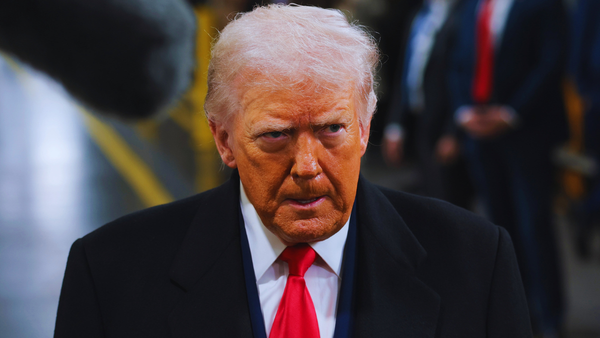

- Investors are willing to “look through” the risks of President Donald Trump’s new batch of tariffs set to take effect on Aug. 1 because they just see them as negotiating tactics, experts say. But tactic or not, current tariff rates are more than six times where they were at the start of the year.

Markets are largely ignoring the possibility a new round of tariffs could tank stocks like they did in April.

President Donald Trump issued another extension to his tariff policy that is now set to go into effect on Aug. 1. Several countries, including major trading partners like South Korea and Japan received “tariff letters” on Monday, which informed them of their new tariff rates on their goods. The president also said more letters will be sent on Tuesday and Wednesday.

Countries issued letters would see the new tariffs replace those Trump originally announced on April 2.

Trump’s sudden tariff announcements earlier this year tanked markets. Now with the same possibility looming, some markets are at all-time highs. It appears markets are not just pricing in the risk, but perhaps ignoring it all together.

“At some point, the rubber has to hit the road, and there’s risks that reciprocal tariffs with the major trading partners could revert back to at or around the April 2 levels, and that could sort of be a headwind for markets,” said Nadia Lovell, UBS global wealth management senior U.S. equity strategist, during a media briefing on Tuesday. “But for now markets are willing to sort of look through this risk.”

And look through it they have.

Last week, the S&P 500 hit an all-time intraday high of 6,284.65. As of Tuesday, it’s only about 50 points off from that record. Markets did roar back from a low in early April, largely because the U.S. was inching its way toward a trade policy investors deemed stable. They also got more accustomed to the herky-jerky nature of the White House’s tariff policy.

“Over the last couple of months, we’ve seen the administration escalate, only to quickly de-escalate, and this could also just be another tactical escalation in some way,” Lovell said of the latest deadlines.

In investment circles, this phenomenon has been referred to as the “Trump put,” a reference to options trading. It’s an investment thesis arguing Trump always reverses course on policies that hurt the stock market; therefore, any dip is temporary and a buying opportunity.

That’s not to say markets have been completely immune from the uncertainty tariffs pose. The Dow Jones and the S&P both sank on Tuesday for the second consecutive day.

So far, Trump has shown some predisposition to turn away from his harshest tariff policies. The numerous deadline extensions and pauses helped assuage investors the final versions of any tariffs wouldn’t be as sweeping as their first drafts. There have also been several carve-outs for certain industries such as chips, critical minerals, and some pharmaceuticals. However, Trump pledged there would be no extensions to the Aug. 1 deadline.

Even with the current pause, overall tariff rates for imports into the U.S. are more than six times higher than they were at the start of the year. The average weighted tariff rate is 16% compared to 2.5% in 2024, according to UBS calculations. If all of the postponed tariffs were to be reimplemented, that rate would rise to 21%.

Across Wall Street, financial institutions have been recommending clients diversify away from U.S. equities, despite having rebounded since April. Many money managers are moving more of their portfolio into some European stocks, which for years had lagged behind their U.S. counterparts. The U.S. markets, these investors reason, are still subject to the vicissitudes of a tumultuous trade policy.

“Nothing that happened yesterday should be taken to mean that we’re near the end to the U.S. tariff story of 2025,” wrote Thierry Wizman, Macquarie global foreign exchange and rates strategist. “Leaving aside that ‘reciprocal tariffs’ still need to be resolved, there are also new ‘strategic tariffs’ to look forward to this year.”

Raising tariff levels would also see the U.S.’ growth forecasts fall lower than they already have. In the earliest days of Trump’s tariff policy, U.S. recession odds soared. Forecasters from Wall Street and the Federal Reserve cut their projections for GDP growth and raised those for inflation and unemployment. The median growth rate for the U.S. among Fed economists is now at 1.4%. UBS’s 2025 projection is lower, coming in at 0.9%, according to Chief U.S. Economist Jonathan Pingle.

If all of the April tariffs were to return, the U.S. might lose “another three tenths” of its annual growth rate, Pingle said.

“Under that scenario, recession probabilities are going to rise, and it’s going to feel like pretty sluggish growth,” he said. “I mean, the U.S. does not run sub 1% growth very often.”