/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

The government acquiring a stake in a private company is a rare occurrence in the United States. That is why the Trump administration's new 10% stake in chipmaker Intel (INTC) has been a hot topic of debate. While some have argued that such a move is akin to a socialist regime and not the free market-centric U.S., others have lauded the move, citing national security concerns.

Now, the government has set its sights on memory and storage solutions provider Micron Technology (MU). A beneficiary of the Biden-era CHIPS Act, Micron received subsidies worth $6.2 billion from the government last year to produce chips in the U.S. Well, President Donald Trump reckons that this funding should not be free, and the government should be allowed to wet its beak.

How this would happen isn't clear, and the messaging coming out of the White House has been inconsistent to say the least.

About Micron

Founded in 1978, Micron specializes in memory and storage solutions, including DRAM, NAND and NOR flash memory, and SSDs. These products are critical components in a wide range of devices, from personal computers and smartphones to data centers, automobiles, and industrial equipment. Notably, Micron operates through several well-known brands, including Micron and Crucial, serving both enterprise and consumer markets.

Valued at a market cap of $131.2 billion, the MU stock is up 37.8% on a YTD basis. Further, the stock offers a dividend yield of 0.39%, and with a payout ratio of just 7.14%, the scope for further growth remains.

But the pertinent question remains: What does the government's potential interest in a stake in the company mean for MU stock? Let's take a closer look.

Micron's Financials Are Strong

Micron has been a consistent performer over the past several years, with its revenues and earnings climbing at 10-year CAGRs of 7.23% and 5.69%, respectively. Granted, it may not jump out as being extraordinary, but it is decent, especially considering the other company in which the government has already taken a stake in: Intel.

Moreover, Micron has reported an earnings beat in nine consecutive quarters. In the most recent quarter, i.e. Q3 2025, Micron's revenues came in at $9.3 billion. This marked a yearly growth of 36.6%, with gross margins expanding to 39% from 28.1% in the same period.

The EPS of $1.91 reflected a quadrupling of the earnings from the previous year's figure of $0.62 per share. This also came in higher than the consensus of $1.60 per share.

Net cash flow from operating activities also saw a jump to $11.8 billion from $5.1 billion in the year-ago period as the company closed the quarter with a healthy cash balance of $10.2 billion. This exceeded the short-term debt levels of $538 million by a wide margin.

For Q4 2025, Micron is projecting revenues to be in the range of $10.4-$11 billion, the midpoint of which would mark a year-over-year (YoY) revenue growth rate of 38.1%.

Micron's Unique Positioning Poises It for Growth

Micron is much better positioned for growth than Intel, too.

A major growth driver for Micron is its High Bandwidth Memory (HBM), an advanced form of DRAM that delivers much faster data transfer speeds while using less power. Its entire HBM supply for 2025 is already sold out, and it is shipping in high volumes to four customers, including AMD’s (AMD) Instinct MI355X GPUs, which use Micron’s 36GB HBM3E.

Meanwhile, Micron has a strong competitive edge in energy efficiency as its HBM3E consumes roughly 30% less power than rival products. In AI data centers, where energy use is a key cost and performance factor, this advantage is critical. Further, the next-generation HBM4, already in testing with several customers, is expected to deliver 2TB/s bandwidth with 20% less power consumption. Sampling should begin by mid-2025, with mass production in 2026, positioning Micron well for future AI accelerator demand.

Another catalyst is the increasing speed of its 1-gamma DRAM production. Micron recently began shipping the industry’s first 1-gamma-based DDR5 products, made using EUV lithography for higher density, lower costs, and better margins.

Finally, Micron also stands out as the only large-scale HBM supplier outside of South Korea, offering customers valuable supply chain diversification amid rising geopolitical tensions, making it a crucial strategic partner for many technology companies.

Analyst Opinion

Thus, Micron is in a much better position than Intel, and the proposed government stake in the company opens it up to possible interventions that may hinder its superb growth prospects. So, investors should be wary of the same. Otherwise, the company looks solid, with the analyst community believing as much.

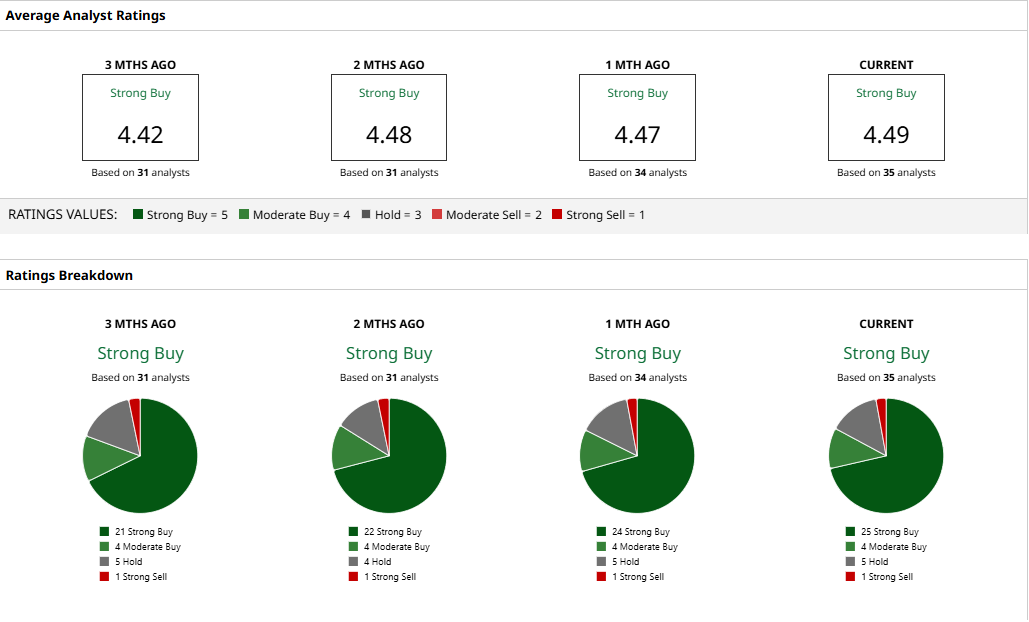

Overall, analysts have deemed the MU stock a “Strong Buy” with a mean target price of $152.42. This denotes an upside potential of about 31.6% from current levels. Out of 35 analysts covering the stock, 25 have a “Strong Buy” rating, four have a “Moderate Buy” rating, five have a “Hold” rating, and one have a “Strong Sell” rating.