Chinese e-commerce giant, JD.Com Inc. (NASDAQ:JD), is stepping up its international ambitions with a playbook that closely resembles that of Amazon.com Inc.’s (NASDAQ:AMZN) approach to overseas expansions.

JD is showing downward pressure. Get the market research here.

The Amazon Playbook

During its second-quarter earnings call on Thursday, the company’s CEO, Sandy Xu, said, “as the largest retailer in China, international expansion has always been a key strategy for JD,” while stressing that, unlike other e-commerce brands, JD’s approach would focus more on building local operations.

Xu says JD's international business will concentrate on supply chain capability and “seize the opportunity of a Chinese premium brand going global,” while also committing to “developing local retail and e-commerce business, establishing local teams and workforce, conduct local procurement and local fulfillment.”

See Also: A Double Jolt For Chinese Stocks — Thanks To Trump And Beijing’s Big Bet

The company notes that it’s now been operating in Europe for three years, building retail formats, warehouses and logistics infrastructure. “Since 2022, we have been piloting innovative retail model in Europe, and we plan to officially launch our retail e-commerce platform called Joybuy later this year,” Xu said.

CECONOMY Acquisition

The proposed Ceconomy AG (OTC:MTTRY) acquisition, which is subject to regulatory approval, could give JD a significant foothold in Europe's electronics and home appliance market.

Xu cited “CECONOMY's brand strength, supply chain capabilities and market position in European market” as holding “significant value for JD,” adding that “both party can achieve synergetic results.”

This approach by the company for overseas expansions directly mirrors that of Amazon, which is known for tailoring its operations to local markets.

This includes the introduction of “cash on delivery” in India, where credit card penetration remains low, alongside heavy investment in local logistics infrastructure and strategic partnerships, which allowed the company to retain its scale while maintaining its relevance in each new region.

JD Looks Overseas To Escape Brutal Chinese Markets

As competition intensifies in the Chinese market, where it competes with Alibaba Group Holding Ltd. (NYSE:BABA) and PDD Holdings Inc. (NASDAQ:PDD), JD is increasingly looking toward the European markets.

The company’s first such foray into Southeast Asian markets led to a withdrawal, after it ended up clashing with the same homegrown players such as Alibaba, but it expects this time to be different, with a supply-chain-centric model, unlike the pure platform play of its competitors.

JD released its second-quarter results on Thursday, reporting $49.8 billion in revenue, up 22.4% year-over-year, and beating consensus estimates of $46.9 billion. It posted a profit of $0.69 per share, which came in ahead of analyst estimates at $0.44 per share.

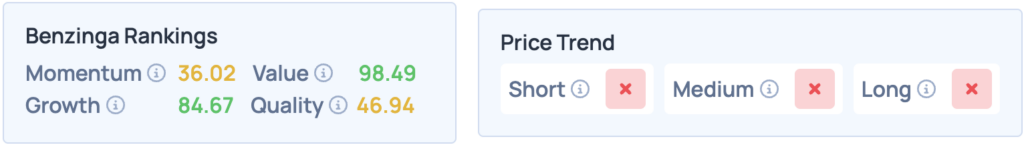

Shares of JD were down 2.86% on Thursday, closing at $31.58, and are down another 1.93% after hours. The stock scores well on Growth and Value in Benzinga’s Edge Stock Rankings, but has an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Shutterstock