Nvidia (NVDA) CEO Jensen Huang recently sold more than $36 million worth of NVDA stock, sparking concerns among investors about the AI giant’s prospects. However, these transactions shouldn’t trigger alarm bells.

Huang’s sales were executed under a Rule 10b5-1 prearranged trading plan, established in March and publicly disclosed. These plans enable executives to sell shares at predetermined times and prices, with the intent to eliminate perceptions of insider trading. Such arrangements are standard practice for corporate leaders seeking to diversify personal wealth without signaling a lack of confidence in their companies.

The recent sale represents less than 1% of Huang’s position, which exceeds 850 million shares across direct ownership, trusts, partnerships, and LLCs.

Investors should note that his trading plan covers the sale of up to 6 million shares through the end of 2025. He sold 100,000 shares in June and 225,000 shares so far in July.

Is Nvidia Stock Still a Good Buy?

Nvidia recently reported $44.1 billion in quarterly revenue, representing 69% year-over-year growth, with second-quarter guidance of $45 billion. The chip maker continues to strengthen its dominance in AI through strategic partnerships that expand its addressable market beyond data centers into enterprise computing and industrial robotics.

For instance, Nvidia recently announced a collaboration with HP (HPE) to launch AI factory offerings that include Nvidia’s latest Blackwell accelerated computing, Spectrum-X Ethernet, and BlueField-3 networking technologies.

HPE’s new RTX PRO servers, powered by Nvidia RTX PRO 6000 Blackwell GPUs, create a turnkey AI platform for enterprises, addressing the critical need for pre-integrated infrastructure solutions. This partnership positions Nvidia to capture enterprise customers who require simplified AI deployment paths.

Even more compelling is Nvidia’s robotics momentum, which it recently showcased at Europe’s Automatica conference. Nvidia offers the Isaac GR00T N1.5 foundation model for humanoid robots, and it also has a multi-part robotics platform that includes supercomputers, and simulation and deployment software.

These developments reinforce Nvidia’s strategy of expanding beyond chip sales into complete AI solutions. With Europe’s 200 billion Euro investment in industrial AI and growing enterprise adoption, Nvidia is positioning itself to capture value across the entire AI value chain, supporting continued premium valuations.

Is NVDA Stock Overvalued?

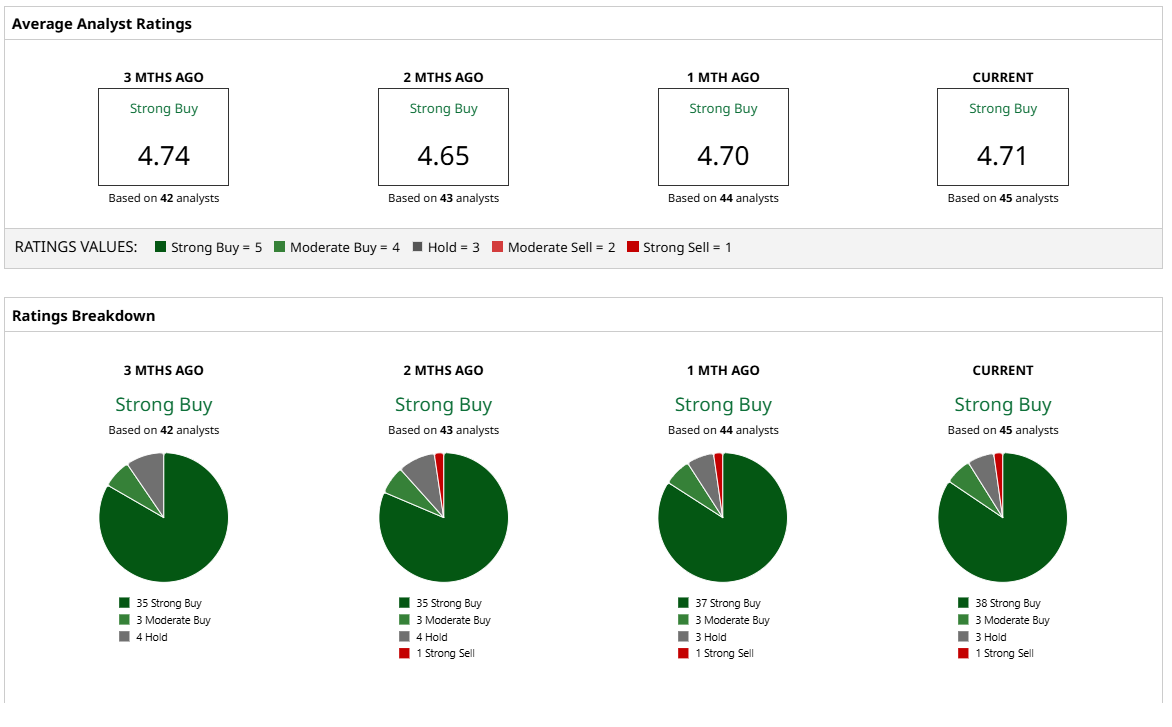

Out of the 45 analysts covering NVDA stock, 38 recommend “Strong Buy,” three recommend “Moderate Buy,” three recommend “Hold,” and one recommends “Strong Sell.” The average target price for NVDA stock is $177.40, indicating upside potential of almost 8% from current levels.

Given Nvidia’s dominant position in AI infrastructure and Huang’s continued substantial ownership stake, investors shouldn’t interpret his routine stock sales as a bearish signal. The company’s fundamental strength in powering the AI revolution remains intact.