What happens when a Wall Street legend finds itself at a crossroads, battered by market underperformance yet dangling one of the juiciest dividend yields in its sector?

Kraft Heinz (KHC), one of America’s most iconic food companies, is grabbing headlines with reports of a breakup swirling. According to the Wall Street Journal, Kraft Heinz could spin off a “sizable” chunk of its grocery business and retool it for new growth. This possibility, viewed positively by analysts, comes as the packaged food titan’s stock stands out for its industry-leading dividend yield.

Investors can’t ignore the numbers. Kraft Heinz basks in a forward dividend yield of nearly 6%, a figure that's almost triple the consumer staples sector average.

Yet, that high yield betrays a deeper story: KHC shares have dropped more than 17% over the past year, sharply underperforming the S&P 500 Index ($SPX).

Is this bold breakup plan the catalyst Kraft Heinz needs to rewrite its growth story and reward loyal shareholders, or just another twist in the tale of a stock stuck in neutral? Let’s dive into KHC.

KHC’s Financial Position

Kraft Heinz (KHC), the global food and beverage giant behind household staples like Kraft macaroni and cheese, Heinz ketchup, Capri Sun, and Lunchables, holds a market capitalization of $33.3 billion. The company remains a magnet for income-seeking investors, offering an annual dividend of $1.60 per share, a yield of 5.8%.

Kraft Heinz trades at a forward price-earnings ratio of 10.7x, well below the packaged foods sector median of 16.12x, with a price-sales ratio of 1.27x, just a tick above the industry’s 1.2x median, marking KHC as attractively valued in comparison to peers.

Earnings haven’t helped the case, though, as on April 30, Kraft Heinz delivered a first-quarter report that highlighted its ongoing operational challenges. Net sales slipped 6.4%, reflecting persistent headwinds, while the gross profit margin contracted by 60 basis points to 34.4%.

Diluted earnings per share landed at $0.59, a year-over-year drop of 10.6%, and adjusted EPS came in at $0.62, down 10.1%. Despite sluggish top-line results, the company’s free cash flow remained stable at $500 million.

So far in 2025, Kraft Heinz has returned $700 million to shareholders, including $477 million in dividends and $225 million in share repurchases. As of March 29, the company had $1.7 billion in buyback authorization remaining, giving it flexibility in capital returns.

Kraft Heinz’s Strategic Pivot

Kraft Heinz is exploring a major breakup that could involve spinning off a large chunk of its grocery business, including many familiar Kraft-branded staples. The new standalone entity could be valued as high as $20 billion.

What remains would center around faster-growing segments like sauces, condiments, and spreads, brands like Heinz ketchup and Grey Poupon mustard, where growth has been steadier and margins more attractive.

In Italy, Kraft Heinz just agreed to sell its infant and specialty food division to NewPrinces S.p.A., a top food producer in the region. The deal includes well-known brands like Plasmon, Nipiol, Dieterba, Aproten, and Biaglut, plus a key manufacturing plant in Latina, Italy. If approved by regulators, the transaction is expected to close by the end of 2025.

Meanwhile, in the U.S., the company is putting $3 billion into upgrading its 30 American factories, the biggest investment it’s made in over a decade. Management says the modernization will speed up new product launches and help the company defend its market share.

What the Analysts Are Saying

The market’s read on Kraft Heinz right now is a mix of caution and curiosity, as investors await its next earnings report set for July 30, 2025. For the current quarter, analysts are expecting earnings per share of $0.64, down from $0.78 a year ago, a 17.95% drop, and for the full year 2025, the consensus is $2.57, a sharp decline from $3.06 in 2024.

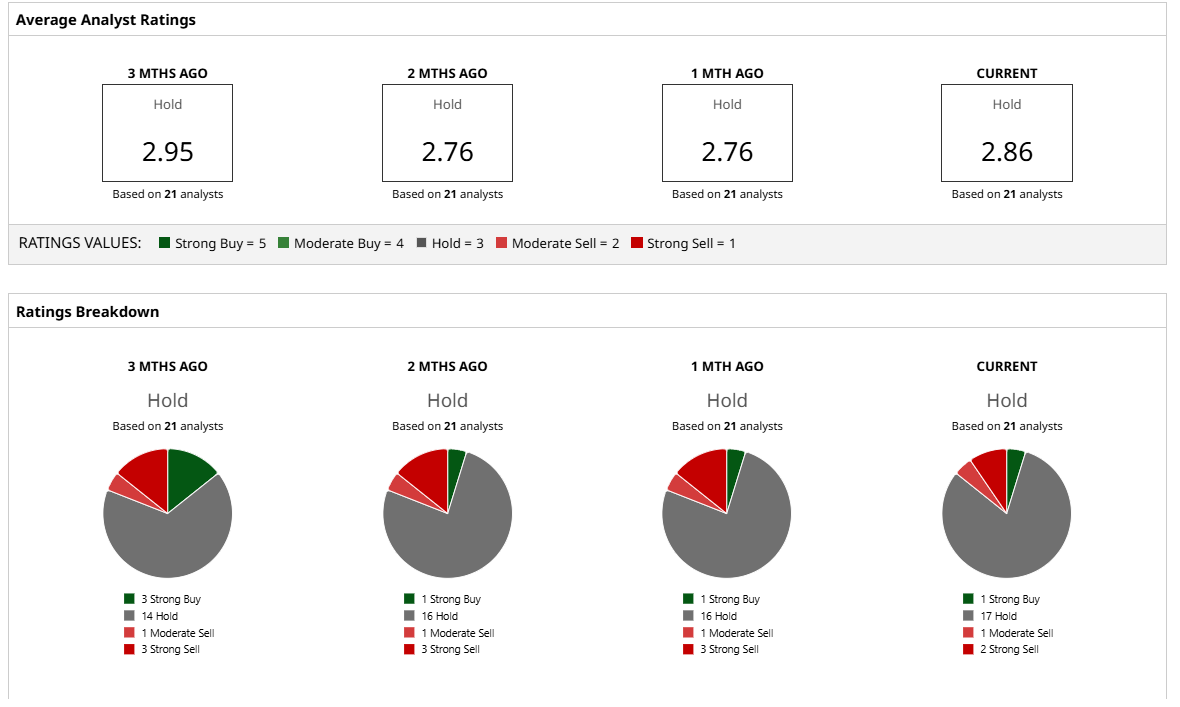

Analysts remain neutral. The 21 surveyed rate KHC a consensus “Hold.” The average price target sits at $28.75, pointing to marginal upside from the current price.

Conclusion

Kraft Heinz is undergoing a transition, streamlining its operations, investing in its core, and is now potentially considering spinning off a major part of its business. With a nearly 6% dividend yield, the stock still earns its place in income portfolios, but the case for growth remains unclear.

For now, it looks more like a “wait-and-see” play than a breakout story. Unless the company shows real progress on execution or unlocks value through the rumored breakup, the stock probably stays rangebound.