Major tech corporations are scrambling to embrace generative AI, even as critics warn it may be a fleeting trend. Speculations suggest that investor enthusiasm may be waning, potentially forcing them to redirect their capital toward more promising opportunities.

However, NVIDIA is seemingly making the most out of the AI bubble, as it briefly became the world's first company to hit $5 trillion in market valuation. The chipmaker's success can be primarily attributed to the rise in demand for AI chips to facilitate sophisticated advances and development in the ever-evolving landscape.

On Wednesday, NVIDIA's shares rose by more than 3%, causing its market capitalization to cross the coveted $5 trillion threshold (via CNBC). This news doesn't come as a surprise, as the chipmaker's market capitalization has been steadily growing as demand for AI chips increases.

After the launch of OpenAI's ChatGPT in 2022, NVIDIA surpassed $1 trillion in market capitalization, swiftly rising to $2 trillion in February 2024, and then $3 trillion in June later that year. In June this year, the chipmaker became the first $4 trillion company in the world, followed by Microsoft and Apple.

And as it now seems, the sky is no longer the limit for the chipmaker, as it recently hit the $5 trillion market valuation threshold. It doesn't appear that the company will be stopping anytime soon...

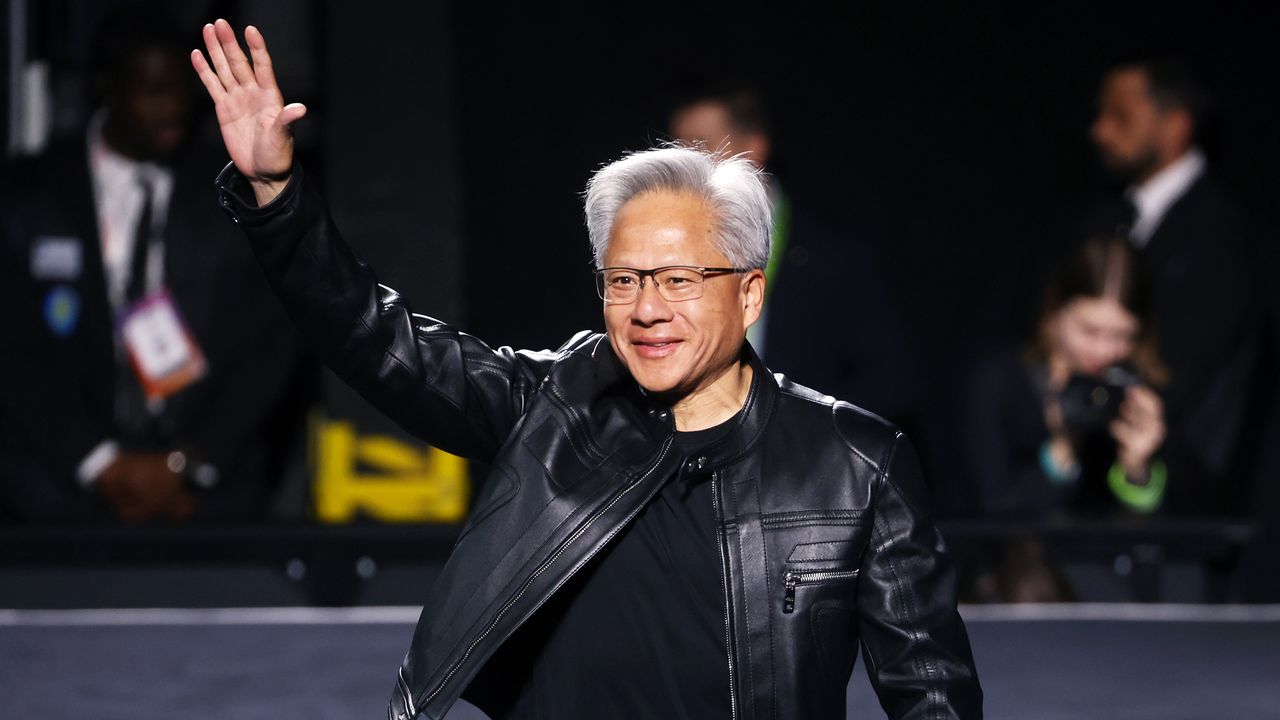

For context, CEO Jensen Huang recently revealed that the company expects up to $500 billion in AI chip orders. In 2023, NVIDIA was named the most profitable semiconductor chip brand in the world, with Microsoft and Facebook's Meta among its A-list clients.

Despite concerns that the world is trapped in an AI bubble that is poised to burst, NVIDIA CEO Jensen Huang dismissed these claims. The executive indicated that the boom in the AI landscape is driven by real demand, not speculation (via artificial intelligence on IG).

I don't believe we are in the AI bubble. And the reason for that is, we're going through a natural transition from an old computing model based on general-purpose computing to accelerated computing. We also know that AI has now become good enough because of reasoning and research capabilities. Its ability to think, it's now generating tokens, and now generating intelligence that's worth paying for.

NVIDIA CEO, Jensen Huang

The executive claims that AI will stand the test of time, revolutionizing innovation at a global scale for decades. He says the technology will be as revolutionary (if not more) that the rise of the internet rather than just a passing fad.

FAQ

Is the AI bubble going to burst?

Despite claims that AI is just a passign fad, NVIDIA CEO Jensen Huang is confident that the technology will evolve, revolutionizing innovation at a global scale.

Did NVIDIA really become a $5 trillion company?

Briefly, yes. NVIDIA’s market cap surged past $5 trillion, making it the most valuable company in the world — for a moment.

Why Is NVIDIA's market capitalization growing so fast?

With every major tech corporation hopping onto the AI bandwagon, there's a rise in demand for chips from NVIDIA to facilitate its sophisticated advances.

Is this sustainable?

That’s the trillion-dollar question. Some analysts see long-term fundamentals; others worry about overexuberance and supply chain bottlenecks.

Why does this matter?

NVIDIA’s rise reflects how central AI has become to the global economy — and how much capital is chasing the next computing platform.

Follow Windows Central on Google News to keep our latest news, insights, and features at the top of your feeds!