/Marriott%20International%2C%20Inc_%20hotel%20by-%20yujie%20chen%20via%20iStock.jpg)

With a market cap of around $73 billion, Marriott International, Inc. (MAR) is a leading global operator, franchisor, and licensor of hotels, residences, timeshares, and other lodging properties. The company manages a diverse portfolio of more than 30 brands across luxury, premium, and select-service segments, including The Ritz-Carlton, St. Regis, Sheraton, Westin, Courtyard by Marriott, and Moxy Hotels.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Marriott International fits this criterion perfectly. With operations spanning the U.S. & Canada and International markets, Marriott delivers hospitality experiences worldwide through its extensive network of hotels, resorts, and residential properties.

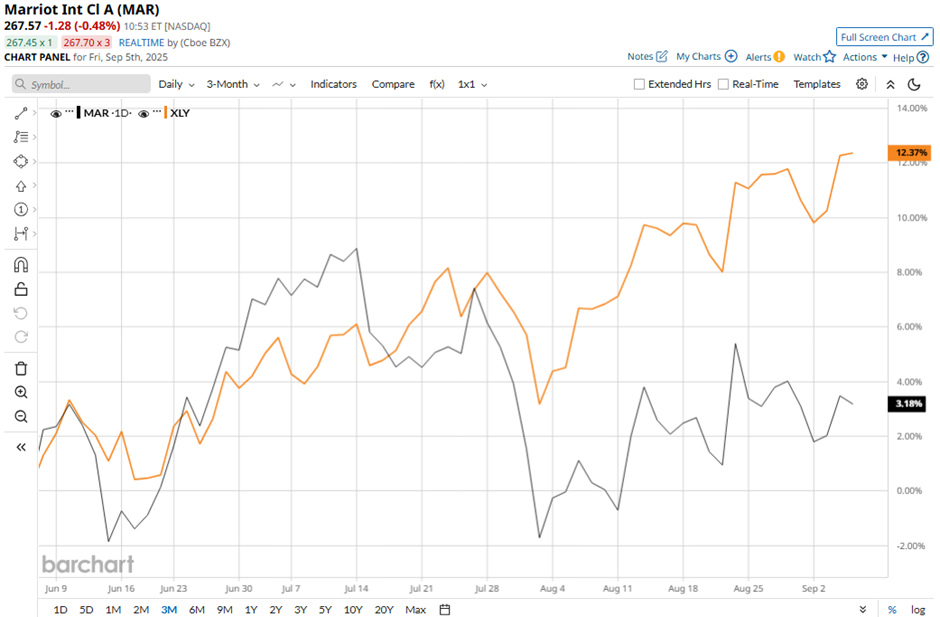

Shares of the Bethesda, Maryland-based company have pulled back 12.9% from its 52-week high of $307.52. Marriott’s shares have risen 4.3% over the past three months, lagging behind the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 13.5% increase over the same time frame.

Longer term, MAR stock is down 2.9% on a YTD basis, underperforming XLY’s 5.9% rise. Moreover, shares of the hotel company have gained 18.3% over the past 52 weeks, compared to XLY’s nearly 27% return over the same time frame.

Despite a few fluctuations, MAR stock has fallen below its 50-day and 200-day moving averages since August.

Shares of Marriott International rose marginally on Aug. 5 after the company reported Q2 2025 adjusted EPS of $2.65, slightly above Wall Street estimates. Revenue of $6.7 billion also topped forecasts, with strength in its upscale and luxury segment - room revenue in U.S. and Canada luxury properties grew 4.1%, offsetting a 1.5% decline in select-service brands.

However, rival Hilton Worldwide Holdings Inc. (HLT) has outpaced MAR stock. Shares of Hilton have climbed 28.3% over the past 52 weeks and 12.1% on a YTD basis.

Despite the stock’s underperformance over the past year, analysts remain moderately optimistic about its prospects. MAR stock has a consensus rating of “Moderate Buy” from 25 analysts in coverage, and the mean price target of $287.75 is a premium of 7.6% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.