/L3Harris%20Technologies%20Inc%20NY%20office%20building-by%20JHVEPhoto%20via%20iStock.jpg)

Melbourne, Florida-based L3Harris Technologies, Inc. (LHX) provides mission-critical solutions for government and commercial customers. Valued at $51.9 billion by market cap, the company designs, develops, and manufactures radio communications products and systems, including single-channel ground and airborne radio systems. It also provides advanced defense and commercial technologies across air, land, sea, space, and cyber domains.

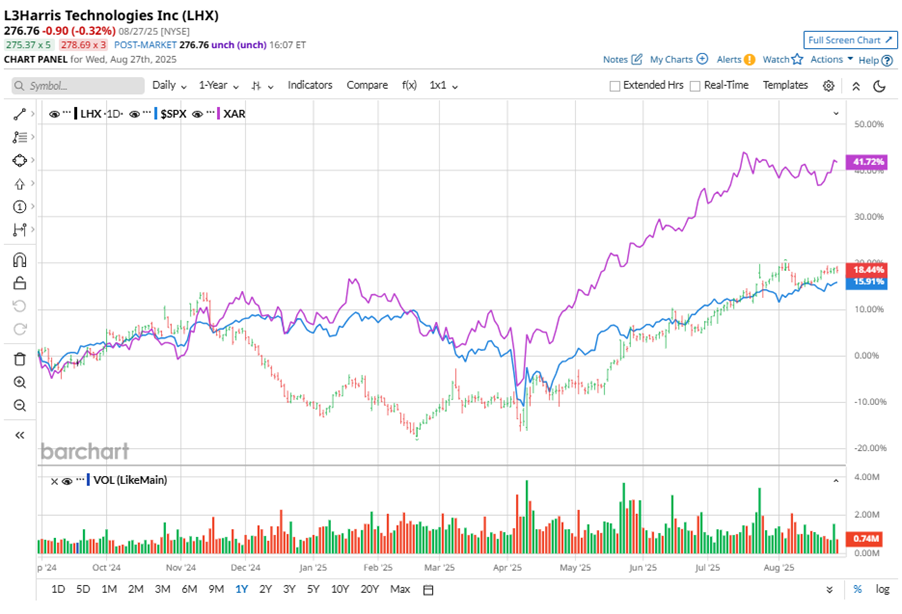

Shares of this leading global aerospace and defense technology company have outperformed the broader market over the past year. LHX has gained 20.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.2%. In 2025, LHX stock is up 31.6%, surpassing the SPX’s 10.2% rise on a YTD basis.

Narrowing the focus, LHX’s underperformance is apparent compared to SPDR S&P Aerospace & Defense ETF (XAR). The exchange-traded fund has gained about 43.8% over the past year. Moreover, the ETF’s 32.4% gains on a YTD basis outshine the stock’s returns over the same time frame.

LHX’s success is driven by its strong presence in growing defense areas like unmanned systems, satellite communications, and advanced weapon systems. Recent achievements, including the expansion of its satellite integration facility, the launch of Navigation Technology Satellite-3, and contributions to the Artemis II mission, position the company for continued growth in the defense industry.

On Jul. 24, LHX shares closed up more than 1% after reporting its Q2 results. Its adjusted EPS of $2.78 exceeded Wall Street expectations of $2.48. The company’s revenue was $5.4 billion, topping Wall Street forecasts of $5.3 billion. LHX expects full-year adjusted EPS in the range of $10.40 to $10.60, and expects revenue to be $21.8 billion.

For the current fiscal year, ending in December, analysts expect LHX’s EPS to decline 19.9% to $10.50 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

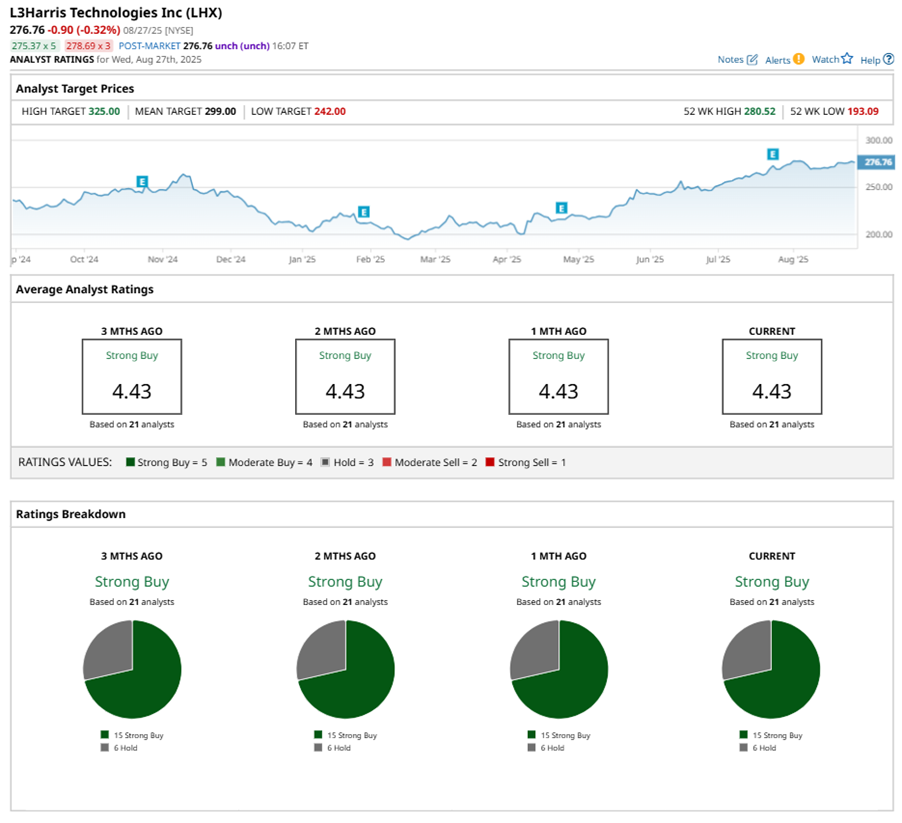

Among the 21 analysts covering LHX stock, the consensus is a “Strong Buy.” That’s based on 15 “Strong Buy” ratings, and six “Holds.”

The configuration has been consistent over the past three months.

On Aug. 25, Ronald Epstein from Bank of America Corporation (BAC) maintained a “Buy” rating on LHX with a price target of $315, implying a potential upside of 13.8% from current levels.

The mean price target of $299 represents an 8% premium to LHX’s current price levels. The Street-high price target of $325 suggests an upside potential of 17.4%.