It sure sounds nice, doesn’t it? You buy a bunch of stocks, and stocks go up over time. Plus, while you wait for your inevitable long-term capital gains, those stocks pay dividend income to you every quarter. You can even stagger the payments by mixing dividend stocks that distribute their dividends in the first, second, and third month of each calendar quarter.

And, within the S&P 500 Index ($SPX), many stocks pay dividends. Some have done so for many decades, earning names like “aristocrats” or “kings,” increasing their dividend payments each year.

Since last century, this has been one of the most popular ways to buy and hold stocks.

However, for much of this current decade, it is a strategy that has left a trail of lackluster performance, frustration, and a feeling that stocks with above-average yields within the S&P 500 index are “overdue” to be market leaders again.

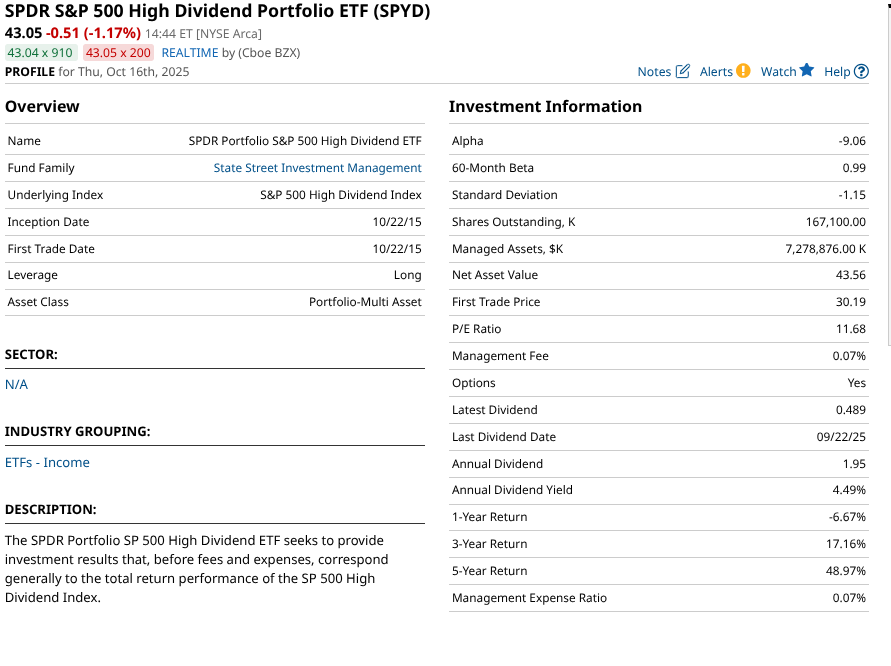

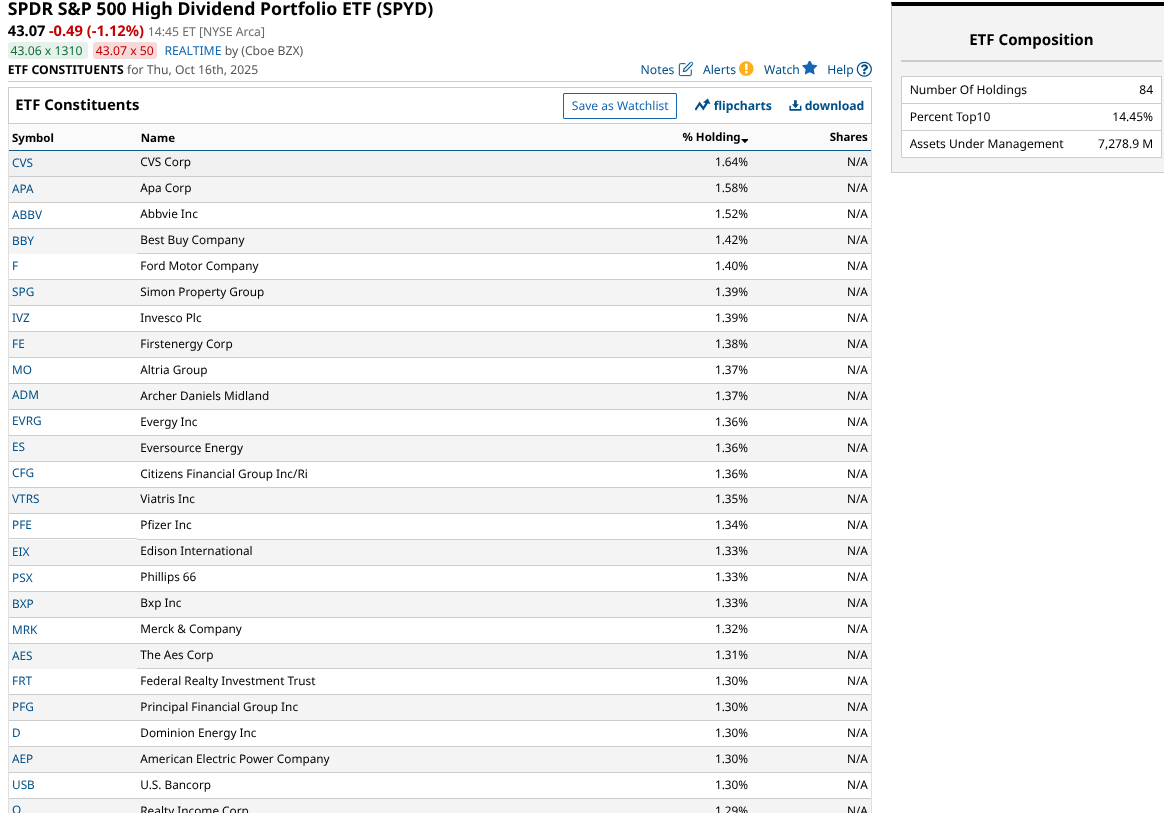

The SPDR S&P 500 High Dividend Portfolio ETF (SPYD) is days short of its 10-year anniversary. It is dedicated to owning about 80 of the highest-yielding stocks within the S&P 500. But increasingly, even with that long a list, it is difficult to find stocks worthy of buying and holding.

Some highlights from that table above:

- SPYD does what it says it does. With the S&P 500 yielding in the low-1% range, a basket of stocks from that index yielding 4.5% is stellar. At least for income.

- The expense ratio is very skinny, at 0.07%. Check that box.

- These stocks sell at under 12x earnings. Another check.

- The ETF is big enough, but not too big, at $7.7 billion in assets.

- It provides decent long-term upside, with a beta around 1.00.

There’s a problem, however. This type of stock has been in a slumber as evidenced by that -9% annualized alpha. OK, so it doesn’t keep up with the S&P 500 over time. But SPYD is also down for the current year, even when we add the dividend yield back in.

So right away, we are in “contrarian” territory here. But do these stocks even qualify to be long-term buys?

By that I mean that in addition to the dividend yield, these stocks are fundamentally sound and have a catalyst that potentially produces solid price gains. Even if the market waffles a bit over the next 3-5 years.

Dividend Stock Charts Are Too Weak for My Taste

I looked at weekly charts and some fundamental details on all 80-plus holdings in SPYD. Here’s a summary, based on looking out at least a year’s time, based on the same criteria I use for any type of long-term equity investing.

Here are a couple of the better-looking ones. But for every one like this, there are seven or eight others that look somewhere between uninspiring and downright awful to me.

More broadly, SPYD’s chart below signals to me that these stocks are so far behind, their long-term returns going forward are unlikely to match even the lagging ones of the past decade.

So, be excited about the potential to get a combination of high dividend yield and long-term growth. Just don’t make the mistake of assuming it is that easy to find.