Fred Thiel, CEO of MARA Holdings Inc. (NASDAQ:MARA), expressed reservations Tuesday about the future success of the Bitcoin (CRYPTO: BTC) treasury play popularized by Michael Saylor’s Strategy Inc. (NASDAQ:MSTR).

What Happened: During the company’s second-quarter earnings call, Thiel praised Saylor and his team for pioneering the Bitcoin treasury strategy, but voiced concerns about the risk of market saturation.

“You know, kudos to Michael and his team, for what they've done there. But any advantage in any market starts disappearing when you have lots of companies going after it,” he said. “They can't all be successful.”

Thiel feared that companies might be forced to sell their coins when their mNAV drops to one or even goes negative. For the curious, mNAV is the ratio of the company’s market capitalization to the market value of Bitcoin it owns.

“If Bitcoin, especially for the newer treasury companies, sees a decline, they may be challenged, and people may sell them the stock to get their money out,” he argued. “And I think, with as many companies doing this as there are, a certain percentage of them will likely fail. And so that will negatively impact the price of Bitcoin.”

Why It Matters: Thiel’s comments came after MARA’s second-quarter earnings and revenue beat expectations. The company mined 2,358 BTC during the quarter and held a total of 50,000 BTC, worth nearly $6 billion, on its balance sheet at quarter’s end.

As of this writing, MARA was the second-largest corporate Bitcoin holder, trailing only Strategy, which had a stash of over $74 billion in BTC. Strategy has front-run Bitcoin's corporate adoption, building its reserve with proceeds from common stock, preferred stock, and convertible bond issuances.

Several companies, including President Donald Trump-owned Trump Media & Technology Group Corp. (NASDAQ:DJT), have jumped on this Bitcoin-buying bandwagon lately.

Price Action: At the time of writing, Bitcoin was exchanging hands at $117,943.25, up 0.18% in the last 24 hours, according to data from Benzinga Pro.

Shares of MARA rose 3.67% in after-hours trading after closing 0.55% lower at $16.61 during Thursday's regular session.

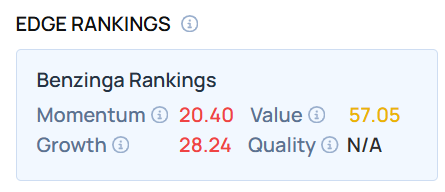

The stock reported low momentum and growth scores as of this writing. To find out how Strategy and other Bitcoin-holding firms stack up on these parameters, visit Benzinga Edge Stock Rankings.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.