Mastercard Incorporated (NYSE:MA) reported better-than-expected second-quarter financial results on Thursday.

The company reported quarterly net revenues of $8.13 billion, up 17% year-over-year and 16% Y/Y on a neutral currency basis, beating the analyst consensus estimate of $7.95 billion. Adjusted EPS rose 16% Y/Y to $4.15, exceeding the analyst consensus estimate of $4.02.

Mastercard expects net revenue growth in the high teens for the third quarter, versus the $8.29 billion analyst consensus estimate. The company now expects high-end mid-teens revenue growth (prior low teen-digit revenue growth) for fiscal 2025 versus the $31.96 billion analyst consensus estimate.

Mastercard shares fell 1% to trade at $560.72 on Friday.

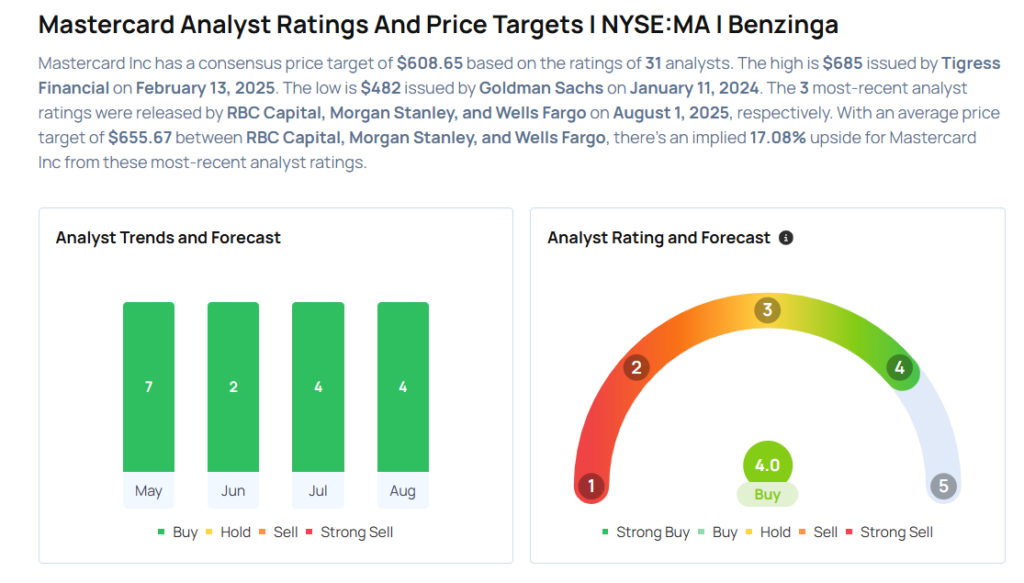

These analysts made changes to their price targets on Mastercard following earnings announcement.

- Keybanc analyst Alex Markgraff maintained Mastercard with an Overweight rating and raised the price target from $635 to $660.

- Wells Fargo analyst Donald Fandetti maintained the stock with an Overweight rating and raised the price target from $625 to $650.

- Morgan Stanley analyst James Faucette maintained Mastercard with an Overweight rating and raised the price target from $639 to $661.

- RBC Capital analyst Daniel Perlin maintained the stock with an Outperform rating and raised the price target from $650 to $656.

Considering buying MA stock? Here’s what analysts think:

Photo via Shutterstock