CNBC commentator Jim Cramer advised Sundar Pichai to stop spending irrationally on artificial intelligence (AI) in response to the Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG) CEO’s recent comments.

Cramer’s Take On Pichai’s ‘Elements Of Irrationality’

On Tuesday, the host of CNBC’s “Mad Money” responded to a post on X that quoted the Alphabet CEO’s remarks about the current AI boom.

“Stop spending irrationally,” wrote Cramer as he offered a “solution.”

In a recent interview with the BBC, Pichai acknowledged the “elements of irrationality” in the AI market but remained optimistic about its future. Pichai said that while the internet saw excessive investment in its early days, no one today doubts its “profound” impact.

The Alphabet CEO said the company wouldn't be “immune” if an AI bubble bursts, but argued it is better positioned than others to withstand the impact. He pointed to Google's "full stack" of in-house technologies, from chips to YouTube data, models, and frontier research, as a key buffer against potential turbulence in the AI market.

In another post, Cramer added that if major tech companies are overspending on data centers, Apple (NASDAQ:AAPL) “is the winner” as those companies would ultimately need strong end markets for their products.

AI Spending Surge In Big Tech

Cramer’s comments come amid high AI spending in big tech and Alphabet’s recent announcement of a $40 billion investment in Texas. Tesla (NASDAQ:TSLA) CEO Elon Musk called the company’s spending on AI computation “mind-blowing.”

As per McKinsey, the surge in AI-related spending is expected to reach $5.2 trillion by 2030, with U.S. tech giants projected to drop nearly $400 billion in capex this year.

Despite a recent sell-off in top AI tech names like Tesla Inc., Microsoft Corp. (NASDAQ:MSFT), Palantir Technologies Inc. (NASDAQ:PLTR), and Nvidia (NASDAQ:NVDA), analysts believe that the downturn is a brief panic rather than an actual slowdown in the AI boom.

Analysts Laud Apple’s Restrained AI Spend

Cramer’s take on Apple’s AI investment is also echoed by Brian Pollak of Evercore Wealth Management.

Pollak told the Los Angeles Times, earlier this month, that Apple plans about $14 billion in capital spending this fiscal year, far below Microsoft's projected $94 billion and Meta's spending over $70 billion for 2025, despite Meta being roughly half Apple's size, yet could still benefit from AI gains without the heavy investment its peers are making.

Meanwhile, Brian Mulberry of Zacks Investment Management highlighted the “positive feel” about Apple not having to justify massive investments and prove returns on that spending.

Price Action: Over the past six months, Apple stock surged 28.11%, while Alphabet stock gained 70.13%. During the same period, Meta fell 6%, while Nvidia climbed 37.64%, as per data on Benzinga Pro.

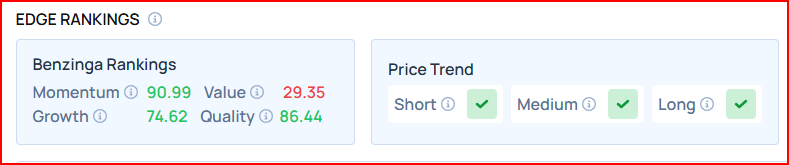

Benzinga's Edge Rankings place Alphabet in the 86th percentile for quality and the 29th percentile for value, reflecting its mixed performance. Check the detailed report here.

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.