One of the most fundamental things in any serious romantic relationship is to be on the same page when it comes to your finances. To put it bluntly, you don’t want there to be any secrets between you two. So, you’ve got to have maximum transparency about your income, spending, savings, investments, and debt.

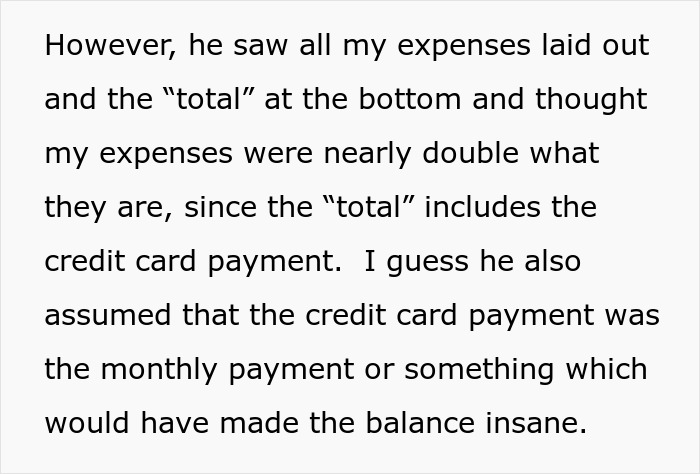

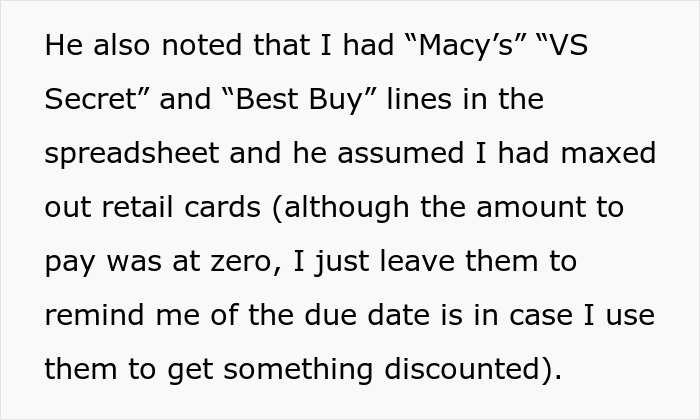

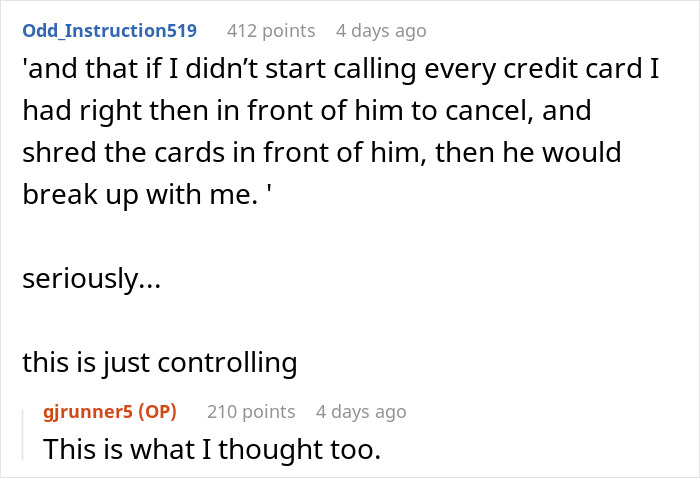

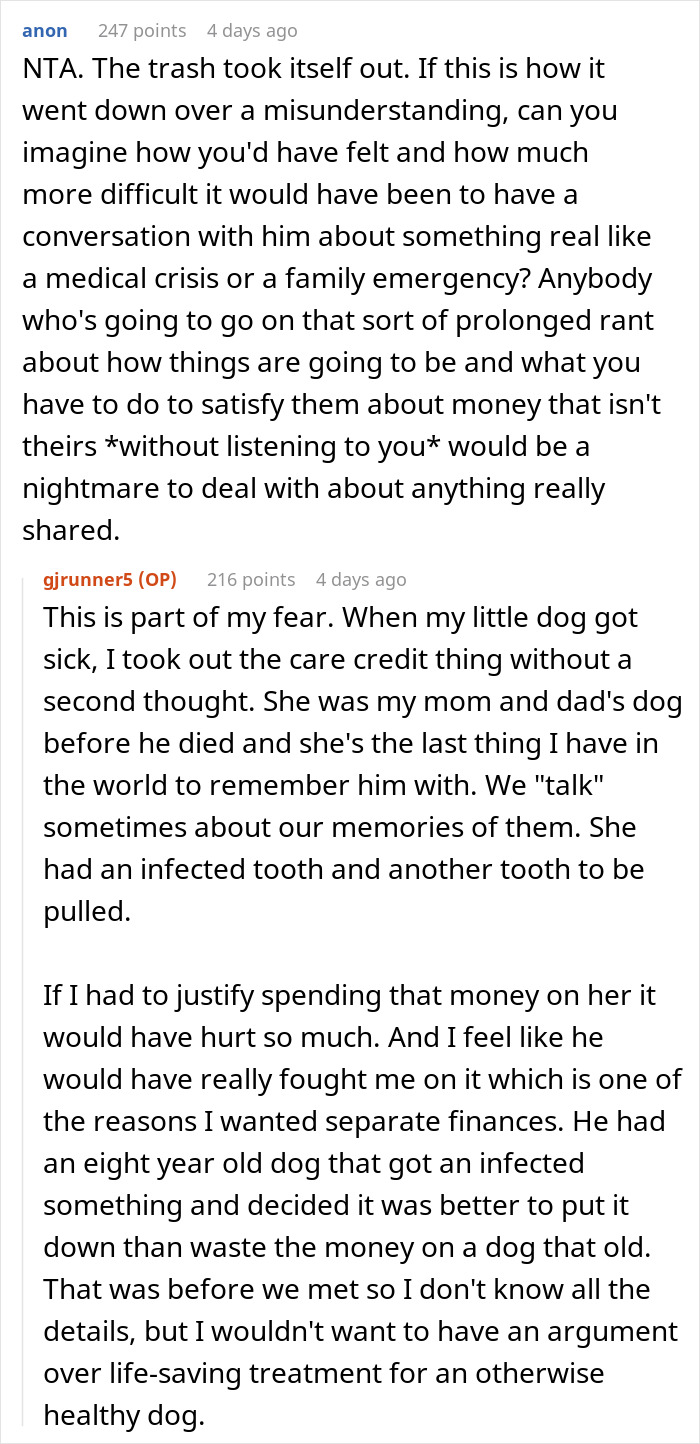

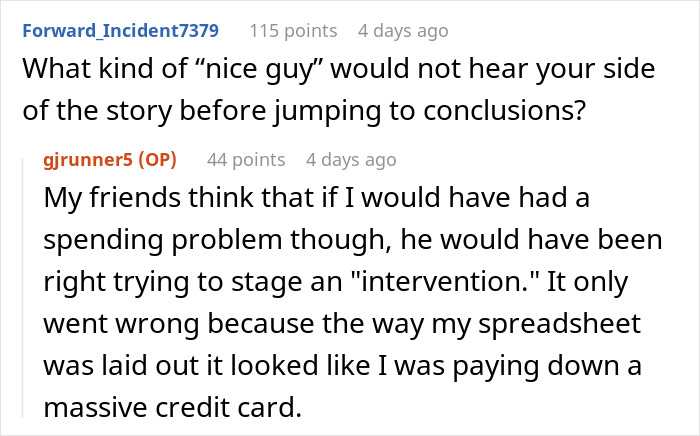

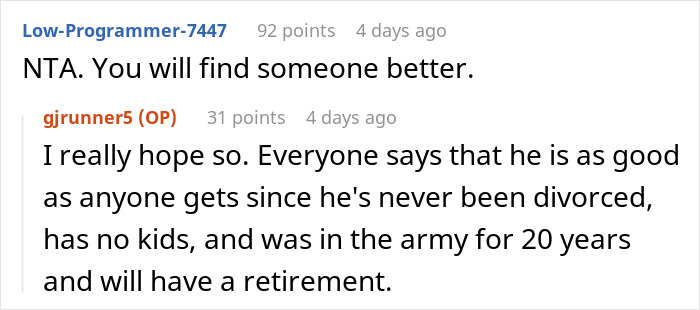

Redditor u/gjrunner5 went viral after asking the AITAH online group for an impartial verdict about a messy misunderstanding between her and her (now ex) boyfriend that got out of hand. She shared how he misinterpreted a spreadsheet of her finances and believed that she had taken on massive debt. After delivering an ultimatum, he broke up with her, and only later realized that he’d been completely wrong. Scroll down for the full story and the internet’s reactions.

Bored Panda has gotten in touch with the author of the story, and we’ll update the article once we hear back from her.

Couples need to be transparent about their finances. However, you shouldn’t make any rash assumptions until you take the time to learn the full context

Image credits: Wavebreakmedia (not the actual photo)

A woman shared how her (now ex) boyfriend issued her an ultimatum after completely misinterpreting her personal finance spreadsheet

Image credits: LightFieldStudios (not the actual photo)

Image credits: svitlanah (not the actual photo)

The author later shared a quick update once her story spread across the web

Image credits: gjrunner5

Giving your partner an ultimatum without even so much as listening to their side of things is unhealthy and arrogant

Personal finances are a very sensitive topic. So, if you suspect that your partner might be keeping secrets from you (e.g., about debt and expenses) that potentially impact you both, it’s definitely the right thing to have a conversation about it. However, it matters how you broach the topic.

Look, we know that spreadsheets can be hard to read if you’re not used to them. However, that’s not an excuse to start doling out ultimatums left and right. Especially when you’re talking with your significant other.

Nobody’s perfect; we all make mistakes, and communication can be a tricky thing to get right. But if you’re unwilling to hear your partner’s side of things, then something’s clearly gone wrong.

Thinking that you’re always right and everyone else is wrong is no way to go through life.

In short, you have to be willing to hear out your partner’s side of things. It’s best to set aside any judgment and your holier-than-thou attitude. Actively listen to what they’re saying.

You might have made a mistake. Or you might not know the full context. Sometimes, we’re not as smart as we think we are.

Image credits:Afif Ramdhasuma (not the actual photo)

It doesn’t matter how much or little you earn, so long as you keep your lifestyle in check and your expenses don’t exceed your income

The golden rule of budgeting and personal finance is to earn more than you spend. And, vice versa, you should be spending less than you earn. No matter how rich you are, if you’re burning through your savings without filling up your coffers, eventually, you’ll run out of doubloons.

Healthy finances require discipline, clarity, and transparency. You don’t necessarily need to track your spending in a massive spreadsheet, but you need to know, very specifically, how much metaphorical bacon you’re bringing home every month. That’s alongside your exact expenses, savings, investments, and debt. The more specific you are, the clearer your strategies for a better lifestyle can be.

On the earnings side, you can ask for a raise or promotion, look for a better-paying job (hopefully, with better benefits and a healthier work/life balance), do overtime, pick up a second job, or focus on monetizing a hobby or side hustle.

Meanwhile, on the expenses side of things, you can cut back on (some) non-essential spending. For instance, you might have a few subscriptions for digital or physical services that you don’t use as often as you’d like. End them.

Or you might be dining out and ordering in far more often than your budget allows. Scale back. Make going out into something that’s special again. Meanwhile, cooking at home can be a ton of fun if you’re willing to try new things.

Obviously, where else you can cut back will depend a ton on your lifestyle. Maybe you travel too much, spend far too much dough on concerts and entertainment, or your hobbies are eating into your savings. The key isn’t to eliminate everything that you love to do. Quite the contrary, it’s vital that you enjoy life. But you have to set a budget for those activities so you don’t feel guilty afterward.

The author of the AITAH post mentioned that she could easily pay off her remaining debt. However, she chooses to use the extra savings as an ‘emergency cushion’ that could last her a few months. This makes her feel financially safe. And it’s sound advice.

Image credits:Jakub Żerdzicki (not the actual photo)

A cornerstone of healthy personal finances is having a sizeable emergency fund you can fall back on in case of an emergency

One of the fundamentals of good personal finance is to build up an emergency fund. That way, you have a safety net to fall back on in case there’s an emergency (medical expenses, home repairs, your car breaking down) or you lose/quit your job.

Essentially, an emergency fund is meant to cover your basic costs, from food and transportation costs to rent and utilities. That way, you don’t have to make financially risky moves in an emergency, like taking on extra debt, asking for quick loans, or cashing out your investments (if you have any).

While most people would probably agree that you need to have an emergency fund, they have different ideas about how big it should be. Broadly speaking, it should be as big as you can make it. At some point, you may want to consider investing some of your savings instead of keeping your cash static in your bank account so that you’re more efficient.

According to Lloyd’s Bank, it’s recommended that you set aside at least 3 months’ worth of essential outgoings to be your financial buffer.

HSBC also recommends having at least 3 months’ worth of living expenses to fall back on. “The more you can save, the better. A bigger emergency fund can help make sure you’re able to handle a large financial shock, so you may want to aim for 6 months’ worth of living expenses.”

Meanwhile, as Investopedia notes, some experts actually suggest going as far as having 12 to 18 months’ worth of living expenses in your emergency fund.

So, dear Pandas, what do you think about the relationship drama that was all sparked by a single spreadsheet? What would you have done if you were in the woman’s shoes? Has anyone ever given you an ultimatum after learning about your finances? Why do you think the author’s boyfriend was unwilling to listen to her side of things? Share your thoughts in the comments section below!

Image credits: Jakub Żerdzicki (not the actual photo)

The author interacted with some of her readers in the comments, sharing more context

Most internet users were completely on the woman’s side. Here are their thoughts about the relationship drama