Oracle (NYSE:ORCL) co-founder Larry Ellison‘s net worth plummeted by $34 billion after briefly surpassing Tesla‘s (NASDAQ:TSLA) Elon Musk as the world’s richest person last week.

Oracle-OpenAI Deal Could Lead To “AI Bubble”

Ellison’s wealth soared to $393 billion, surpassing Musk’s $385 billion, after Oracle’s strong earnings report. This made him the richest person in the world, a title he held for a brief period. However, this was short-lived, as his net worth plummeted by $34 billion in the days that followed, according to the Bloomberg Billionaires Index.

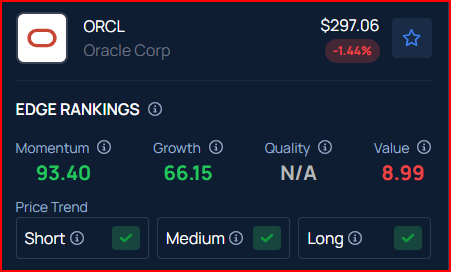

Check out the current price of ORCL stock here.

J. Bradford DeLong, a U.C. Berkeley economist, told Fortune that the sudden drop in Ellison’s wealth was attributed to market skepticism regarding Oracle’s recent $300 billion deal with OpenAI.

"The subsequent decline came from second thoughts about the magnitude of Oracle's involvement," as per DeLong. The economist also warned that the deal could lead to a potential “AI bubble.”

Concerns Grow Over OpenAI’s Financial Ability To Honor The Deal

Despite initial market excitement, concerns quickly mounted over the financial risk of the deal. Oracle, which has yet to prove itself as a top cloud provider, is heavily reliant on OpenAI, a company whose annualized revenue of $12 billion is dwarfed by the $300 billion deal.

The future of OpenAI has been thrown into uncertainty as the company reportedly has a high cash burn and lacks the funds to honor its $300 billion deal with Oracle. This poses a massive challenge to the deal, as OpenAI is unable to meet its financial obligations.

Chanos Flags Oracle Risks, Munster Bullish On AI Deal Impact

In September, famed short-seller Jim Chanos had expressed concerns about Oracle’s massive backlog and the financial risk associated with the OpenAI deal. "Even better, this $300B deal doesn’t even begin until…2027!,” stated Chanos.

Despite these concerns, Gene Munster, a managing partner at Deepwater Asset Management, had expressed optimism about Oracle’s position in the AI race following the deal. According to him, Oracle’s deal with OpenAI could reshape industries and change the world, positioning Oracle as an AI “hyperscaler.”

According to Benzinga Edge Stock Rankings, Oracle has a growth score of 66.15% and a momentum rating of 93.40%. Click here to see how it compares to other leading tech companies.

READ NEXT:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.