Cost pressures are mounting for American households, with the latest U.S. inflation gauge up 2.6% in June after new tariffs drove prices higher. Despite this, retail sales rebounded 0.6% in June following a mild dip in May, though spending habits are marked by greater caution.

The housing market shows another side of this complex picture. Home sales fell to an annual rate of 3.89 million units while the median home price climbed to a record $426,000, tightening affordability and cooling buyer demand.

This convergence of rising inflation, resilient but watchful shoppers, and a strained real estate sector puts next week’s earnings from Home Depot (HD), Lowe’s (LOW), Target (TGT), BJ’s Wholesale Club (BJ), and Walmart (WMT), firmly in the spotlight. These reports are worth watching. Let’s find out more about these stocks.

Home Depot (HD)

Home Depot (HD) is one of the biggest home improvement stores in the world, worth about $405 billion. The company’s next earnings update comes out on Aug. 19, 2025, and most experts think it will show profits of $4.71 per share for the quarter and $15.03 for the year.

In April, Home Depot shared it made $39.86 billion in sales and ended up with $3.43 billion in net income. The results were just under what analysts guessed, off by $0.03 a share. Shares are up about 3% for the year to date and 12.7% over the past 52 weeks.

Among 35 analysts, the consensus for Home Depot is a “Strong Buy,” with an average target price of $423.67, suggesting a possible 6% gain from where shares are now.

Lowe’s Companies (LOW)

Lowe’s Companies (LOW) is a big name in home improvement, and has a market capitalization of $143 billion. Its next earnings update comes out on Aug. 20, 2025, and most experts expect profits of $4.24 per share for the quarter and $12.29 for the year, each up 2%-3% year over year.

In April, Lowe’s brought in $20.93 billion in sales and made $1.64 billion in net income, with earnings per share of $2.92, slightly better than what the experts expected. Shares are up 2% so far in the year to date and are up 6.1% over the past 52 weeks.

The average analyst rating is “Moderate Buy” and the average target price is $267.55, also implying about 6% upside potential from here.

Target (TGT)

Target (TGT) is one of the largest big-box retailers in the U.S. Its next earnings update is set for Aug. 20, 2025, and experts think Target will earn $2.05 a share this quarter and $7.54 for the year, down 20% and 15% year over year.

In its last earnings update for April 2025, Target recorded $23.85 billion in sales and made $1.04 billion in net income, or $1.30 per share, coming in about 20% below what analysts predicted. Shares are down 23% in the year to date and over the past 52 weeks.

Earlier this year, Target announced its plans to add $5 billion in gross merchandise volume by 2030, expand its advertising business, and significantly increase the size of its Target Plus marketplace by five times. These initiatives aim to revitalize the company’s performance and steer the business in the right direction.

Each year, Target pays a dividend of $4.56 per share, which is a 4.4% yield. Target has a market capitalization of about $47.9 billion.

Most analysts rate Target as a “Hold,” with an average target price of $107.90, meaning they see a 4% gain from here.

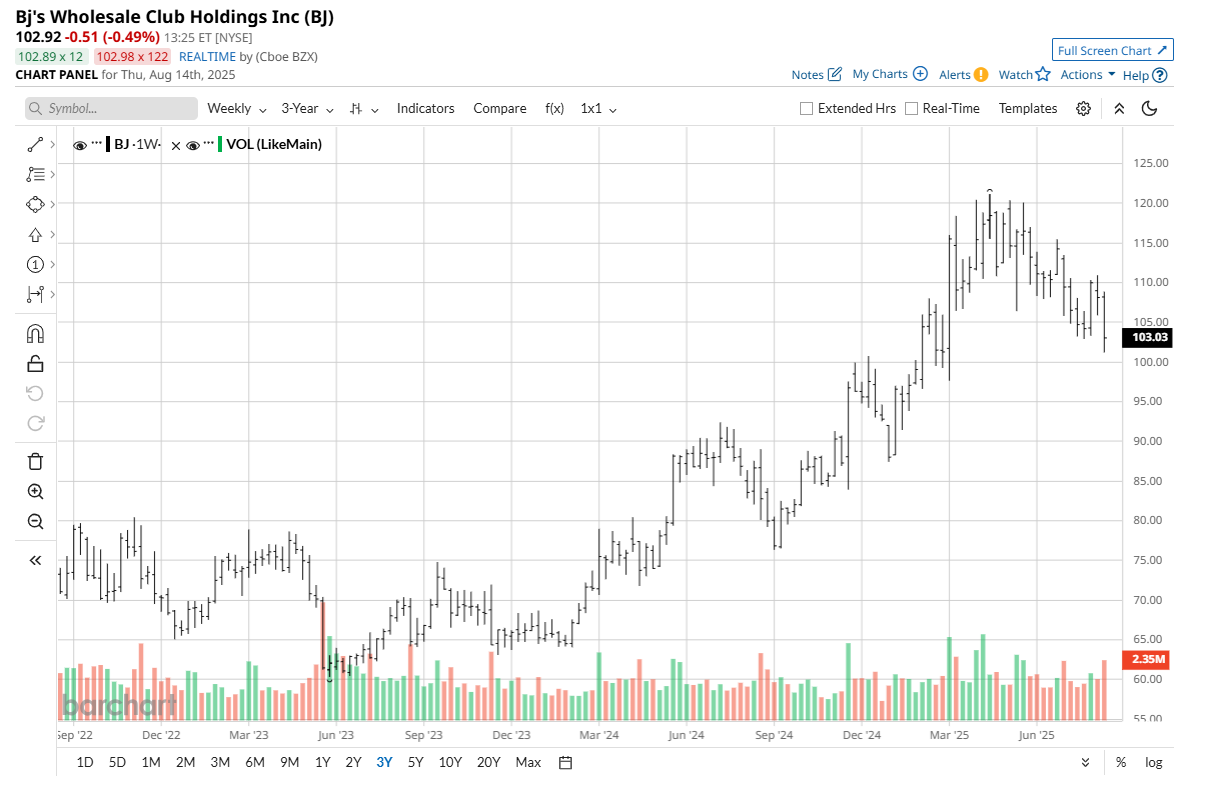

BJ’s Wholesale Club (BJ)

BJ’s Wholesale Club (BJ) is a membership warehouse chain worth about $13.7 billion. The company’s next earnings report comes out Aug. 22, 2025, and analysts think BJ’s will make $1.10 per share this quarter and $4.29 for the year.

In its last earnings report for the first quarter, released in May, BJ’s said it made $5.15 billion in sales and brought in nearly $150 million in net income, or $1.14 per share, which beat what experts were expecting by a wide margin of 25%. Shares are up about 15% in the year to date and up 25% over the past 52 weeks.

Most analysts are upbeat about BJ’s, with 18 calling it a consensus “Moderate Buy” and giving it an average price target of $125.44, a possible 21% climb from current prices.

Walmart (WMT)

Walmart (WMT) is one of the biggest retailers in the world, worth about $805 billion, with stores and online shopping everywhere. The company pays a yearly dividend of $0.94 per share, giving investors a 0.93% yield.

Its next earnings update is coming up on Aug. 21, 2025, and most experts think Walmart will show profits of $0.72 a share for the quarter and $2.60 for the whole year. That would be a healthy jump of over 7% and 3% compared to last year.

For its April earnings report, Walmart reported $165.61 billion in sales and $4.49 billion in net income, or $0.61 a share, beating what analysts predicted by more than 7%. Shares are up 11.9% in the year to date and up 47% over the past year.

The consensus is very optimistic, with 35 analysts saying Walmart is a consensus “Strong Buy.” Their average price target is $111.85, suggesting the stock could go up another 10%.

Conclusion

Earnings season for these five giants is packed with signals about where Main Street and Wall Street head next. With inflation still pressing wallets and the housing market tight, retailers showing growth and defensive strength look well-positioned to keep leading, while others may have to fight just to hold ground.

Chances are, we could see more positive surprises from value-focused names, while those relying on discretionary spending may face extra pressure. Either way, next week’s results are set to shake things up.