With a market cap of $19.3 billion, Lennox International Inc. (LII) is a global leader in heating, ventilation, air conditioning, and refrigeration (HVACR) solutions. The company designs, manufactures, and markets a wide range of residential and commercial climate control products under well-known brands such as Lennox, Armstrong Air, Heatcraft, and Bohn.

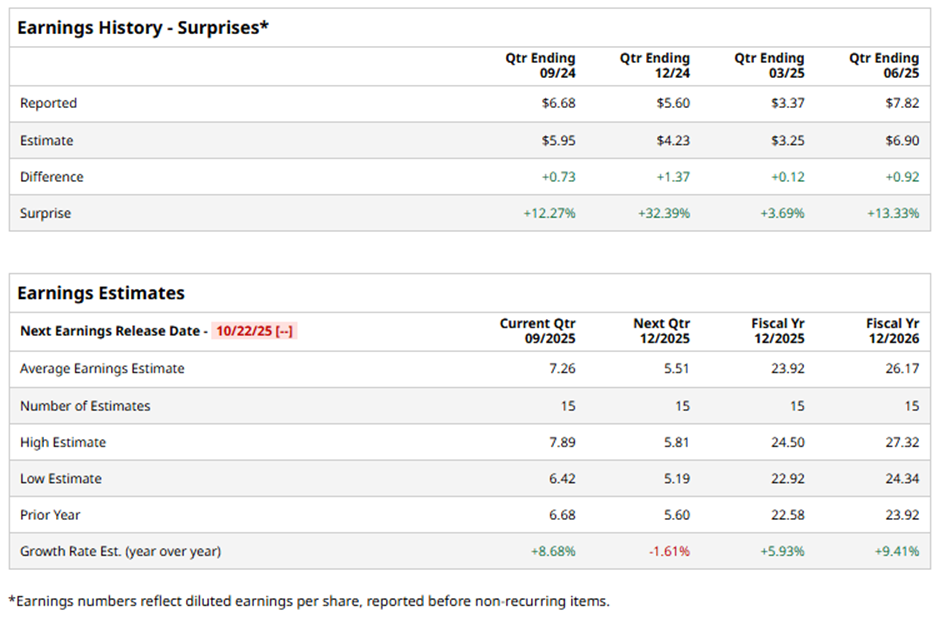

The Richardson, Texas-based company is expected to release its fiscal Q3 2025 earnings results on Wednesday, Oct. 22. Ahead of this event, analysts project LII to report an EPS of $7.26, an 8.7% growth from $6.68 in the year-ago quarter. It has exceeded Wall Street's bottom-line estimates in the last four quarters.

For fiscal 2025, analysts forecast the heating and cooling systems maker to report EPS of $23.92, up 5.9% from $22.58 in fiscal 2024. Looking forward, EPS is projected to rise 9.4% year-over-year to $26.17 in fiscal 2026.

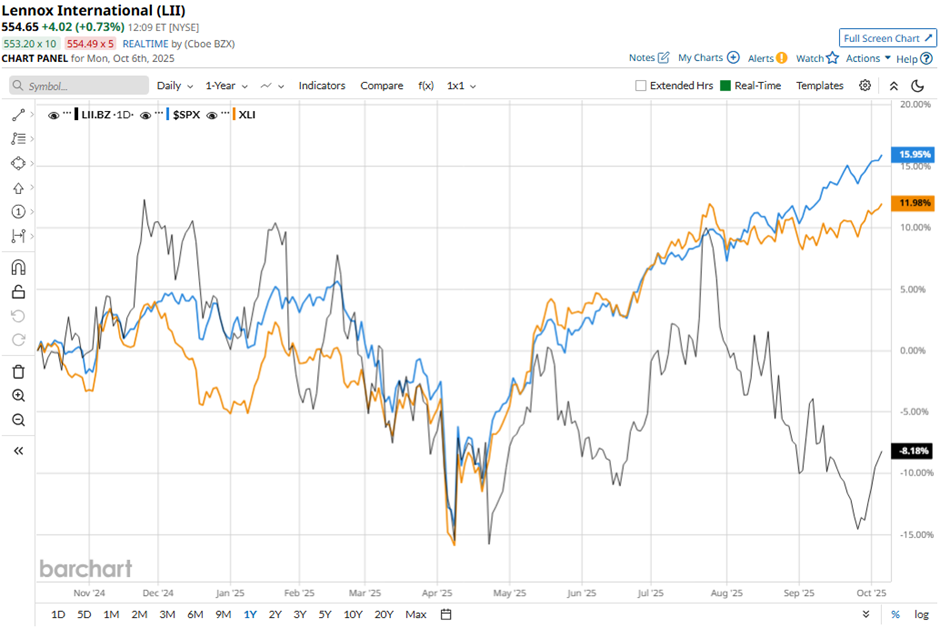

LII stock has declined 6.6% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 17.2% return and the Industrial Select Sector SPDR Fund's (XLI) 14.5% gain over the same period.

Shares of Lennox International jumped 6.6% on Jul. 23 after the company reported stronger-than-expected Q2 2025 results, with revenue up 3% to $1.5 billion and operating income rising 11% to $354 million, driving an EPS of $7.82, well above analyst estimates. Profit margins expanded significantly, with segment margin up 170 basis points to 23.6%, supported by $114 million in mix and price benefits.

Additionally, management raised full-year 2025 guidance, projecting revenue growth of 3% and a higher adjusted EPS range of $23.25 to $24.25.

Analysts' consensus view on LII stock is cautious, with an overall "Hold" rating. Among 18 analysts covering the stock, six suggest a "Strong Buy," seven give a "Hold," one provides a "Moderate Sell" rating, and four have a "Strong Sell." The average analyst price target for Lennox is $652.27, indicating a potential upside of 17.6% from the current levels.