Valued at $24.4 billion by market cap, San Francisco-based Williams-Sonoma, Inc. (WSM) operates as a multi-channel specialty retailer of premium quality home products. The company offers various cooking, dining, home decor, and related products through its brands like Pottery Barn, West Elm, Rejuvenation, etc.

Companies worth $10 billion or more are generally described as "large-cap stocks." WSM fits right into that category, reflecting its significant presence and influence in the specialty retail and premium home decor space.

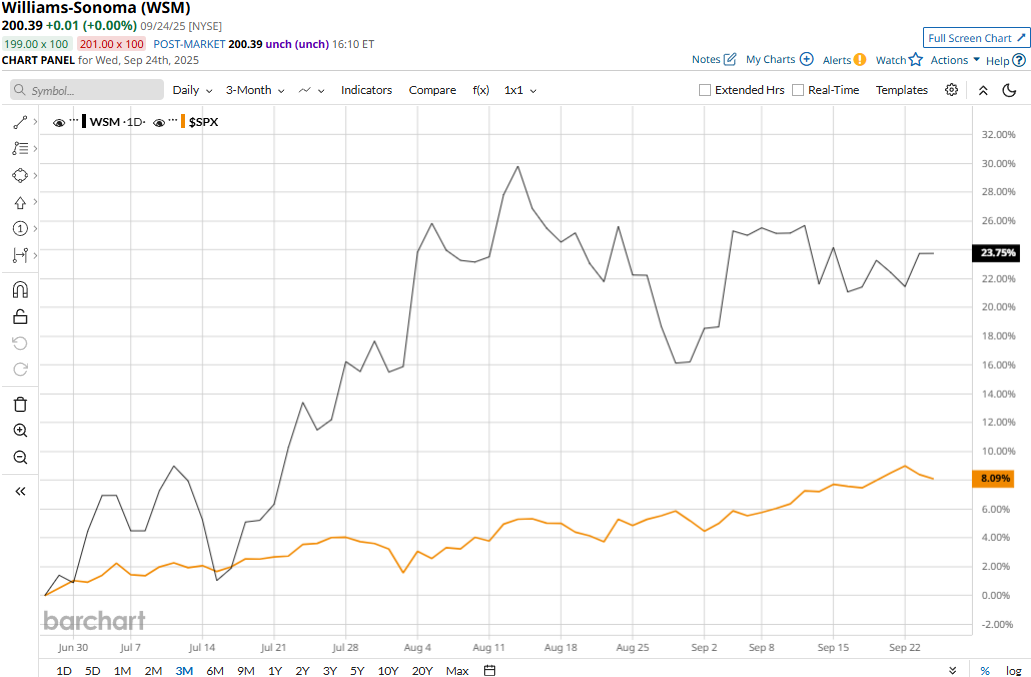

WSM stock touched its all-time high of $219.98 on Jan. 30, and is currently trading 8.9% below that peak. Over the past three months alone, the stock has soared 26.9%, significantly outperforming the S&P 500 Index’s ($SPX) 9% uptick during the same time frame.

Williams-Sonoma’s performance has remained mixed over the longer term. The stock has gained 8.2% in 2025 and surged 31.2% over the past 52 weeks, lagging behind SPX’s 12.9% gains on a YTD basis, but substantially outpacing SPX’s 15.8% returns over the past year.

Further, WSM stock has traded above its 50-day moving average since mid-May and above its 200-day moving average since July, with some fluctuations, underscoring its bullish trend.

Despite delivering better-than-expected results, Williams-Sonoma’s stock prices dipped 2.9% in the trading session following the release of its Q2 results on Aug. 27. The quarter was marked with solid comparable brand revenue growth of 3.7%, leading to a notable 2.7% year-over-year growth in net revenues to $1.8 billion, surpassing the Street’s estimates by 1.1%. Further, it delivered a notable 19.8% year-over-year surge in EPS to $2, exceeding the consensus estimates by 11.7%.

However, moving forward, the company expects its operations may get negatively impacted due to cost hikes caused by additional tariffs on China, India, Vietnam, and other countries around the globe, along with 50% tariffs imposed on aluminium and copper.

Meanwhile, Williams-Sonoma has significantly outperformed its peer, Home Depot, Inc.’s (HD) 5.3% gains in 2025 and a 2.3% uptick over the past 52 weeks.

Among the 20 analysts covering the WSM stock, the consensus rating is a “Moderate Buy.” As of writing, its mean price target of $208.28 suggests a modest 3.9% upside potential from current price levels.