Up a scarcely believable 973% on a year-to-date (YTD) basis, the short-squeeze party is alive and well for the Newegg (NEGG) stock, thanks to the surprise rally because of the second round of the meme-stock frenzy.

The short-squeeze is coming amid an expanded share sale program, with insiders continuing to dump the stock, profiting from this unlikely rally. Now, contentious former pharmaceutical executive Martin Shkreli has weighed in on the debate with a clear verdict, calling the stock “close to worthless.” Thus, he is short-selling the counter, citing the company's weak fundamentals, especially its low gross margins.

About Newegg Commerce

Founded in 2001, Newegg Commerce is a tech-focused e-commerce retailer specializing in computer hardware, consumer electronics, gaming peripherals, and tech accessories. Rapid growth led to being named a top 10 internet retailer by 2005, with sales exceeding $1 billion, and rising to $1.3 billion by 2006.

Newegg got listed in 2021 via a SPAC merger with Lianluo Smart, and currently commands a market cap of $4.21 billion.

So, is Shkreli right? Is the stock really “worthless?” It may not be worthless, but investors should still avoid the stock. Why? Let's find out.

Profitability Concerns Overshadow Visible Improvement

Newegg recently reported its results for the first six months of this year. Although there has been improvement, the company remains unprofitable.

Net sales increased by 12.5% from the previous year to $695.67 million, as net losses narrowed to $4.2 million from about $25 million in the year-ago period. Cash outflow from operations narrowed as well, but then again it remained that, an outflow. Net cash outflow from operating activities stood at $49.9 million, which was $63.2 million for Jan-June 2024. Overall, the company closed the quarter with a cash balance of $59.1 million, higher than its short-term debt levels of $12.8 million.

Interestingly, gross margins, the primary reason for Shkreli's short-selling stance, actually improved to 11.5% from 10.2%.

Shifting focus towards some key operational metrics, average order value increased to $467 in H1 2025 from $401 in H1 2024 as active customers also increased to 1.13 million from 1.09 million in the same period. Repeat purchase rate, an indicator of customer stickiness, improved to 25.2% from 23% in the comparable period a year ago.

Just A Meme Stock

Yet, despite all the improvements, Newegg's days in the sunshine look numbered, and it is just a bubble that is waiting to burst.

For starters, one of the fundamental reasons for the recent optimism surrounding NEGG shares stems from the involvement of the Galkin family. This is the same family that previously amassed substantial gains during the meme-stock rally, with nearly 80% of their net worth invested in video game retailer GameStop (GME) at its peak. As of July 29, the Galkins held 3.33 million shares of Newegg, equating to 17.1% of the company’s outstanding stock. This marks a notable increase from July 8, when they owned 2.16 million shares, or 11.1% of the total.

Also, a significant short-term driver for the stock was the firm’s eleventh annual “FantasTech” sale, held from July 7 to July 13, which functions as Newegg’s counterpart to Amazon’s (AMZN) Prime Day event. While management expressed a positive tone regarding the sale, the actual financial impact will not be visible until later in the year. This delay is due to Newegg’s incorporation in the British Virgin Islands and its practice, in line with many other foreign issuers, of reporting results on a semiannual and annual basis rather than quarterly. Consequently, the Q3 results that include FantasTech’s performance will be released much further down the line.

However, the event is unlikely to fundamentally change the company’s trajectory. GameStop shares, once a key source of wealth for the Galkins, are currently down nearly 72 percent from their $81 peak during the height of the meme-stock surge. More importantly, Newegg’s own financials have shown a consistent downward trend. Between 2022 and 2024, revenue contracted from $1.72 billion to $1.24 billion. The number of active customers declined from 2.7 million to 2.1 million, which in turn drove gross merchandise value sharply lower from $2.20 billion to $1.53 billion. Average order value also slipped during the same period, from $411 to $396, underscoring the challenges facing the business.

Final Take

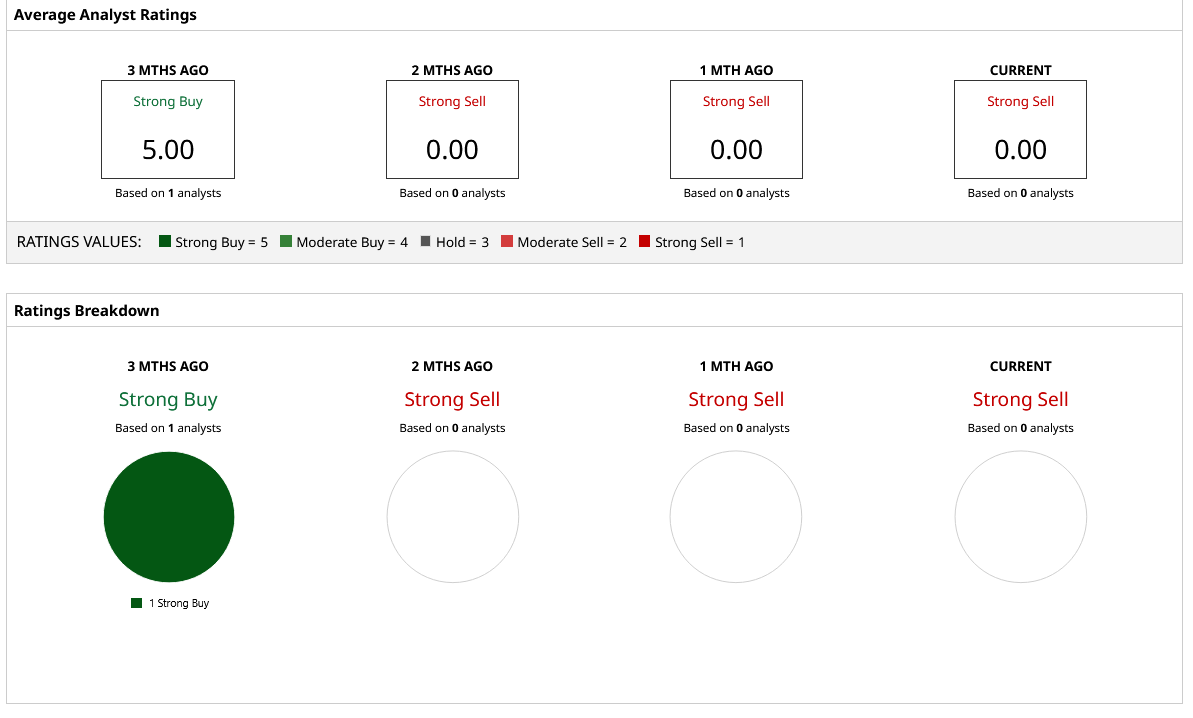

Thus, amid all this, any fresh investment in the NEGG stock is not warranted. Even the analysts are avoiding it, with none currently covering NEGG. Granted, investors with a speculative bent of mind can dabble in it, but serious investors looking to create wealth should steer clear of this name due to its declining fundamentals and the consistent downward spiral seen in its key operating metrics over the years.