Shares of electric vehicle maker Lucid Group Inc (NASDAQ:LCID) are trading sharply higher Friday, after hitting a new all-time low Thursday. Here’s what investors need to know.

What To Know: The rebound is fueled by a vote of confidence from Wall Street, as Cantor Fitzgerald reiterated a Neutral rating on the stock while increasing its price target from $3 to $20 per share. This new target equates to $2 per share prior to the company’s recent 1-for-10 reverse stock split.

The analyst upgrade provides a much-needed boost for investors after a difficult period for the company. On Thursday, the stock fell amidst growing pessimism following a 1-for-10 reverse stock split that took effect earlier in the week.

Additionally, the company's decision to reduce its 2025 production forecast to 18,000-20,000 vehicles has dampened sentiment. This comes after a disappointing second-quarter earnings report.

Lucid has been navigating a challenging market, with its stock down nearly 50% year-to-date before today’s rally. The company faces broader industry headwinds, including the end of federal EV tax credits.

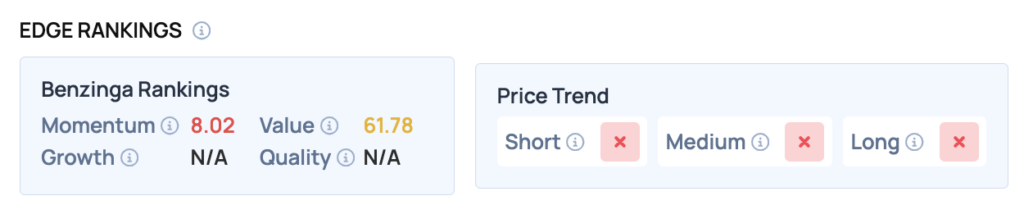

Benzinga Edge Rankings: Highlighting a potential opportunity for investors, Benzinga Edge stock rankings show the company with a strong value score of 61.78, despite its recent negative price trend.

Price Action: According to data from Benzinga Pro, LCID shares are trading higher by 11.32% to $17.99 Friday afternoon. The stock has a 52-week high of $40.80 and a 52-week low of $15.25.

Read Also: UWMC Stock Surges As Weak Jobs Report Fuels Fed Rate Cut Hopes

How To Buy LCID Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Lucid Group’s case, it is in the Consumer Discretionary sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Courtesy of Lucid