Luxembourg's Ministry of Finance confirmed that its Intergenerational Sovereign Wealth Fund (FSIL) has allocated 1% of its portfolio to Bitcoin (CRYPTO: BTC), marking the nation's first official exposure to the asset class.

The move comes as Bitcoin consolidates above $121,000, testing a key resistance level for the fourth time this quarter.

Luxembourg Allocates 1% Of Sovereign Fund To Bitcoin

During his 2026 budget presentation at the Chambre des Députés, Finance Minister Gilles Roth announced that Luxembourg had diversified into Bitcoin via its sovereign wealth fund as part of a new investment policy approved in July.

The update allows the fund to allocate up to 15% of total assets to alternative investments, with 1% having been allocated to Bitcoin.

According to Bob Kieffer, the country’s director of the treasury and secretary general of the finance ministery, Luxembourg’s Bitcoin exposure has been taken through a basket of regulated ETFs, rather than direct spot holdings to minimize operational risks.

He noted that while the allocation may appear modest, it signals a "clear message about Bitcoin's long-term potential."

Luxembourg Joins The Sovereign Bitcoin Club

The decision places Luxembourg among a growing number of governments and sovereign funds experimenting with digital assets as part of broader diversification efforts.

While El Salvador remains the only country adopting Bitcoin as legal tender, institutional participation in ETFs has broadened the path for regulated exposure in Europe.

Luxembourg's financial sector already hosts several blockchain custodians and fund administrators, making it one of Europe's most crypto-compliant jurisdictions under the MiCA framework.

Bitcoin Technical Outlook: Fourth $125K Test

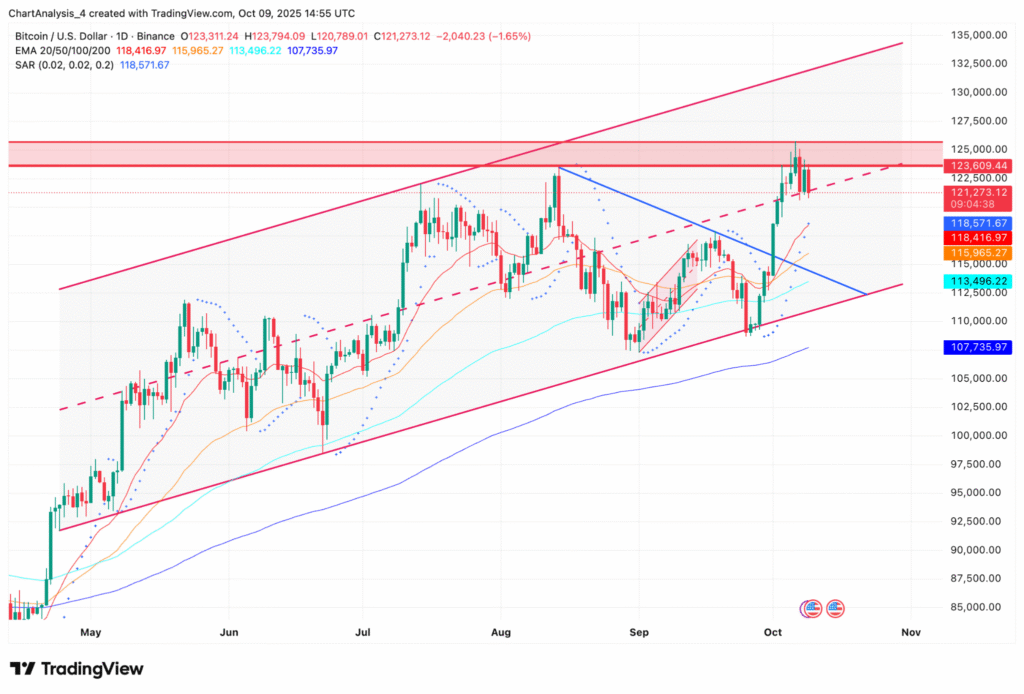

BTC Price Forecast (Source: TradingView)

Technical analysis: Bitcoin has retreated slightly from the $125,000 resistance zone after testing the upper boundary of its ascending channel.

The daily chart shows the price stabilizing near $121,000, with the 20- and 50-day EMAs at $118,400 and $115,900, respectively, providing immediate support.

The Parabolic SAR remains bullish above $118,500, indicating buyers still control the trend unless a breakdown occurs.

A close below $118,000 could expose support at $113,500, while sustained strength above $123,600 would likely reopen the path toward $135,000 and potentially a fresh all-time high.

Why It Matters

Luxembourg's allocation may look small, but it sets a precedent with outsized signaling power.

A financial hub openly backing Bitcoin reframes the asset from speculative plaything to institutional reserve candidate.

This step also tests the MiCA regime in real time, offering Europe a blueprint for regulated sovereign adoption.

If the fourth $125,000 resistance break aligns with this policy shift, Bitcoin's next leg higher could carry the weight of government validation rather than retail hype.

Read Next:

Image: Shutterstock