Every options trader knows that volatility creates both risk and opportunity, but few truly understand the hidden forces that drive it.

In his latest video, Barchart contributor Gavin McMaster breaks down one of the most important — and misunderstood — concepts in options trading: Gamma Exposure (GEX) and the Gamma Flip.

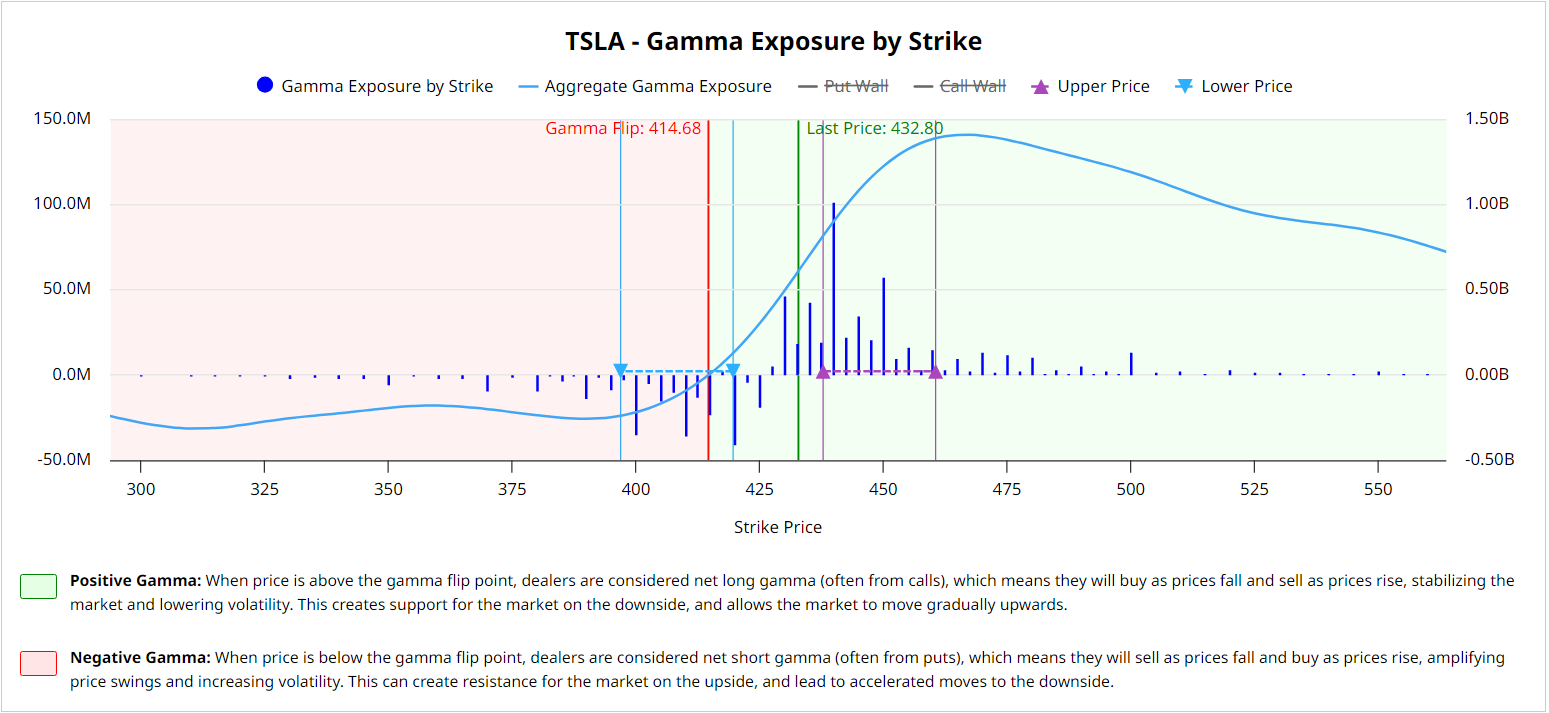

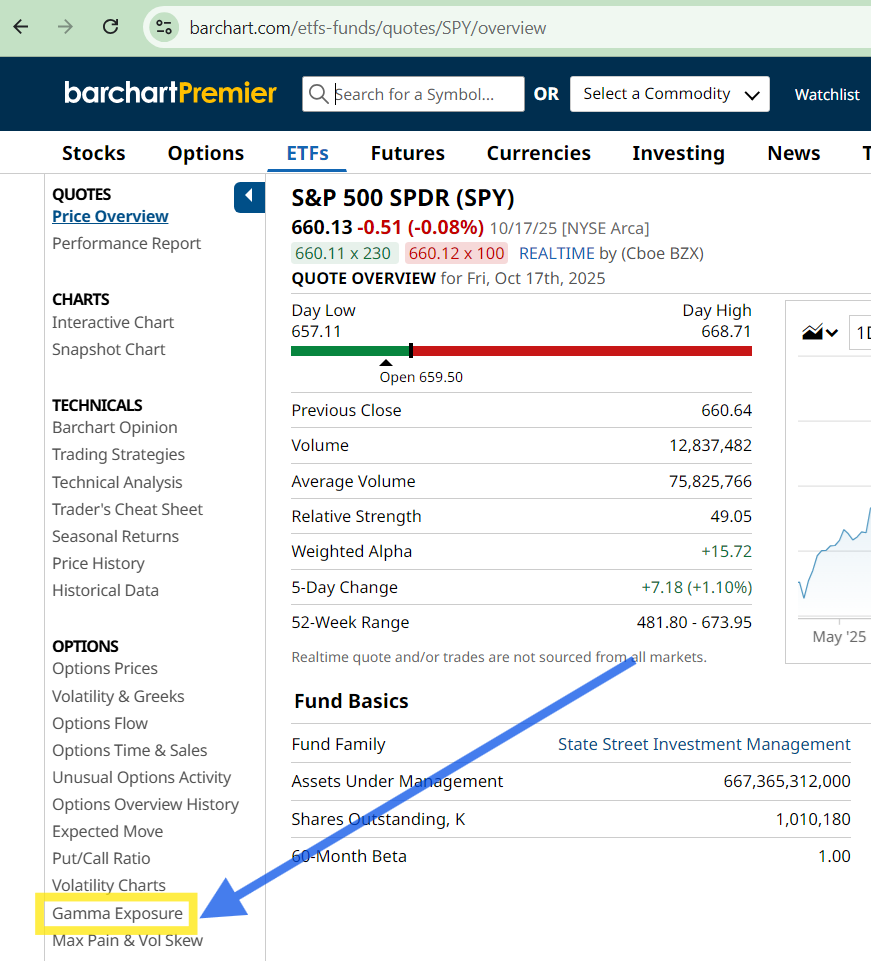

Using Barchart’s Gamma Exposure Tool, Gavin shows how traders can visualize these levels and use them to anticipate when volatility may surge or fade.

“When the index or stock trades below the gamma flip, price swings can get much more violent,” Gavin explains. “Above the flip point, markets tend to feel more stable and range-bound.”

Let’s break it down.

What Is Gamma Exposure?

Gamma Exposure (GEX) measures how market makers hedge their options positions as prices move.

- Positive Gamma means dealers hedge by buying when prices fall and selling when they rise — which dampens volatility.

- Negative Gamma means the opposite: dealers sell into declines and buy into rallies — which amplifies volatility and drives sharper moves.

The Gamma Flip marks the price level where this shift happens — the “line in the sand” where dealer positioning transitions from stabilizing to destabilizing.

“Think of the Gamma Flip like a fault line in the market,” Gavin says. “When price trades above it, things feel calm. Below it, volatility spikes fast.”

Example: SPY and the Gamma Flip

In the video, Gavin pulls up SPY on Barchart’s Gamma Exposure page. At the time of recording, SPY was trading near $650, and the gamma flip sat just below at $646.97.

“That’s not far below where we’re trading,” he notes. “If the market drops even a little and falls under that flip point, losses could start to accelerate quickly.”

The chart shows how aggregate gamma exposure flips negative beneath that level — meaning dealers may be forced to sell into weakness, amplifying the move.

Barchart’s built-in legend makes it easy to interpret:

🟩 Positive Gamma (above flip)

- Low volatility, range-bound trading

- Great for option sellers

🟥 Negative Gamma (below flip)

- High volatility, big swings

- Better for option buyers

Strategies for Trading Gamma Exposure

Knowing which side of the Gamma Flip the market is on can completely change your approach.

“Positive gamma is great for option sellers,” Gavin explains. “Below the flip, things can get dangerous — volatility can rise fast.”

Above the Gamma Flip → Positive Gamma (Calmer Markets)

Best for:

- Selling premium (covered calls, iron condors, cash-secured puts)

- Theta-positive strategies

- Short-term mean-reversion trades

Below the Gamma Flip → Negative Gamma (Volatile Markets)

Best for:

- Buying calls/puts or debit spreads to capture volatility spikes

- Hedging portfolios

- Avoiding aggressive short volatility exposure

How to Use Barchart’s Gamma Exposure Tool

- Pull up any stock or ETF on Barchart

- Scroll to the Options section and click Gamma Exposure

Look for:

- Gamma Flip Level: The dividing line between calm and chaos

- Positive vs. Negative Gamma Zones: Marked clearly on the chart

- Put/Call Walls: Major open interest levels acting as support or resistance

You can use the tool on benchmark ETFs like SPY, QQQ, and IWM, or on individual names to spot where volatility may surge next.

The Bottom Line

The Gamma Flip isn’t a prediction; it’s a pressure gauge. When you know where it sits, you can anticipate when the market might shift from calm to chaos, and position accordingly.

Gavin sums it up best: “When volatility is about to change, Gamma Exposure often shows you the warning before it happens.”

Watch Gavin’s quick breakdown of Gamma Flip →

- Stream the Full Video: Gamma Trading Secrets: Transform the Way You Trade Options >>

- Use the Gamma Exposure Tool for your favorite stocks & ETFs >>