Prices at the pump are among the most noted costs for American families: If prices slump there's a rush to forecourts; if they spike higher it's the topic of conversation.

So it's no surprise that a 10.6% rise in gasoline prices in August—which in turn pushed up core inflation by 0.6%—might be causing a stir; after all, an estimated 84.1% of the U.S. population holds a license.

But a JPMorgan strategist—and a self-professed worrier—says even he isn't panicking over fuel prices.

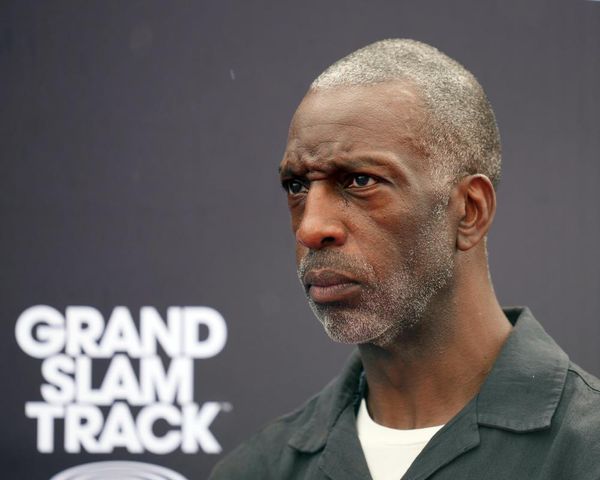

David Kelly, chief global strategist at JPMorgan, wrote the oil price surge "from an economic or investment perspective really doesn’t seem worth losing sleep over in 2023."

In a note sent to clients on Monday, Kelly professes he comes "from a long line of worriers"—his father doing so "loudly" while his mother fretted more quietly—"sparing her vocal cords at the expense of her sleep."

An inherent trait, the economic expert says "on any given evening [he could] compile an extensive catalog of the things that are troubling [him]" but adds some things "are just not worth the worrying."

America's 'bogeyman'

Oil falls into this category, though Kelly acknowledges the asset has been America's "economic bogeyman" for decades.

Foreign factors pushing up prices have indeed tightened the purse strings of U.S. consumers over the years: the Arab oil embargo of 1973, the Iranian revolution of 1979, and the first Gulf War in 1990 all inflated costs.

Price increases in 2023 are no different. In April members of OPEC announced they were going to begin curbing production, slashing approximately 1.15m barrels a day in a bid to stabilize the market.

Meanwhile Russia—another oil-rich nation, though not a part of OPEC—has said it will not sell its product either directly or indirectly to the U.S., after the latter placed price caps on the commodity following Russia's invasion of Ukraine. The retaliation will do little harm to prices any further, as President Biden has already banned Russian oil imports into the U.S.

Currently, Brent crude futures for October sit at $85.86 a barrel, while U.S. West Texas Intermediate crude futures rose to $81.63.

The very fact they can't control these rises are part of the reason consumers fear the fluctuations so much, which Kelly writes is completely understandable: "There is no price in America better known than the price of a gallon of gasoline so when gas prices rise, Americans often regard it as a sign of runaway inflation, leading to lower consumer confidence and greater business caution. Moreover, for many lower and middle-income Americans, spending more on gasoline means spending less elsewhere, undermining the consumption that is the principal driver of the American economy."

However, Kelly highlights there is easing pressure both on the demand and supply side. For example, the expert highlights that long-term investment into energy transition will dampen demand, while America's increasing domestic oil supply is continuing to ramp up.

The nation is therefore freeing itself of the constraints of being a net oil importer, thus protecting consumers from outside influences, he writes: "For many decades, the U.S. had been a net importer of oil so that when oil prices rose, American consumers found themselves poorer and foreign oil producers found themselves richer.

"However, because of the success of fracking technology, since the end of 2019, the U.S. has largely been a net exporter of oil and in the first half of 2023, our trade surplus in oil and petroleum products amounted to over 0.1% of GDP."

'Don't worry too much'

Despite understandable concerns about the cozy relationship between Saudi Arabia and Russia pushing up a key inflation factor further, Kelly adds the Fed could be a secret weapon.

"We expect inflation to moderate next year and, when the economy inevitably falters, we expect the Fed to reverse a good chunk of its recent aggressive tightening," Kelly writes.

"There is, as always, no shortage of things for investors to worry about in the weeks ahead, including the possibility of a government shutdown and an auto-workers strike," he added. "For now, however, investors should probably not worry too much about the recent spike in oil."