LIV Golf's UK entity has suffered total losses of more than $1.1 billion between its launch in 2021 and the end of 2024, accounts recently filed with Companies House show.

The 54-hole league's UK-based organization wound up losing $461.8 million in 2024 alone, on top of almost $396 million in 2023 and around $243 million in the 18 months until the end of 2022.

In terms of revenue, LIV Golf Investments Ltd brought in almost $65 million last year and just over $37 million in 2023.

Meanwhile, the same body has sold circa $4.89 billion in the form of ordinary and non-voting preference shares since starting up.

But, as a result of significant losses in the most recent full financial period, the December 2024 accounts stated that directors had concluded there was "a material uncertainty which might cast significant doubt over [LIV Golf Investments'] ability to continue" as a financially-stable company.

If you think football clubs are good at losing money Liv Golf has racked up losses of £1.1 billion between 2021 and 2024. #MashedPotato pic.twitter.com/woRZs7nn6pOctober 3, 2025

Effectively, the business was deemed to be at risk if losses continued at this rate with no method of clearing debts.

However, in the accounts, the Saudi PIF officially noted its ability and commitment to provide the necessary financial support to LIV Golf Investments Ltd during the applicable assessment period.

While the $1.1 billion losses are far from ideal, the latest write-off could be deemed a drop in the ocean for the Saudi PIF - which is worth approximately $925 billion.

Although, it should also be noted that the PIF has paid out far more than the aforementioned sum overall since helping to introducing the breakaway circuit because the Companies House accounts do not include anything regarding LIV Golf's US dealings.

From a wider perspective, LIV's overall business has made notable strides in establishing itself globally following the initial heavy payout to many of the game's biggest and brightest stars.

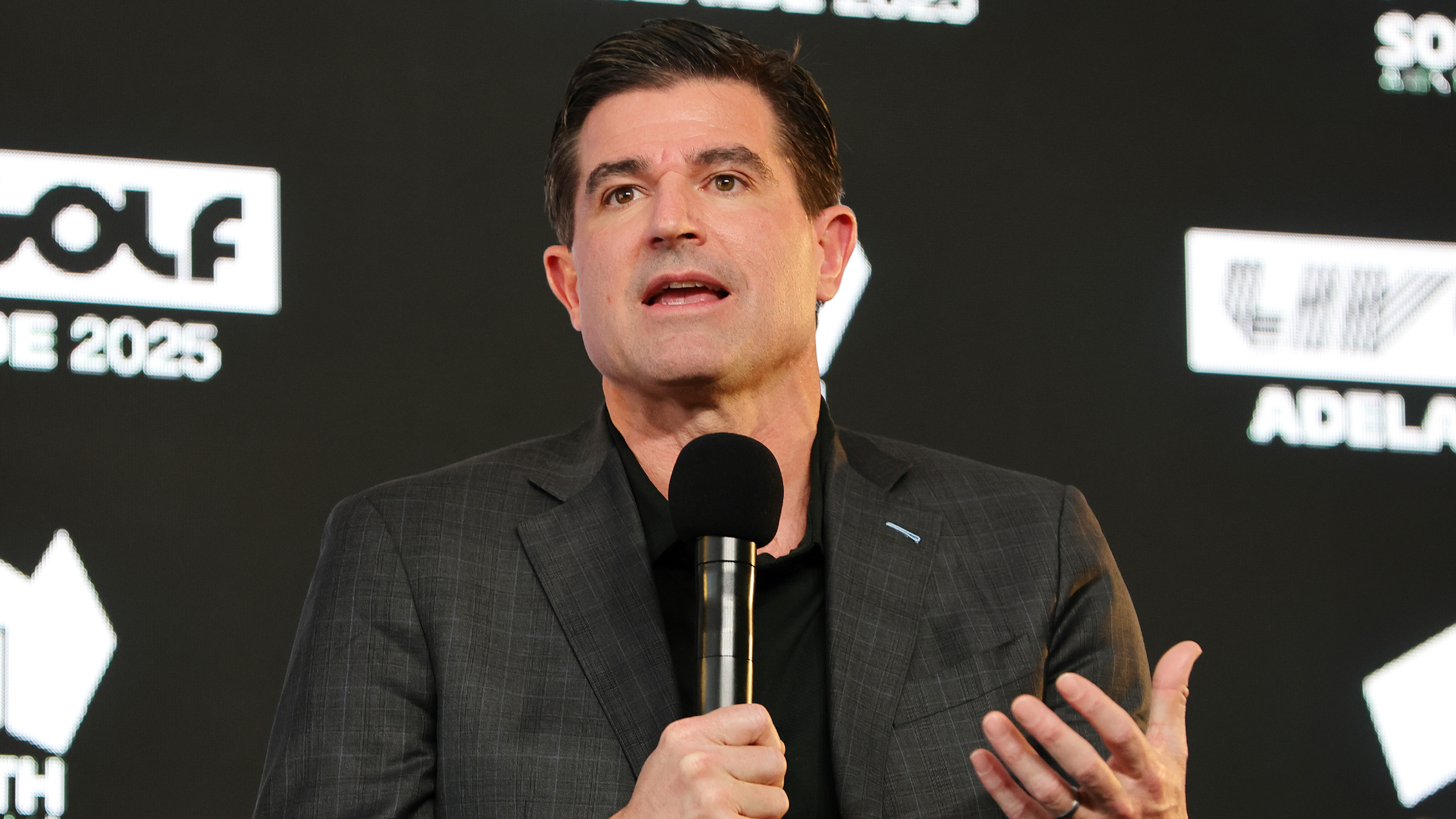

Since Scott O'Neill took over from Greg Norman as LIV's chief executive, the PIF-backed league has signed a multi-year TV deal with Fox in America and added a plethora of other multi-national brands to its portfolio.

LIV also committed to diversify its future playing schedule by operating in new countries such as South Korea and South Africa while penning a long-term agreement to remain in Australia, too.

The future of men's professional golf remains up in the air, however, with no immediate change expected in the standoff between the PGA Tour, LIV Golf and the DP World Tour.

Following the Framework Agreement, which was signed in 2023, hopes of some kind of unification had been raised. But, while it had been suggested that LIV would invest in a new commercial entity alongside PGA Tour, that has yet to materialize.

Instead, the US-based Strategic Sports Group ploughed an initial $1.5 billion from a total of $3 billion into the historic golf tour last year, leaving LIV out in the cold somewhat.

Although talks are continuing between the PGA Tour, LIV and DP World Tour in a bid to find a resolution, a deal appears far from being agreed at this stage.

Golf Monthly has contacted LIV Golf for comment.