Venture capitalist Sarah Kunst of Cleo Capital is raising concerns regarding Meta Platforms Inc.'s (NASDAQ:META) latest reorganization and its high-priced push into artificial intelligence, warning that the strategy could mirror the company's failed metaverse experiment.

Building A “Super Team” of Engineers

On Monday, Kunst noted that while Meta is splitting into four divisions, “the fourth one is TBD,” or to be determined, a move she describes as “kind of reflects the mood inside of Meta right now,” while appearing on CNBC’s Worldwide Exchange.

She says CEO Mark Zuckerberg wants to give Alexandr Wang and Nat Friedman “the two guys he is reportedly paying billions to come in and do this, some room to run.”

She compares Meta's approach to building an NBA “super team,” recruiting top engineers from Apple, Scale AI and others. But she’s skeptical about whether the model would work. “I don't think anyone's the ’96 Bulls,” she says, referring to the 1995-96 Chicago Bulls Basketball team, which is widely seen as one of the greatest basketball teams of all time.

According to Kunst, even with this top talent, the company’s efforts could end in failure, much like it did with “the Metaverse,” citing the mix of egos, oversized pay packages, and the lack of drive that could make it tough to win.

“Zuck has pulled crazy things off before. But I think this might look a little bit more like the metaverse days than the early days of Facebook in terms of the output here,” she says.

Success, she says, will depend on whether Meta can integrate its costly new hires into its culture. If not, "it's sort of like a bad transplant and the body starts to reject the organ.”

Meta Faces Growing AI Scrutiny

Meta recently came under criticism from prominent short seller Jim Chanos, who accused the company of overstating profits through extended depreciation schedules on its AI infrastructure.

“If the true economic life on its GPUs is actually 2–3 years, most of its profits are materially overstated,” Chanos said on X, late last month.

This comes as the company plans $100 billion in AI-related capex for 2026, which, according to CFO Susan Li, will require significant external financing.

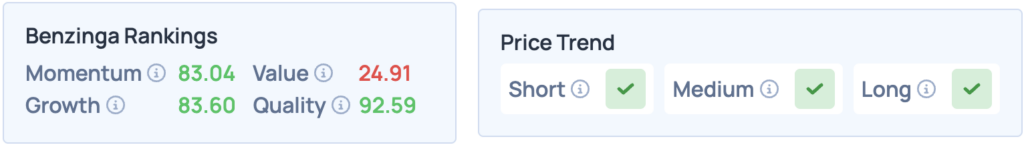

Shares of Meta Platforms were down 2.27% on Monday, closing at $767.37, and another 0.05% after hours. The stock scores high on Momentum, Growth and Quality in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo Courtesy: Skorzewiak on Shutterstock.com