/Microchip%20Technology%2C%20Inc_%20HQ%20sign-by%20Michael%20Vi%20via%20Shutterstock.jpg)

With a market cap of $36.5 billion, Microchip Technology Incorporated (MCHP) develops and manufactures smart, connected, and secure embedded control solutions for global markets. Its diverse product portfolio includes microcontrollers, analog and interface products, memory, FPGAs, and application development tools, serving industries such as automotive, industrial, communications, and aerospace.

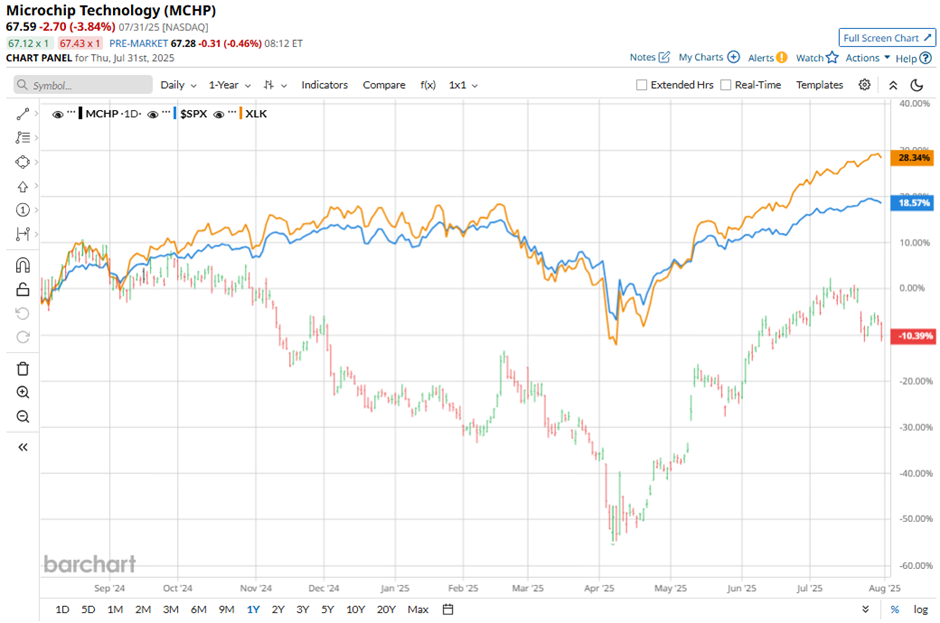

Shares of the Chandler, Arizona-based company have underperformed the broader market over the past 52 weeks. MCHP stock has declined 21.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.6%. However, shares of Microchip Technology have gained 17.9% on a YTD basis, lagging behind SPX's 7.8% rise.

Looking closer, the chipmaker stock has also fallen behind the Technology Select Sector SPDR Fund's (XLK) 25.2% return over the past 52 weeks.

Shares of Microchip Technology climbed 12.6% following its Q4 2025 results on May 8. Adjusted earnings came in at $0.11 per share and revenue reached $970.5 million, surpassing Wall Street’s consensus. The company also guided Q1 revenue between $1 billion and $1.1 billion and projected EPS of $0.18 to $0.26, further boosting investor confidence amid industry-wide inventory normalization and strategic expansion into automotive and industrial markets.

For the current fiscal year, ending in March 2026, analysts expect MCHP's EPS to grow 12.9% year-over-year to $1.14. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

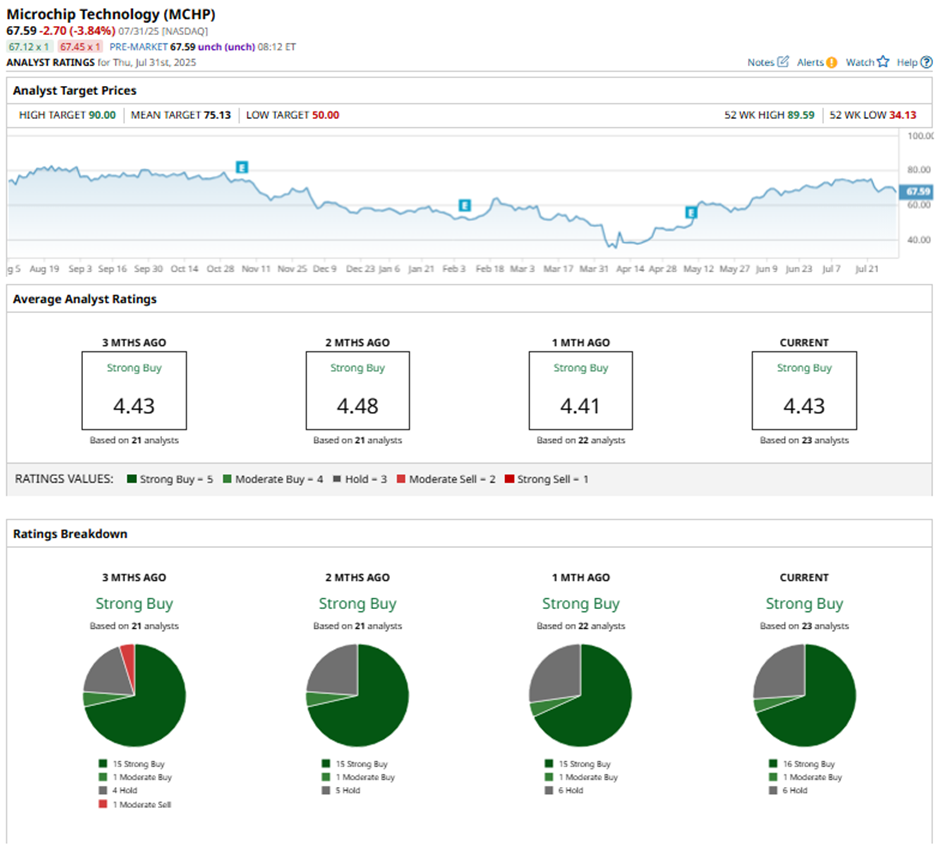

Among the 23 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 16 “Strong Buys,” one “Moderate Buy” rating, and six “Holds.”

On May 12, Citi raised its price target on Microchip to $55, maintaining a “Buy” rating.

As of writing, the stock is trading below the mean price target of $75.13. The Street-high price target of $90 implies a potential upside of 33.2% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.