Kenvue, Inc. (KVUE), which manufactures Band-Aid, Listerine, Neutrogena, and Johnson's consumer products, reported disappointing Q2 sales and just announced that its CEO had left. Put options are showing unusually high volume today.

KVUE is at $21.59 today, well off its highs after releasing disappointing Q1 sales results on May 8. That probably led to the CEO's ouster yesterday. But it could be a value investor's signal to consider buying into KVUE stock.

Disappointing Q2 Results

Yesterday, Kenvue reported preliminary Q2 sales will be 4% lower, and “organic” sales would be -4.2%. The company said it would update its 2025 outlook on Aug. 7. This was after disappointing Q1 sales.

On May 8, Kenvue reported 3.9% Y/Y lower Q1 sales, although its gross margin rose slightly to 58% from 57.6%. In addition, its operating income margin rose to 14.9% from 14.1%.

However, in its updated Q1 outlook, Kenvue said it expects a lower operating income margin for the full year 2025. But it did not give an exact number. It is trying to “mitigate” the effects of tariffs on its future performance.

In yesterday's announcement about the CEO's leaving (after having ousted the CFO on May 12), the company is making a clean sweep of its upper management.

Moreover, Kenvue said it's looking to unlock shareholder value but did not give any concrete examples of what it plans to do.

So, no wonder there has been heavy put option activity in KVUE stock.

Unusual Put Option Activity

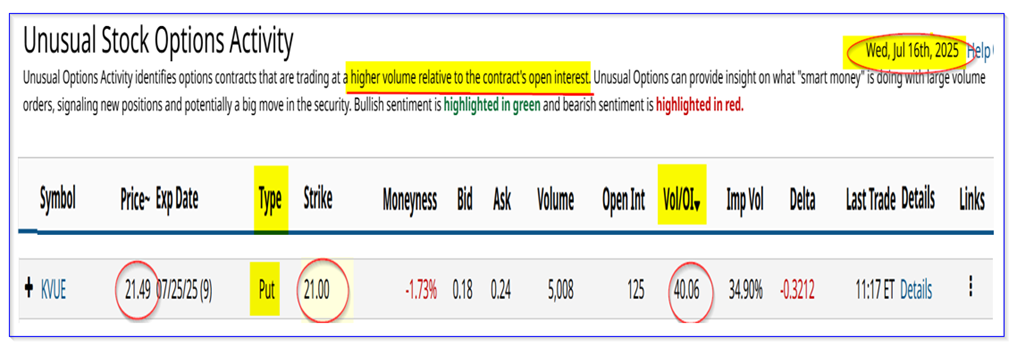

Today, the Barchart Unusual Stock Options Activity Report shows that over 5,000 put options have traded at the $21.00 strike pricve in the July 25 expiration contract, expiring in 9 days. That is over 40 times the number of prior outstanding contracts at that strike price.

This $21.00 strike is slightly lower than today's price, so it is out-of-the-money (OTM). The premium at the midpoint is 24 cents, so that means buyers of the puts hope to see KVUE close below $20.76, or 3.4% below today's trading price.

However, sellers of the puts, who may have received just 18 cents on the bid side, are making an immediate yield of 0.86% (i.e., $0.18/$21.00). At the midpoint premium, the short-put yield is slightly higher at 1.14% (i.e., $0.24/$21.00). So, on average, short sellers of the puts are making around 1.0% for 9 days until expiration.

In effect, they may be willing to buy shares at $21.00 if KVUE falls to that price on or before July 25. That may or may not be a good buy, based on the stock's outlook.

Price Target for KVUE Stock

Right now, there is a good deal of fear that tariffs could upset Kenvue's operating income and net income. But, has this already been discounted in the stock price?

For example, analysts now project $1.13 earnings per share (EPS) this year and $1.21 next year.

That puts KVUE stock on a forward price/earnings (P/E) multiple of 18.5x

$21.59 price / $1.17 next 12 months (NTM) EPS = 18.45x

This is slightly higher than its average over the past two years. For example, Morningstar reports that in 2023 and 2024 its forward P/E multiples were around 16.4x.

That implies the stock could be worth $19.19 per share, or 11% lower. Moreover, using the 2026 EPS, the stock would still only be worth $19.84, or -8% downside from today.

However, the company has said it expects to implement a series of shareholder value actions. Let's hope that they will help improve the outlook for the stock's valuation.

As a result, it may be that the buyers of these puts could end up making more money than the short-sellers of these puts.

The bottom line is that until the company updates its 2025 and further outlook, based on tariff impacts, KVUE stock may be in a transition period.

As a result, investors should be careful about taking a strong directional position or copying these unusual options trades until there is more clarity.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.