/Waters%20Corp_%20phone%20logo%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $18.2 billion, Waters Corporation (WAT) is a leading global provider of analytical instruments and workflow solutions. The company operates through two segments, Waters and TA, offering technologies in liquid chromatography, mass spectrometry, thermal analysis, rheometry, and calorimetry, along with software and consumables.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Waters fits this criterion perfectly. Serving pharmaceutical, life sciences, industrial, academic, and government customers worldwide, Waters supports critical applications in research, development, quality assurance, and regulatory compliance.

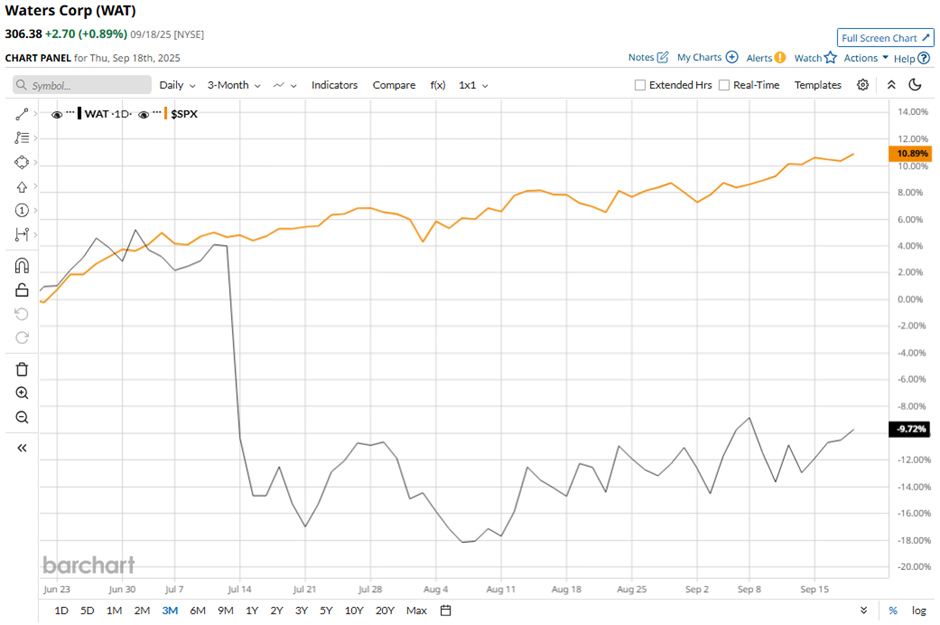

Shares of the Milford, Massachusetts-based company have fallen 27.7% from its 52-week high of $423.56. Waters’ shares have decreased 9.7% over the past three months, underperforming the broader S&P 500 Index’s ($SPX) 10.9% gain over the same time frame.

In the longer term, WAT stock is down 17.4% on a YTD basis, lagging behind SPX’s 12.8% increase. Moreover, shares of the lab equipment maker have dropped 8.1% over the past 52 weeks, compared to SPX’s over 18% return over the same time frame.

The stock has been trading below its 200-day moving average since April.

Despite posting stronger-than-expected Q2 2025 adjusted EPS of $2.95 and revenue of $771.3 million, Waters’ stock fell 1.6% on Aug. 4. Investors focused on concerns around the costly acquisition of Becton Dickinson’s bioscience and diagnostics unit, viewed as a “high-priced deal of a weaker business” with potential integration risks. Additionally, academic and government sales declined 3% amid uncertainty around U.S. research funding, tempering sentiment despite the company raising its annual EPS guidance to $12.95 - $13.05.

In contrast, rival Quest Diagnostics Incorporated (DGX) has outpaced WAT stock. DGX stock has gained 21.5% on a YTD basis and 17.9% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain moderately optimistic on WAT. The stock has a consensus rating of “Moderate Buy” from the 17 analysts in coverage, and the mean price target of $361.88 is a premium of 18.1% to current levels.

.png?w=600)