Meta Platforms Inc. (NASDAQ:META) saw its stock tumble 7.37% in after-hours trading on Wednesday following its earnings release, but Wedbush analyst Dan Ives believes the pullback misses the bigger picture.

Dan Ives Says Meta's Spending Surge Is Fuel For The AI Revolution

Taking to X, formerly Twitter, Ives defended Meta's massive capital expenditure increase.

"We want Meta to increase CapEx and they did. Any sell-off is short sighted," Ives wrote.

"Zuck is wartime CEO and leading Meta into next stage of AI Revolution. Increase in Capex gonna happen across tech and bullish for Nvidia, AMD, and cloud players. This the fuel for AI Revolution."

His comments came as Meta reported capital expenditures, including lease payments, of $19.4 billion, driven by investments in servers, data centers and network infrastructure.

Meta CFO Susan Li during the earnings call said, "We currently expect 2025 capital expenditures, including principal payments on finance leases, to be in the range of $70 to $72 billion, increased from our prior outlook of $66 to $72 billion."

Zuckerberg Doubles Down On AI Infrastructure

In prepared remarks, CEO Mark Zuckerberg said capital spending growth in 2026 will be "notably larger" than in 2025.

Meta's aggressive AI push mirrors similar strategies across Silicon Valley, where companies like Nvidia Corp. (NASDAQ:NVDA) and Advanced Micro Devices Inc. (NASDAQ:AMD) are expected to benefit from rising demand for high-performance computing.

Meta's Q3 Earnings Beat Adjusted Estimates

For the third quarter, Meta reported diluted earnings per share of $1.05, including a one-time, non-cash income tax charge of $15.93 billion, which makes it not directly comparable to analyst estimates of $6.68.

On an adjusted basis, EPS stood at $7.25, according to Benzinga Pro.

The company guided fourth-quarter revenue between $56 billion and $59 billion, compared with the Street estimate of $57.21 billion.

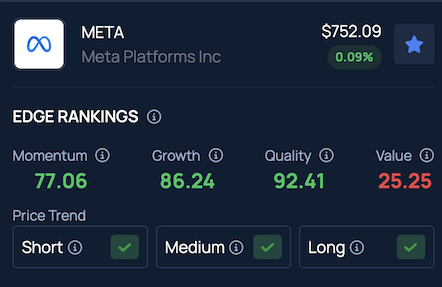

According to Benzinga's Edge Stock Rankings, Meta ranks in the 92nd percentile for stock quality — click here to see how it stacks up against other top competitors.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: Skorzewiak on Shutterstock.com