/Meta%20Platforms%20by%20Primakov%20via%20Shutterstock.jpg)

Meta Platforms (META) is cutting approximately 600 positions within its Superintelligence division as CEO Mark Zuckerberg works to streamline artificial intelligence (AI) operations that have become “overly bureaucratic.”

The layoffs affect employees across AI infrastructure units, the Fundamental AI Research lab, and product-related positions, though the company's TBD Labs unit remains untouched.

Chief AI Officer Alexandr Wang, hired in June following Meta's $14.3 billion investment in Scale AI, explained in an internal memo that reducing team size will enable faster decision-making and give remaining employees greater scope and impact. The cuts reflect Zuckerberg's growing frustration with Meta's AI progress after the lukewarm reception to its Llama 4 models released in April.

Meta invited affected workers to apply for other internal positions and expects most will land elsewhere within the company. Employees received 16 weeks of severance, plus two weeks for each year of service. The restructuring solidifies Wang's role in steering AI strategy, underscoring Zuckerberg's preference for expensive recent hires over legacy employees.

Meta's Superintelligence Labs now employs just under 3,000 people following the reduction. The company continues aggressive AI investments, including a $27 billion Louisiana data center partnership, and raised 2025 expense guidance to $114 billion to $118 billion.

Is Meta Stock a Good Buy Right Now?

Meta Platforms continues to push aggressively into AI and smart glasses technology despite recent workforce adjustments in its Superintelligence division. CFO Susan Li emphasized that Meta aims to balance near-term profitability with longer-term investments spanning multiple time horizons, from core advertising improvements to frontier AI models and next-generation computing platforms.

The social media giant has been delivering operating profit growth while funding ambitious projects across its portfolio. Li noted that investments made during the 2025 budgeting cycle have been paying off across the family of apps and monetization teams, with core ranking and recommendation improvements driving engagement and revenue growth.

Meta maintains robust instrumentation to measure returns on these projects, though uncertainty remains around marginal returns as engineering teams scale. The advertising business has consistently outgrown the broader digital advertising market over the past 18 months despite its massive scale.

The company's Ray-Ban Meta smart glasses continue to gain traction, with sales trajectories comparable to some of the most popular consumer electronics in history. Meta announced next-generation Ray-Ban models featuring double the battery life, 3k video recording, and new conversation focus technology that amplifies voices in noisy environments.

The glasses already support live AI translation across multiple languages and are positioned as the ideal form factor for personal superintelligence, allowing AI to see and hear what users experience throughout the day.

New Oakley Meta Vanguard glasses target the performance segment with marathon-length battery capacity, 122-degree field-of-view cameras, powerful open-ear speakers, and partnerships with Garmin (GRMN) and Strava for automatic video capture and stat overlays.

Meta also unveiled prototype Orion AR glasses featuring holographic displays, though these remain years from commercial release. The tech behemoth is exploring various financing structures for its expanding data center infrastructure, including partnerships and traditional cloud leases, to achieve flexibility amid ambitious capacity plans.

CEO Mark Zuckerberg indicated U.S. investments totaling $600 billion through 2028 will cover data centers, business operations, and employee hiring across major offices.

Meta maintains its commitment to returning capital through dividends and share buybacks while offsetting equity dilution from employee compensation.

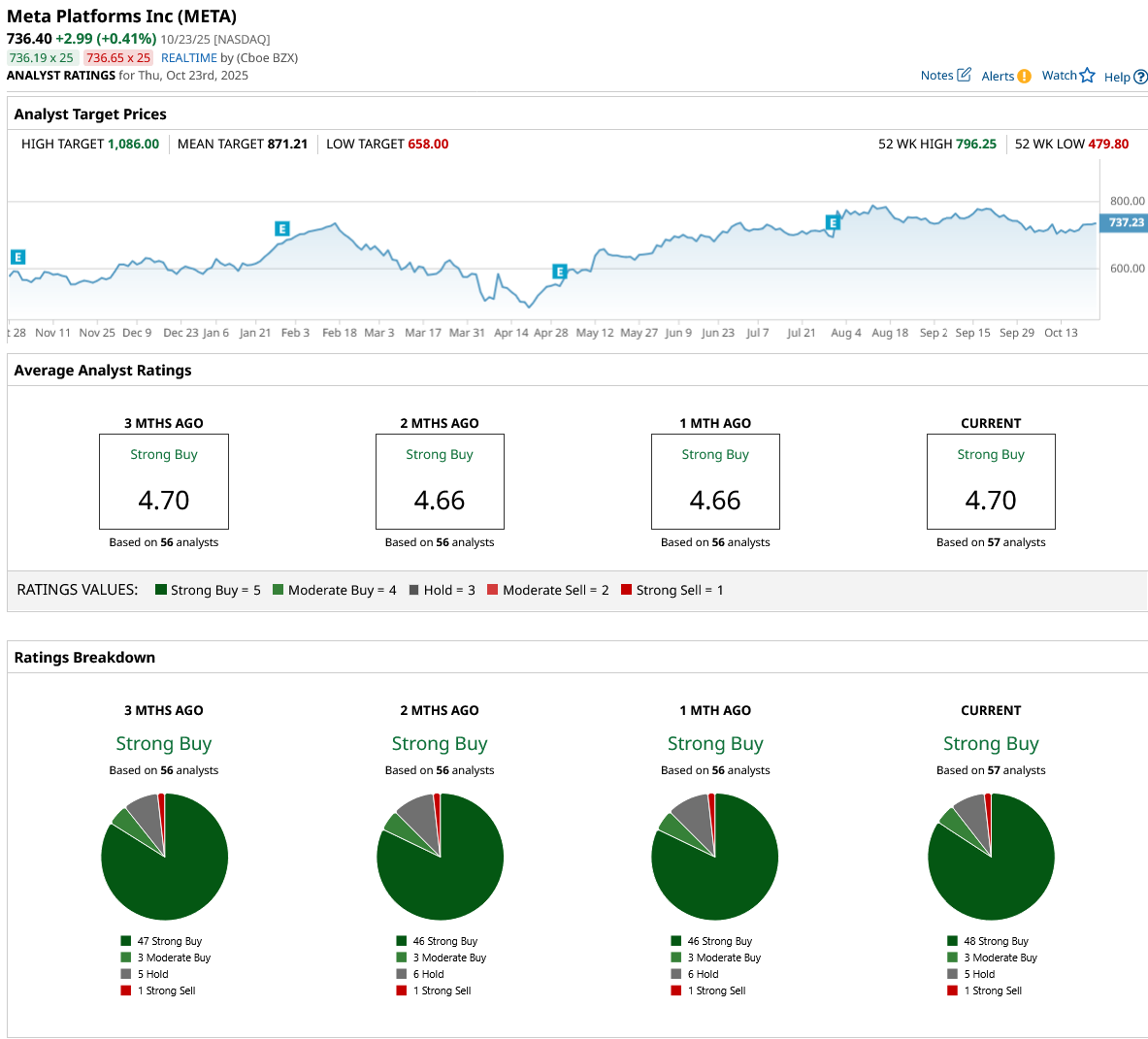

What Is the META Stock Price Target?

Analysts tracking META stock forecast revenue to increase from $164.5 billion in 2024 to $325 million in 2029. Comparatively, adjusted earnings are projected to expand from $23.86 per share to $45.56 per share in this period. If META trades at 25x forward earnings, a relatively moderate valuation, it could gain over 50% within the next four years.

Out of the 57 analysts covering META stock, 48 recommend “Strong Buy,” three recommend “Moderate Buy,” five recommend “Hold,” and one recommends “Strong Sell.” The average META stock price target is $871.21, above the current price of about $736.