Stellantis NV (NYSE:STLA) has reportedly decided to shelve its Level 3 advanced driver-assistance program due to financial constraints and consumer apprehension.

Level 3 Driver-Assist Program On Hold Amid Costs

Stellantis, the parent company of brands such as Jeep and Chrysler, has put a halt to its Level 3 driver-assistance program due to the high costs, technological difficulties, and consumer reluctance, Reuters reported on Tuesday. The program was part of the AutoDrive initiative, which was previously touted as a key element of the company’s strategy.

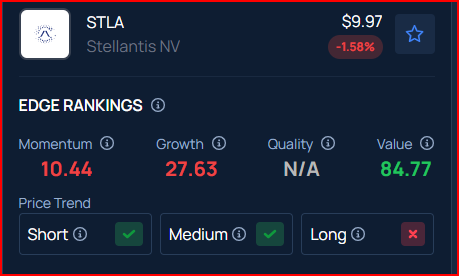

Check out the current price of STLA stock here.

The Level 3 software, which would have allowed drivers to momentarily divert their attention from the road, was never launched, although the company did not officially confirm the cancellation of the program. However, sources have indicated that the program has been put on hold and is unlikely to be implemented.

Stellantis did not reveal how much time or money it has invested in the initiative, noting only that the work on AutoDrive will benefit future versions. The automaker is now relying on aiMotive, a tech startup it acquired in 2022, to develop the next generation of the AutoDrive program.

Stellantis did not immediately respond to Benzinga’s request for comment.

Tech Hurdles Hurt Competitiveness

The decision to shelve the Level 3 driver-assistance program is a significant setback for Stellantis, which has been striving to keep pace with the rapidly evolving automotive technology landscape. This move also reflects the challenges faced by traditional automakers as they endeavor to transition to software-focused vehicles, a domain that has been dominated by companies like Tesla Inc. (NASDAQ:TSLA) and Chinese electric-car brands.

Stellantis has also ended its collaboration with Amazon (NASDAQ:AMZN) on the SmartCockpit infotainment system and will transition to an Android-based platform. The move highlights challenges Stellantis faces in achieving its tech ambitions.

Revenue Drops 13% Amid Tariffs; EV Sales Rise In July

The company’s H1 2025 revenue fell by 13% due to President Donald Trump’s tariffs, and its CEO, Antonio Filosa, expressed that 2025 was a tough year. Despite this, Filosa supported Trump’s tariff strategy during the company’s Q2 earnings call.

Meanwhile, Stellantis-owned Leapmotor experienced a surge in sales in July, even as rivals Li Auto and Nio saw a decline in deliveries. This indicates that while Stellantis faces challenges in its tech ambitions, it still holds potential in the competitive EV market.

According to Benzinga Edge Stock Rankings, Stellantis has a growth score of 27.63% and a value rating of 84.77%. Click here to see how it compares to other leading EV companies.

READ MORE:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.