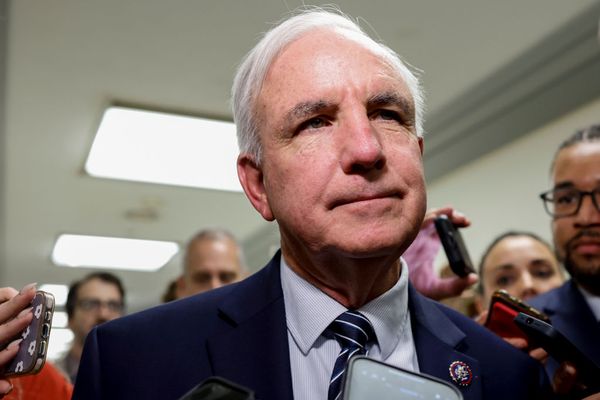

Intel Chief Executive Lip-Bu Tan was scheduled to visit the White House Monday after President Donald Trump called for his removal last week over ties to Chinese businesses, the Wall Street Journal reported on Sunday.

Intel stock rose 3.7% to close at 20.68 on Monday.

AMD and Nvidia shares wavered on news that both have received U.S. export licenses to ship AI processors to China. However, both will have to give 15% of the revenue generated from those China sales to the U.S. government, according to media reports.

Mizuho Securities trading-desk analyst Jordan Klein said it is "way better" for AMD and Nvidia to get 85% of the billions in expected sales to China than "100% of nothing."

Meanwhile, Taiwan Semiconductor Manufacturing, the contract manufacturer for both AMD and Nvidia, is likely to the "biggest winner" from the resumption of AI chip sales to China, Klein said in a client note.

Follow Patrick Seitz on X at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.