Levi Strauss (LEVI), the century-old denim icon, delivered a strong third quarter that beat Wall Street’s expectations and even prompted management to lift its full-year outlook. Yet, despite the upbeat numbers, Levi Strauss shares fell more than 11% in morning trading.

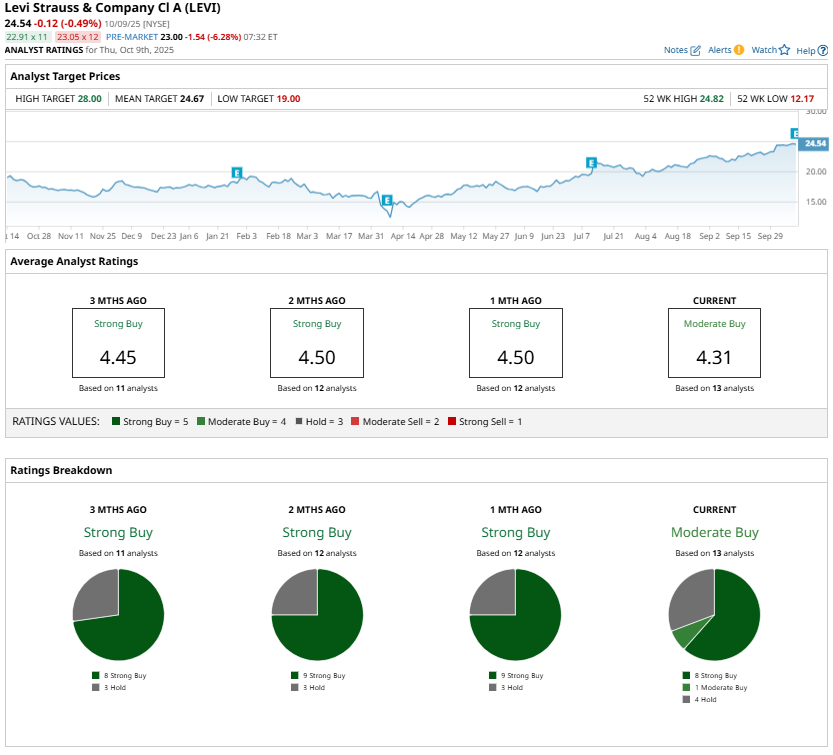

The market’s reaction came on the heels of the stock’s stellar run in the recent past. Ahead of earnings, Levi’s shares had touched a new 52-week high of $24.82, climbing more than 64% over the past six months. Expectations were running high, and the stock’s pullback suggests that investors may have been looking for stronger forward guidance to justify further gains.

Management’s conservative tone raised eyebrows, especially after a strong Q3 performance. Margin pressures, particularly those tied to tariff-related costs, also gave investors pause. These headwinds could constrain near-term profitability, even as overall business momentum remains intact.

Momentum in Levi’s Business to Sustain

The broader picture suggests that Levi’s latest pullback may be more of a pause than a reversal. Moreover, the longer-term picture for Levi Strauss appears more resilient. The company has been steadily reshaping its business model, shifting toward higher-margin direct-to-consumer (DTC) sales, expanding internationally, and growing its women’s category. All of these moves are driving its revenue and profitability.

This strategic pivot is paying off. DTC sales rose 9% in the third quarter, powered by both online and in-store growth, while e-commerce surged 16%. Consumers are buying more per visit, paying full price, and responding positively to Levi’s broader denim lifestyle assortments. These trends reflect the benefits of Levi’s ongoing shift from heavy discounting toward brand-driven, full-price sales.

Profitability is also benefiting from this transformation. Productivity initiatives and better store-level efficiency drove over 400 basis points of expansion in margins in Q3. Levi’s store optimization strategy, including enhanced lifestyle merchandising and improved assortment planning, is driving consumer satisfaction and efficiency gains.

Levi’s women’s segment is growing steadily, with sales rising 9% in Q3. The company has strong potential to increase its share in the women’s market, which currently has higher profit margins. Meanwhile, the men’s segment continues to perform well, supporting overall growth and sustaining momentum across the business.

The wholesale segment, too, is showing steady progress, with net revenues up 5% as Levi’s deepened its presence in top U.S. retail doors and expanded its western wear offerings through partnerships.

International expansion is another growth catalyst. Global revenue outside the U.S. now accounts for nearly 60% of total sales, providing natural diversification from U.S.-centric risks such as tariffs. In Q3, international sales climbed 9%, with strong performances in Asia. Markets like India, Japan, Korea, and Turkey posted double-digit growth, reflecting the brand’s global resonance and the company’s efforts to refine its product mix.

LEVI Stock: Looking Past Short-Term Volatility

From a valuation standpoint, Levi’s stock trades at a forward price-to-earnings multiple of about 18.9x, a reasonable level given analysts’ expectations for double-digit earnings growth by 2026. Wall Street remains moderately bullish, with a consensus “Moderate Buy” rating, reflecting confidence that Levi’s long-term strategy can sustain momentum even as short-term pressures play out.

While Levi’s stock came under pressure following Q3 earnings, this reaction largely reflects high expectations rather than any fundamental weakness. The company’s strategic focus on direct-to-consumer sales, international expansion, and premium product positioning is paying off, as evidenced by robust revenue growth, full-price sales, and improving profitability metrics. Margin pressures and tariff-related costs may temper near-term results, but Levi’s ongoing operational efficiencies and store optimization efforts provide a buffer against these headwinds.

Globally, the brand is resonating with consumers, particularly in Asia, and its diversified revenue base reduces reliance on any single market.

Thus, for investors willing to look past short-term volatility, the pullback in Levi Strauss stock presents a buying opportunity.