Houston, Texas-based LyondellBasell Industries N.V. (LYB) is one of the leading plastics, chemical, and refining companies globally. Its products are used in electronics, automotive parts, packaging, construction materials, and biofuels. With a market cap of $14.5 billion, LyondellBasell’s operations span North America, Europe, Indo-Pacific, and internationally.

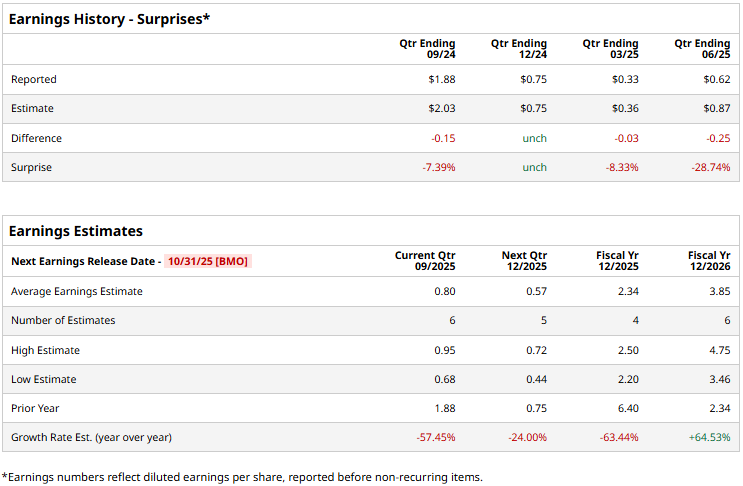

The chemicals industry giant is gearing up to announce its third-quarter results before the markets open on Friday, Oct. 31. Ahead of the event, analysts expect LYB to deliver a non-GAAP profit of $0.80 per share, down a staggering 57.5% from $1.88 per share reported in the year-ago quarter. While the company has met the Street’s bottom-line estimates once over the past four quarters, it has missed the projections on three other occasions.

For the full fiscal 2025, analysts project LyondellBasell to deliver a non-GAAP EPS of $2.34, down 63.4% from $6.40 in fiscal 2024. While in fiscal 2026, its earnings are expected to rebound 64.5% year-over-year to $3.85 per share.

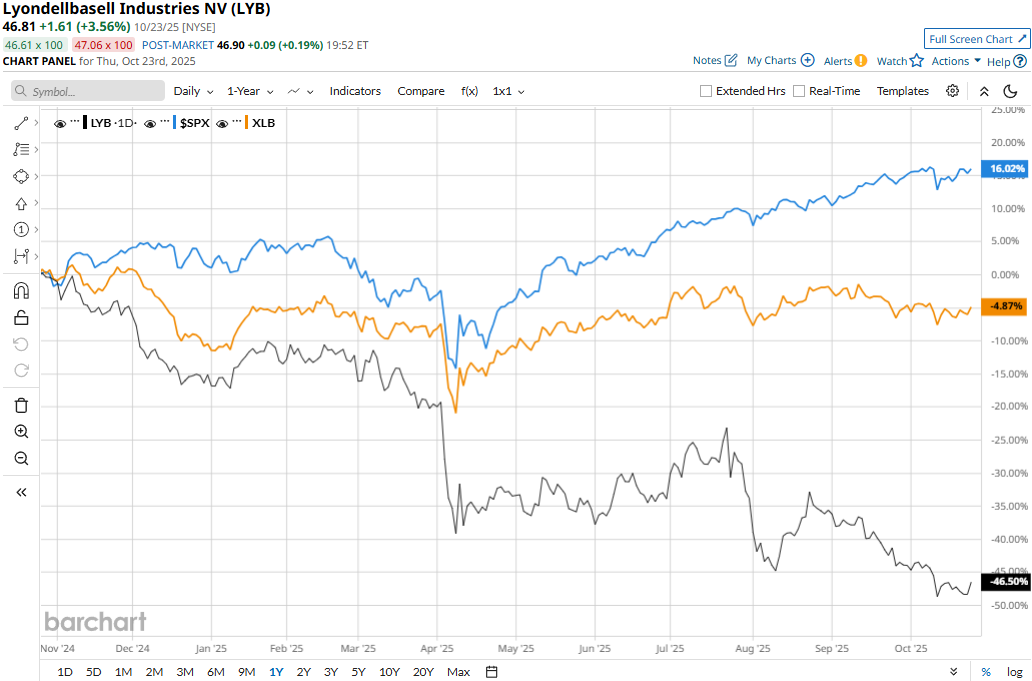

LYB stock prices have tanked 47.3% over the past 52 weeks, notably underperforming the Materials Select Sector SPDR Fund’s (XLB) 6.6% decline and the S&P 500 Index’s ($SPX) 16.2% returns during the same time frame.

LyondellBasell Industries’ stock prices declined 7.8% in a single trading session following the release of its lackluster Q2 results on Aug. 1. The company’s topline for the quarter plummeted 11.8% year-over-year to $7.7 billion, but managed to beat the Street expectations by a notable margin. However, its margins observed an even worse contraction, leading to a 71.8% fall in adjusted EPS to $0.62, missing the consensus estimates by 28.7%.

Analysts remain cautious about the stock’s prospects. LyondellBasell has a consensus “Hold” rating overall. Of the 20 analysts covering the stock, opinions include three “Strong Buys,” one “Moderate Buy,” 13 “Holds,” and three “Strong Sells.” Its mean price target of $57.53 suggests a 22.9% upside potential from current price levels.