/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

On Aug. 15, air mobility company Joby Aviation (JOBY) announced the completion of a test flight between the airports of Marina and Monterey in airspace controlled by the Federal Aviation Administration (FAA). This test was seen as a testament to Joby's commercial readiness. The news also marks the first time a piloted electric vertical takeoff and landing (eVTOL) air taxi has flown from one public airport to another.

JOBY stock has been rising on the back of favorable developments. First, the company signed a deal with popular defense firm L3Harris Technologies (LHX) to develop an autonomous, gas turbine hybrid VTOL aircraft. The aircraft will be specifically designed for military operations, and could open up a brand new revenue stream. Additionally, Joby also agreed to acquire the passenger business of Blade Air Mobility (BLDE) for up to $125 million. This derisks the company’s service launch at scale by providing immediate infrastructure, an existing customer base, and built-in on-the-ground experience.

Adding to the company’s recent achievements, the test flight led to a surge in JOBY stock on Aug. 15. So, how should you play Joby Aviation stock now?

About Joby Aviation Stock

Joby Aviation is an innovative aerospace company headquartered in Santa Cruz, California, specializing in the development and commercialization of eVTOL aircraft. Joby designs aircraft intended to serve as aerial ridesharing vehicles, offering fast, quiet, and sustainable transportation in congested metropolitan areas.

The company's core operations include advanced aircraft engineering, flight testing, regulatory certification, and future air taxi services. Joby operates several facilities across the U.S., including pilot training and manufacturing centers, to support its goal of launching commercial operations. The company has a market capitalization of $12.6 billion.

Over the past 52 weeks, JOBY stock has gained a whopping 176%. Over the past three months alone, the stock is up 118%. Due to the recent positive developments, shares reached a 52-week high of $20.95 on Aug. 4, although they are now 30% off that mark.

Joby Aviation Posted Mixed Q2 Results

On Aug. 6, Joby Aviation reported subdued results for the second quarter of fiscal 2025. Still vying for commercialization at scale, the company reported modest revenue of $15,000 from flight services, representing a 46% year-over-year (YOY) decline. Net loss per share climbed from $0.18 in Q2 2024 to $0.41 in Q2 2025.

Contrarily, Joby Aviation ended the second quarter with $991 million in cash, cash equivalents, and investments in marketable securities. The company expects its use of cash, cash equivalents, and short-term investments during this year to range between $500 million and $540 million. However, this excludes any potential impact of its proposed acquisition of Blade’s passenger business.

Joby Aviation has also completed the expansion of its Marina, California, facility, which spans 435,000 square feet. The additional space is expected to double the site’s production capacity. The site will be capable of producing up to 24 aircraft per year once fully operational.

At the same time, Joby’s Dayton, Ohio, facility is coming online to support the manufacturing and testing of critical aircraft components. The company anticipates that this facility will have the capacity to produce up to 500 aircraft per year over time.

Wall Street analysts are also optimistic about Joby Aviation’s ability to reduce its losses. For the current quarter, its loss per share is expected to narrow by 14.3% YOY to $0.18. For the current year, the company’s loss per share is expected to reduce by 3.8% annually to $0.76, followed by a 6.6% improvement to a $0.71 loss in the next year.

What Do Analysts Think About Joby Aviation Stock?

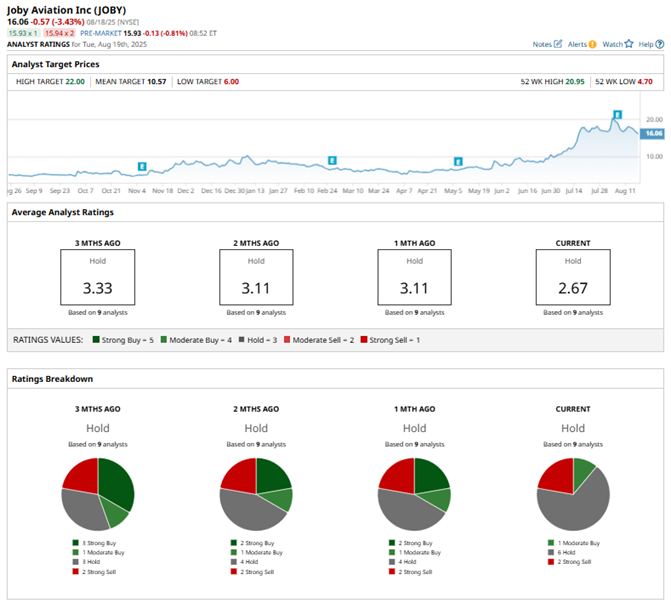

Wall Street analysts have become cautious about JOBY stock, despite its myriad developments. Following the Q2 results, analysts at Canaccord Genuity downgraded the shares to a “Hold” rating, expressing concerns about valuation, while maintaining a price target of $17.

Analysts at HC Wainwright also downgraded the stock from “Buy” to “Neutral.” They believe that numerous developments surrounding the stock have emerged in a short period, and that the company needs to digest the impact. However, analysts also kept a positive view about Joby’s long-term prospects.

Wall Street analysts recommend caution at the moment, giving a consensus “Hold” rating overall. Of the 10 analysts rating the stock, one analyst has a “Moderate Buy” rating, two have a “Strong Sell” rating, and seven analysts take a middle-of-the-road approach with a “Hold” rating. The consensus price target of $10.57 represents 28% downside from current levels, but the Street-high price target of $22 indicates 51% potential upside from here.

Key Takeaways

Joby Aviation’s recent developments, expansion plans, and testing success have led to JOBY stock being appreciated on Wall Street. However, the company’s deep losses and analysts’ cautious tone could be indicative that investors should observe shares for now to gauge a suitable entry point.