With just one trading session left before Christmas, the share market closed higher on Thursday.

See how the trading day unfolded on our markets blog.

Follow the day's financial news and insights from our specialist business reporters.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Market snapshot

By Nassim Khadem

This is the numbers after market close at 4pm AEDT on Thursday, December 22.

- ASX 200: Up 0.5 per cent to 7,152.2

- All Ords: Up 0.6 per cent to 7335.2.

- Aussie dollar: 67.27 US cents

- On Wall Street: Dow up 1.6 per cent, S&P 500 up 1.5 per cent, Nasdaq up 1.5 per cent.

- In Europe: Stoxx up 1.6 per cent, FTSE up 1.7 per cent, DAX up 1.5 per cent

- Spot gold: Up 0.2 per cent to $US1828.90 an ounce

- Brent crude: Up .50 per cent to $US82.61 a barrel

- Iron ore: Up 0.75 per cent to $US110.95 a tonne

- Bitcoin: Up 0.18 per cent at $US16833.60

ASX 200 adds 0.5 per cent

By Nassim Khadem

The S&P/ASX 200 Index rose for a second day.

With just one trading session left before Christmas, the index added 0.5 per cent to 7152.5 points.

The All Ordinaries rose 0.6 per cent to 7335.2.

The Australian dollar was trading at 67.6 US cents.

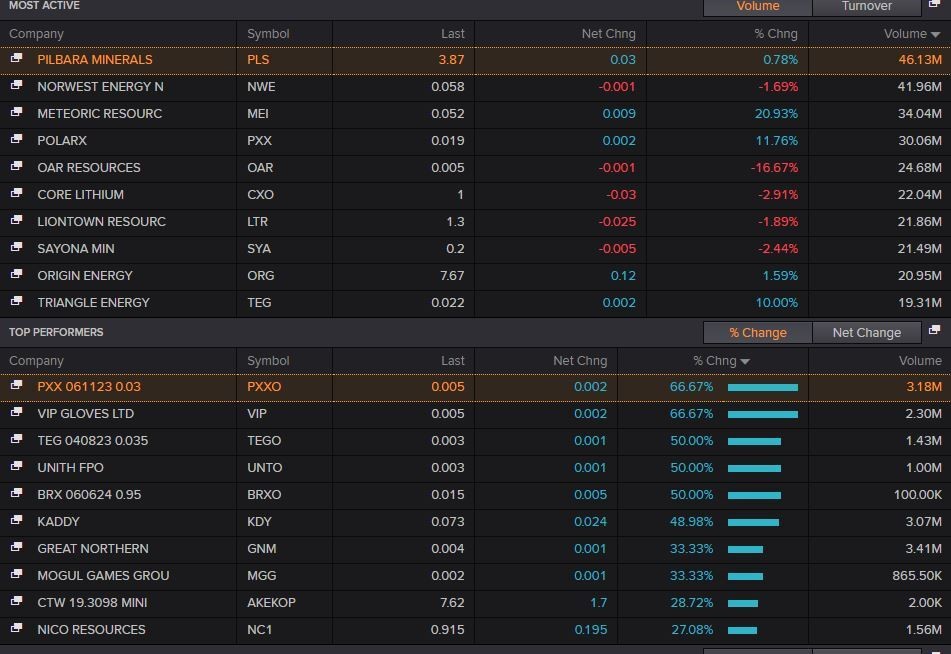

Below are some of the most active and best performing stocks of the day.

Thanks for spending the day with us, until next time!

Hundreds of thousands of borrowers could end up in mortgage stress in 2023

By Nassim Khadem

About 15 per cent of borrowers would not have any spare cash flow by the end of 2023 due to rate rises and increases to the cost of living, RBA data shows.

A review of the Reserve Bank of Australia's annual report includes some of the central banks forward-looking analysis.

It suggests that this cohort have "quite high debt and very little in the way of pre-payment buffers—less than three months' worth of excess mortgage payments".

"Those households—the high-debt, low-buffer households—tend to be the ones that are disproportionately populated by low-income households—so they have less ability to trim their expenditure."

The House of Representatives Standing Committee on Economics notes that in July Treasurer Jim Chalmers announced a 'wide-ranging' independent review of the RBA and Australia's monetary policy.

Its report says the committee "appreciates that several factors influencing inflation could not have been foreseen", but that it expects the RBA to examine lessons learnt and consider how its communication can be improved.

"Australian households, workers and industries—facing intensifying cost-of-living pressures and challenging work and business conditions—deserve no less," the report said.

FTX co-founder Gary Wang and ex-Alameda CEO Caroline Ellison plead guilty to fraud charges

By Nassim Khadem

On the same day that that the Bahamas extradited FTX co-founder and former CEO Sam Bankman-Fried to the United States to face criminal charges, two former executives at FTX and Alameda Research pleaded guilty to federal fraud charges.

Caroline Ellison, the former chief executive of Alameda Research — the crypto trading company founded by Bankman-Fried — and Zixiao (Gary) Wang, co-founder of crypto platform FTX and its former chief technology officer, were charged for their roles in contributing to the crypto platform's collapse.

You can listen to US Attorney Damian Williams below.

Williams suggested more charges in the FTX case could be coming.

"If you participated in misconduct at FTX or Alameda, now is the time to get ahead of it," Williams said.

"We are moving quickly and our patience is not eternal."

"We continue to work around the clock and we are far from done."

The US Securities and Exchange Commission also announced separate lawsuits against the pair, "for their roles in a multiyear scheme to defraud equity investors in FTX."

Medibank returns $207m cash to customers

By Nassim Khadem

Medibank will return another $207 million of the savings it made during the COVID-19 pandemic to customers.

The company told the ASX on Thursday that takes the total redistribution to $950 million since the initial outbreak in 2020.

Funds will be delivered automatically through a "cash back" feature, deposited directly to customers' bank accounts from late May.

"Our COVID-19 support package and give back program has now reached a record $950 million," customer portfolios executive Milosh Milisavljevic said.

"We know a lot of people are doing it tough at the moment with rising cost of living expenses, so we hope that this provides our customers with some financial relief."

It's some welcome news for some customers following the recent hacking scandal, where sensitive data of up to 10 million Medibank customers was stolen and ransomed online.

Medibank shares were trading 1.6 per cent higher at $2.94 in midday trade Thursday.

ASX still tracking higher at lunch

By Samuel Yang

The ASX 200 was up 44 points or 0.6 per cent, to 7,159, at 12:30pm AEDT.

Local energy stocks rose 0.5 per cent and was among the top gainers on the index after oil prices gained following a larger-than-expected draw in US crude stockpiles.

Sector majors Woodside Energy and Santos added 0.7 per cent and 0.8 per cent, respectively.

Miners gained 0.8 per cent following gains in Chinese iron ore and steel futures.

Iron ore behemoths BHP and Rio Tinto rose 0.3 per cent and 0.8 per cent, respectively.

Tech stocks climbed 1.4 per cent, tracking gains on its Wall Street peers.

Financials added 0.7 per cent. Three of the big four banks climbed 0.8 per cent to 1.1 per cent.

Gold stocks lost 0.2 per cent, with the country's largest gold miner Newcrest Mining sliding 0.6 per cent.

ReadyTech says Pacific Equity Partners working on new buyout offer

By Samuel Yang

Software firm ReadyTech said on Thursday that Pacific Equity Partners (PEP) had withdrawn its updated buyout offer of $4.50 per share for the company and was working on an alternative proposal.

PEP revised its per-share offer last month, allowing ReadyTech shareholders to opt for cash, shares or a mix of both.

The private-equity firm's alternative offer could deliver the same per-share value, although it was yet to give out further details on the proposal, the company said in a press statement.

Readytech is among a handful of Australian software firms that have agreed to be bought out by PE firms in recent months. Others include Xero and Tyro.

ReadyTech, which has a market capitalisation of $447.3 million, also reaffirmed its fiscal 2023 outlook.

Shares of ReadyTech fall as much as 8.4 per cent to $3.6, posting its sharpest losses since March.

Kogan acquires Brosa

By Samuel Yang

Retailer Kogan has bought collapsed online furniture retailer Brosa for $1.5 million.

Kogan.com COO and CFO David Shafer said the acquisition will broaden the online furniture offering of the Kogan Group.

"We are pleased to be able to offer a lifeline to Brosa customers, to be able to save the Brosa brand, and to relaunch Brosa.com.au very shortly," he said in a statement to the stock exchange.

Following years of investment in brand-building and marketing, Brosa is a well known online furniture brand in Australia, and we are delighted to be able to bring the brand within the Kogan Group."

Brosa went into voluntary administration earlier this month due to cashflow issues.

ASX opens higher

By Samuel Yang

Australian shares have risen in the first 20 minutes of trade in tandem with gains in global markets as improved US consumer confidence data eased investors expectations about inflation.

The benchmark index ASX 200 was up 44 points or 0.6 per cent, to 7,157 at 10:15am AEDT.

Here are the top and bottom movers at open.

US set to ban TikTok on government phones over national security risk fears

By Samuel Yang

A proposal to ban United States federal employees from using TikTok on government devices looks set to become law, threatening to deal a blow to the company's reputation and scare off advertisers even if it will not affect many users, experts say.

US politicians have included the proposal in a key spending bill, virtually ensuring its passage later this week, following a Senate vote to green-light a similar measure.

The move is the latest US effort to crack down on the popular social media platform, which has been the subject of a number of recent state bans and a long-running US national security probe over fears it could be used by the Chinese government to censor content, or spy on Americans.

Click the link below for more details.

Online gambling sites are increasingly offering crypto deposits

By Samuel Yang

In Australia, it's against the law to provide gambling services without an Australian licence.

The Australian Communications and Media Authority says 652 sites have been blocked for operating illegally.

Many sites obtain their licences offshore, with a growing number offering crypto deposits.

It is costing Australians like Blake thousands.

Read the story from 7.30's Patrick Begley.

Wall Street advances

By Samuel Yang

Wall Street's main stock indexes closed higher on Wednesday with help from upbeat Nike and FedEx quarterly earnings.

Nike shares rallied sharply after beating profit expectations for its second quarter on strong holiday demand from North American shoppers, while FedEx also gained and shares in cruise operator Carnival Corp jumped after posting a smaller-than-expected quarterly loss.

FedEx, which sparked a market selloff in September after pulling financial forecasts, provided financial guidance and announced plans for $US1 billion cost cuts.

US consumer confidence rose to an eight-month high in December as inflation retreated and the labor market remained strong while 12-month inflation expectations fell to 6.7 per cent, the lowest since September 2021.

"We're seeing a broad rally. It's been helped by upbeat corporate commentary and an improvement in consumer confidence," said Angelo Kourkafas, investment strategist at Edward Jones in St. Louis referring to Nike and FedEx.

According to preliminary data, the S&P 500 gained 56 points, or 1.48 per cent, to end at 3,878 points, while the Nasdaq Composite gained 159 points, or 1.51 per cent, to 10,706. The Dow Jones Industrial Average rose 522 points, or 1.59 per cent, to 33,371.

Fears of a recession following the US central bank's prolonged interest rate hikes have weighed heavily on equities and these fears have put the S&P on track for its biggest annual decline since 2008 and a decline for December.

ICYMI: ASX shrugs off panic about the Bank of Japan’s rollback of low interest rates

By Samuel Yang

Market snapshot

By Samuel Yang

This is how we are at 4.30pm AEDT on Thursday, December 22.

- ASX 200: Up 0.5 per cent to 7152.5

- All Ords: Up 0.6 per cent to 7335.2.

- Aussie dollar: 67.6 US cents

- On Wall Street: Dow up 1.6 per cent, S&P 500 up 1.5 per cent, Nasdaq up 1.5 per cent.

- In Europe: Stoxx up 1.6 per cent, FTSE up 1.7 per cent, DAX up 1.5 per cent

- Spot gold: Up 0.20 per cent to $US1829 an ounce

- Brent crude: Up 0.44 per cent to $US82.56 a barrel

- Iron ore: Up .75 per cent to $US110.95 a tonne

- Bitcoin: Up 0.10 per cent at $US16820.90

ASX poised to rise

By Samuel Yang

Good morning, I'll be taking you through all the live markets action from ASX open to close, along with a bit of economics and company news along the way.

The local market looks set for a rise after Wall Street rallied overnight.

The ASX SPI 200 futures are up more than half a per cent, following a 1.4 per cent jump in the main Wall Street index, the S&P 500.

That's helped by upbeat Nike and FedEx quarterly updates, as well as improving consumer confidence and easing inflation expectations from investors.

We'll bring you more in a post soon once Wall Street closed its session.