/Masco%20Corp_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Masco Corporation (MAS), headquartered in Livonia, Michigan, has carved its niche in producing and marketing a broad range of branded home improvement and building products. Its portfolio spans Behr paints, Delta and Hansgrohe faucets and bath fixtures, Liberty decorative hardware, and HotSpring spas.

With a market capitalization of approximately $15.1 billion, the company firmly sits in the “large-cap” arena, delivering faucets, showerheads, bath accessories, water systems, paints, coatings, and related supplies, maintaining a presence in both residential and light commercial markets.

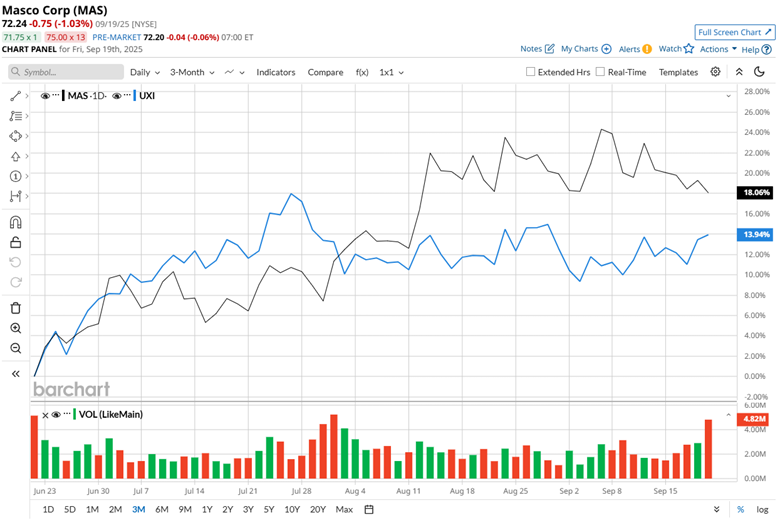

Despite these strong offerings, MAS stock has faced a bumpy ride in recent months. Shares currently trade about 16.7% below their October 2024 peak of $86.70. Over the past three months, however, the stock has clawed back nearly 18.6%, slightly outpacing the ProShares Ultra Industrials ETF (UXI), which rose 14.2% in the same period.

Looking at the bigger picture, MAS stock has struggled to keep pace with broader industrial momentum. Over the past 52 weeks, the stock has slipped 13.2%, while year-to-date, it has seen a marginal drop. In comparison, UXI surged 20.7% in that stretch and has jumped 25.6% year-to-date in 2025.

Yet, a silver lining emerges as MAS shares have maintained trading above their 50-day moving average of $70.86 and 200-day moving average of $70.10 since late August, signaling that investor confidence has not completely wavered.

A notable spark came on July 31, when the stock jumped 3.7% following stronger-than-expected second-quarter fiscal 2025 results. Revenue for the period reached $2.05 billion. Although down 1.9% year over year, it surpassed the Street’s forecast of $2 billion. Adjusted EPS came in at $1.30 per share, beating the anticipated $1.08 and showing an 8.3% year-over-year increase.

Looking ahead, Masco’s management has laid out ambitious plans. For the second half of 2025, it expects full-year sales to generally mirror the prior year when adjusted for divestitures and currency fluctuations. The company anticipates maintaining market outperformance, projecting adjusted EPS between $3.90 and $4.10 for the year.

Yet, the path remains challenging when benchmarked against its rival, Armstrong World Industries, Inc. (AWI), which has posted a remarkable 49.1% gain over the past 52 weeks and witnessed a further year-to-date jump of 39.1%, highlighting MAS’ relative underperformance in the sector.

Analysts are keeping a balanced view on the company’s prospects. Among 21 analysts covering the stock, the consensus rating stands at “Moderate Buy,” with a mean price target of $74.88, suggesting a premium of 3.7% from current levels.