Analysts from Jefferies have expressed concerns about Lululemon Athletica Inc. (NASDAQ:LULU) moving away from its foundational yoga-inspired ethos, a shift that could potentially pose risks to the company’s business.

What Happened: Jefferies analysts, after visiting two Lululemon outlets in Westport, Connecticut, and Coral Gables, Florida, identified issues with the brand’s product line. They observed that Lululemon was heavily relying on large logos and moving significantly away from its yoga origins. The analysts commented, “LULU continues to stray further away from its yoga-inspired roots to designs similar to general apparel brands like the Gap (NYSE:GAP),” reported Business Insider.

Check out the current price of LULU stock here.

Chip Wilson, the founder and ex-CEO, supported the analysts’ concerns in a Forbes interview earlier this year, stating that the brand’s offerings were becoming similar to the Gap.

The brand’s attempts to add new colors and products to address its product struggles resulted in a “disjointed assortment that’s failing to convert,” the analysts noted. This resulted in a 2% decline in Lululemon's comparable sales in the Americas during the first quarter of 2025, along with over 36% plunge in its stock value since the start of the year.

“Color Palette Goes Sesame Street,” observed the analysts

The Jefferies note also highlighted the large volume of discounted items both in stores and online, indicating difficulties with sell-through and a reliance on markdowns to reduce excess inventory.

They also pointed out that the new designs at the two stores featured “loud colors and large logos in an attempt to sell beyond their core customer and attract younger shoppers,” which could potentially alienate Lululemon’s base consumers.

SEE ALSO: UnitedHealth Former Staff Reveal Dark Secrets Of Medicare Billing Practices

Why It Matters: These concerns from analysts came soon after Lululemon filed a lawsuit against Costco (NASDAQ:COST), accusing the retailer of copying designs from some of its best-selling products.

Lululemon’s recent struggles with its product offerings and sales come on the heels of a strong first-quarter performance. The company reported a revenue of $2.37 billion, beating the consensus estimate. However, the stock tumbled after the company’s weaker earnings forecast.

Following the disappointing guidance, Lululemon’s stock continued to slide, with analysts flagging tariffs and markdowns as potential issues. The recent report by Jefferies adds to the growing concerns about Lululemon’s future performance and its ability to maintain its brand identity in the face of increasing competition.

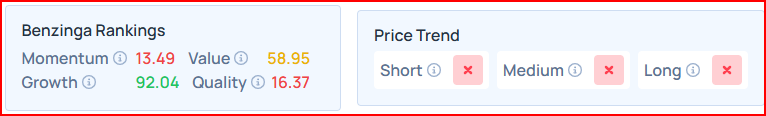

Benzinga's Edge Rankings place Lululemon in the 92nd percentile for growth and the 59th percentile for value, reflecting mixed performance. Check the detailed report here.

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.