JP Morgan (NYSE:JPM) CEO Jamie Dimon has raised a red flag about the potential underestimation of the risk of higher U.S. interest rates by the financial markets.

What Happened: Dimon expressed his concerns at an event hosted by Ireland’s foreign ministry in Dublin on Thursday. He stated that the financial markets may not be fully considering the possibility of a rise in U.S. interest rates, which he described as a “cause for concern,” reported Reuters.

Dimon’s apprehension is based on several factors, including the impact of tariffs, the U.S. government’s immigration policies and the country’s budget deficit. He also highlighted the potential inflationary effects of the global trade restructuring and demographic changes.

Despite the recent decision of the Federal Reserve to maintain the current interest rates, Dimon believes that the likelihood of a further increase is higher than what the market is currently pricing in. He noted that the market is pricing in a 20% chance of a rate hike, while he would put it at 40-50%.

Dimon also pointed out the challenges in reading ‘real-time data’ on the U.S. economy, stating that it is “totally impossible to read.” He further criticized the market for being complacent in the face of President Donald Trump‘s tariff policies and global trade uncertainty.

See Also: Bitcoin Breaks Above $113,000…But There Is A Catch

Why It Matters: The Federal Reserve’s June meeting was marked by “uncertainty” amid tariff turmoil and Trump’s call for a 3 percentage point rate cut. Furthermore, Federal Reserve Chair Jerome Powell indicated that Trump’s tariff strategy deterred the central bank from easing monetary policy.

At the same time, money market funds hit a record $7.4 trillion, hinting that any rate cuts could direct these funds into the equity markets, as noted by billionaire Bill Ackman. This context underscores Dimon’s concerns about the underestimated risk of higher interest rates and potential economic instability.

Meanwhile, polymarket bettors now see a 50% chance that the Federal Reserve will make its first interest rate cut of 2025 at the September meeting, while there was a 44% chance that rates would stay at the current 4.25%–4.50% range.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

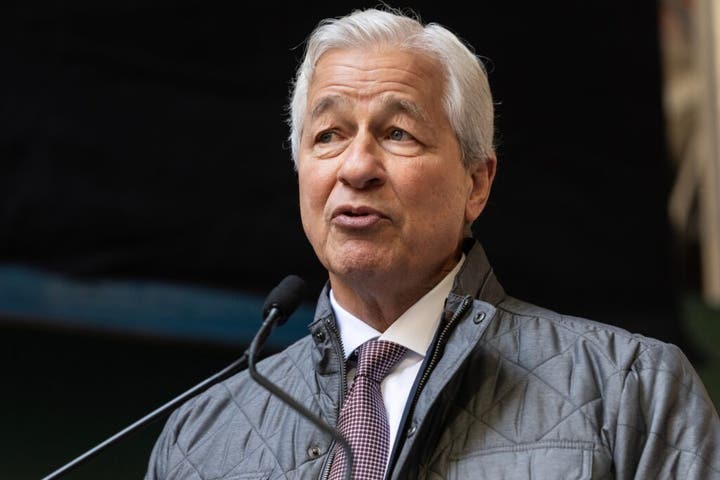

Image via Shutterstock