CNBC's Jim Cramer called for the creation of a "gone meme list" in a post on the social media platform X on Wednesday, suggesting a need to track companies whose speculative trading frenzy has concluded.

His comments came as the market is witnessing a lot of traction for Opendoor Technologies Inc.‘s (NASDAQ:OPEN) stock on social media, while quantum computing firm IONQ Inc.’s (NYSE:IONQ) meme cycle has already passed.

‘Gone Meme’ List To Track Retail Trader’s Past Favorites

Cramer's post highlighted the chaotic nature of the retail trading phenomenon. "We do need a ‘gone Meme' list at all times," he stated.

"Notice that IONQ, an intriguing quantum company, has gone meme. There should be a betting line about what's about to go meme, just to complete the meme farce."

Is OPEN The New Meme Stock?

His remarks were set against the backdrop of the ongoing OPEN frenzy, which has seen the real estate technology firm's stock skyrocket 135.98% over the last month on immense social media buzz and heavy retail trading volume.

Even though OPEN’s backers, like Eric Jackson from EMJ Capital, don’t think that it is a meme stock, many skeptics like ‘Pharma Bro‘ Martin Shkreli and Citron Research‘s Andrew Left have shorted the stock.

The surge in Opendoor has drawn direct comparisons to past meme stock events involving companies like GameStop Corp. (NYSE:GME) and AMC Entertainment Holdings Inc. (NYSE:AMC).

Does The Meme Stock Craze Usually Fade?

By nominating IonQ for his theoretical list, Cramer implies that the period of intense, social media-driven volatility in the company's stock has largely faded.

According to him, "gone meme list" would serve to identify stocks that, after experiencing a speculative craze, may be returning to trading patterns based more on their underlying business fundamentals. IonQ, a key player in the nascent quantum computing industry, had previously been a favorite among retail investors.

Cramer’s “meme farce” comment further underscores his characteristic skepticism toward valuations driven by online trends rather than traditional financial metrics. His proposal for a list tracking the full lifecycle of these volatile trades highlights the ongoing effort by market analysts to understand and categorize this powerful market force.

Price Action

OPEN fell 3.36% in premarket on Wednesday and 6.06% on Tuesday to $8.92 per share. The stock has advanced 461.01% year-to-date and 277.97% over the year.

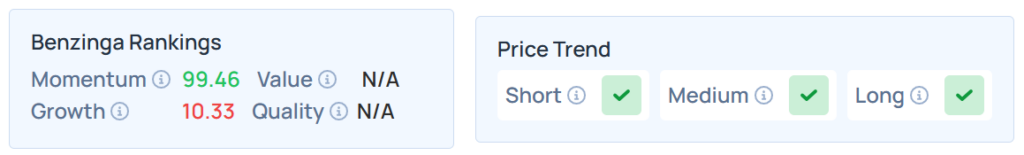

Benzinga’s Edge Stock Rankings indicate that OPEN maintains a stronger price trend in the short, medium, and long terms. However, the stock’s growth ranking is relatively weak. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell in premarket on Wednesday. The SPY was down 0.062% at $659.59, while the QQQ declined 0.066% to $590.79, according to Benzinga Pro data.

Read Next:

- Eric Jackson Rejects ‘Roaring Kitty' Label: OPEN ‘Isn't A Meme Stock. It's A Cult Stock,' Unlike GME

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image Via Shutterstock