Joby Aviation Inc (NYSE:JOBY) shares are trading higher Friday morning after the company announced its participation in the White House’s new eVTOL Integration Pilot Program.

What To Know: The initiative, a joint effort by the Department of Transportation and the FAA, is designed to accelerate the safe integration of electric air taxis into U.S. airspace.

Joby’s inclusion in the program follows several key operational achievements, including extensive flight testing and its recent piloted flight between two airports. The company has already logged over 40,000 miles in flight tests and recently completed the first piloted flight between two public airports.

This federal program inclusion, coupled with a strategic partnership with Toyota to scale production and plans to expand manufacturing facilities in California and Ohio, has bolstered investor confidence in 2025 with the stock gaining 77% on a year-to-date basis.

Additionally, Joby’s recent progress in FAA certification and its proactive collaboration with states like Texas, Florida and New York are seen as key steps toward launching commercial passenger service and solidifying its market leadership.

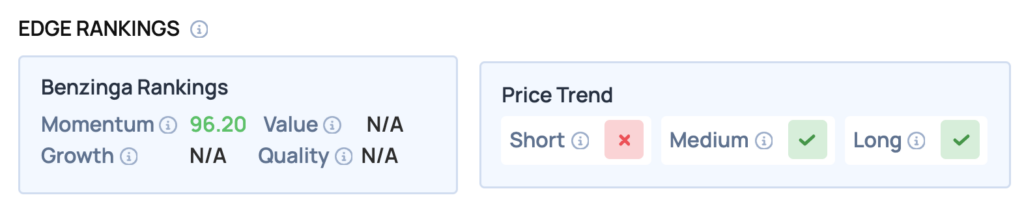

Benzinga Edge Rankings: Highlighting the stock’s powerful recent performance, Benzinga Edge rankings show a very strong Momentum score of 96.20, even as the short-term price trend indicator remains negative.

Price Action: According to data from Benzinga Pro, JOBY shares are trading higher by 5.63% to $14.45 Friday morning. The stock has a 52-week high of $20.95 and a 52-week low of $4.78.

How To Buy JOBY Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Joby Aviation’s case, it is in the Industrials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock