/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

Electric air mobility is rapidly transforming from science fiction into a tangible industry, and Joby Aviation (JOBY) is leading the charge. The company’s stock has surged more than 40% in the past month and over 130% year-to-date as investors grow increasingly confident in its progress toward FAA certification and commercial readiness. Following successful demonstration flights in the U.S., Japan, and Dubai, Joby’s eVTOL technology is gaining credibility as a viable new transport platform.

The broader aerospace innovation boom, driven by decarbonization goals and rising investor interest in advanced air mobility, continues to push the sector forward. As capital and government support flow into electrified aviation, Joby stands out as one of the most advanced and well-capitalized players entering the final stretch toward commercialization.

About Joby Aviation Stock

Joby Aviation is a California-based aerospace firm designing all-electric vertical take-off and landing (eVTOL) aircraft for urban air mobility. It is headquartered in Santa Cruz and is focused on creating an aerial ridesharing network of clean, quiet, and efficient air transport. With a market capitalization of about $14 billion, Joby ranks among the giants of next-generation aviation along with its peers, including Archer Aviation (ACHR) and Lilium (LILMF).

Following a trade as low as $4.80 during the last twelve months, stock prices have soared by more than 295% to around $19.59, having reached a 52-week high of $20.95 in August. JOBY stock's price rose by a whopping 40% during the past month, significantly beating the S&P 500 Index's ($SPX) meager advances. Investors have warmly welcomed both the firm's swift moves towards FAA certification and increased acceleration of its international commercialization strategy.

Despite its traction, Joby is a pre-money, pre-revenue company, as is evident by extreme valuation multiples. The stock sells for a price-to-book (P/B) of 17.29, numbers that reflect speculative objects of early-stage aerospace companies. With a -71% return on equity and no profitability on the horizon, the company's valuation is heavily dependent upon future hopes instead of fundamentals. Nevertheless, Joby's $991 million cash and Toyota's (TOYOF) $250 million strategic investment provide respectable liquidity and endorsement by a world-class industrial partner.

Joby Aviation Edges Closer to Certification and Commercial Operations

Joby entered the FAA type certification critical path—Stage 5 (Type Inspection Authorization). Final assembly of its first conforming airframe began for Joby recently, and flight testing by Joby pilots is anticipated for later this year, with FAA testing to follow soon after. Certification reached now is 70% complete on Joby's side and more than 50% on the FAA's, improving 10 points since early 2025 and getting Joby nearer to commercial priming.

Operationally, it's been a year of seeing demonstrations and star-studded collaborations for Joby. The firm executed its maiden U.S. public flight during the California International Airshow in Salinas following conducted demonstration flights of ANA in Osaka, Japan—flights that run until Oct. 13. In the UAE, Joby allied with Skyports Infrastructure and RAKTA for the development of an air-taxi service for Ras Al Khaimah, expanding its expanding global reach.

Joby also revealed a partnership with L3Harris (LHX) to create a gas-turbine hybrid version of its current aircraft for military purposes. Flight testing of the hybrid version should begin during this autumn, and operational demonstrations are planned for military exercises in 2026. It shows how its ambition is to dominate both the commercial and government sectors—a dual-track policy like the major aerospace giants.

As a key milestone on the path to monetization, Joby entered a definitive pact to buy Blade Air Mobility’s passenger business. The transaction should enable improved market access and infrastructure, both across New York City and Southern Europe, to go along with Joby’s expansion deals with Abdul Latif Jameel and ANA for a potential fleet of about 300 aircraft. The purchase is Joby’s initial step towards creating end-to-end customer operations—an important benefit for establishing early network density.

Manufacturing scale-up is also under way. The Marina, California, facility now spans 435,000 square feet after expansion, doubling output capacity to 24 aircraft per year. Meanwhile, the Dayton, Ohio, plant is ramping up to produce up to 500 aircraft annually over time, signaling Joby’s transition from prototype to production phase.

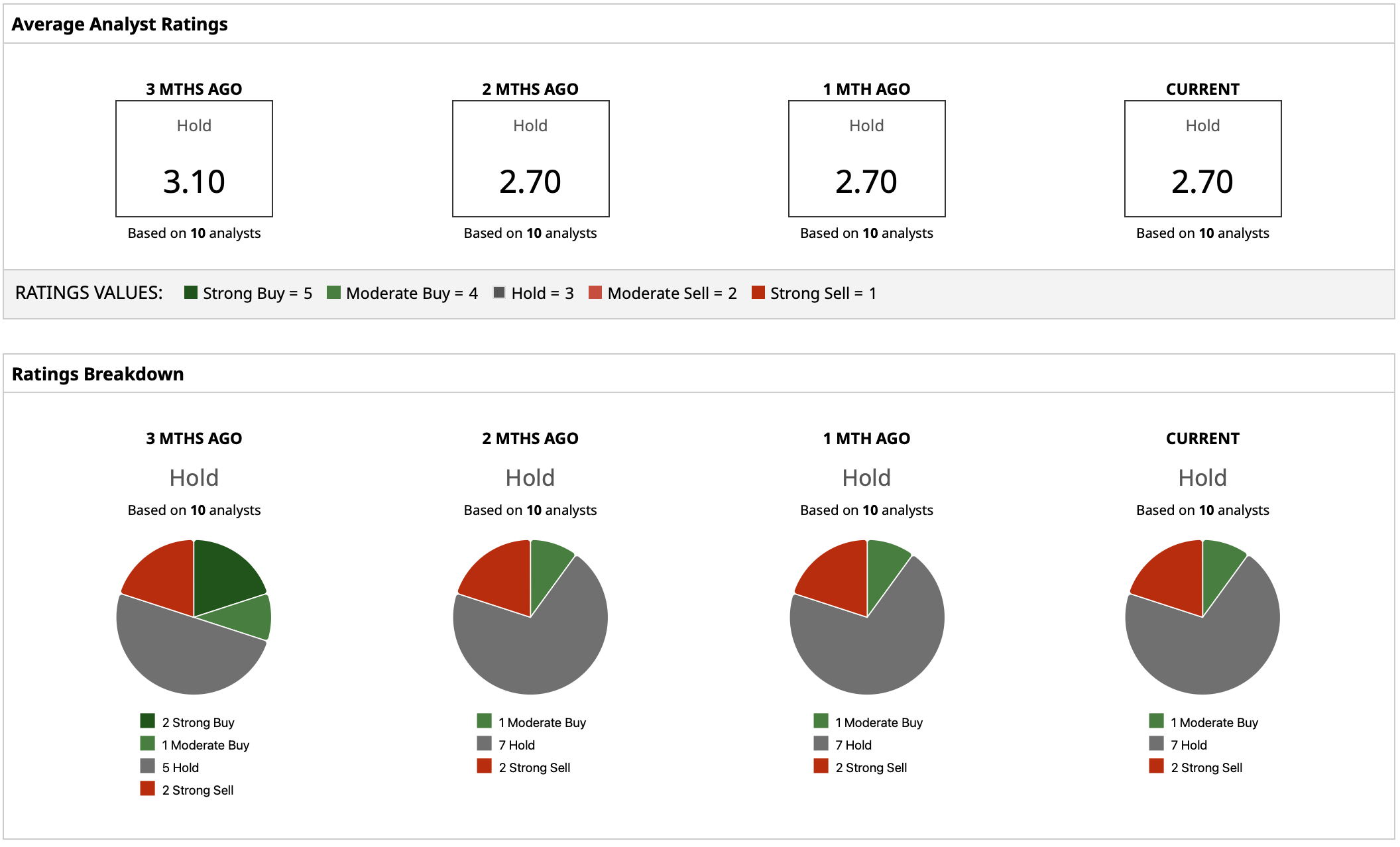

What Are Analysts Predicting for JOBY Stock?

Wall Street is divided on valuation following the recent surge, with a current “Hold” rating consensus and a target price of $10.83, which should spell a potential downside of about 43% compared to current prices. With a high of $22, it should mean there's little upside of about 17%, but a low of $6 should mean getting back to pre-surge prices. The large difference here is due to ambiguity regarding certification timelines, unit economics, as well as commercial adoption pace.