/Intuit%20Inc%20logo-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

Based in Mountain View, California, Intuit Inc. (INTU) is a $195.6 billion company specializing in financial management, compliance, and marketing solutions. Its offerings span business management and payroll processing tools, personal finance platforms, and widely used tax preparation and filing software.

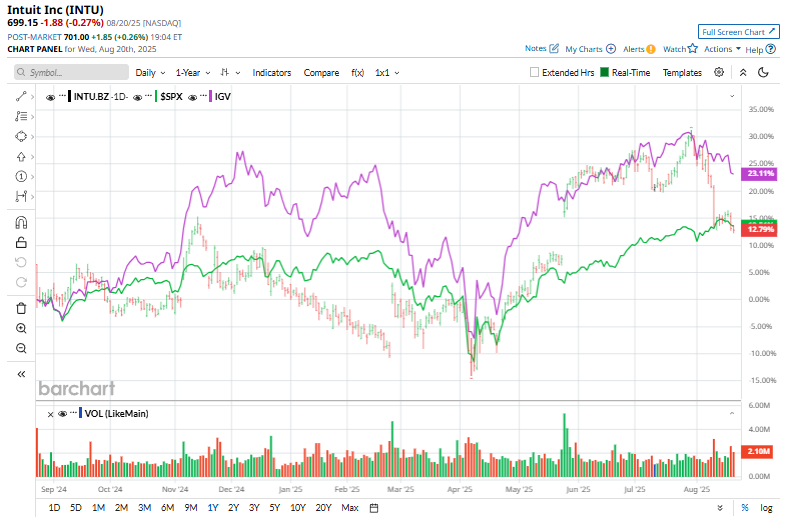

Shares of this software giant have underperformed the broader market over the past year. INTU has gained 4.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.3%. However, in 2025, INTU’s stock rose 11.2%, surpassing the SPX’s 8.7% rise on a YTD basis.

Narrowing the focus, INTU has also trailed the iShares Expanded Tech-Software Sector ETF (IGV), which has gained about 22.7% over the past year. However, INTU’s gains on a YTD basis outshine the ETF’s 6.2% returns over the same time frame.

On July 23, Intuit shares rose 1.2% after the company rolled out new agentic AI capabilities for its Enterprise Suite. The update introduced four AI agents designed to automate functions such as cash flow forecasting and invoice reminders. Built on its GenOS platform, these enhancements are designed for mid-market businesses, aiming to improve productivity and capture a larger share of the $89 billion ERP market.

For the current fiscal year, ending in July, analysts expect INTU’s EPS to grow 26.8% to $14.72 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

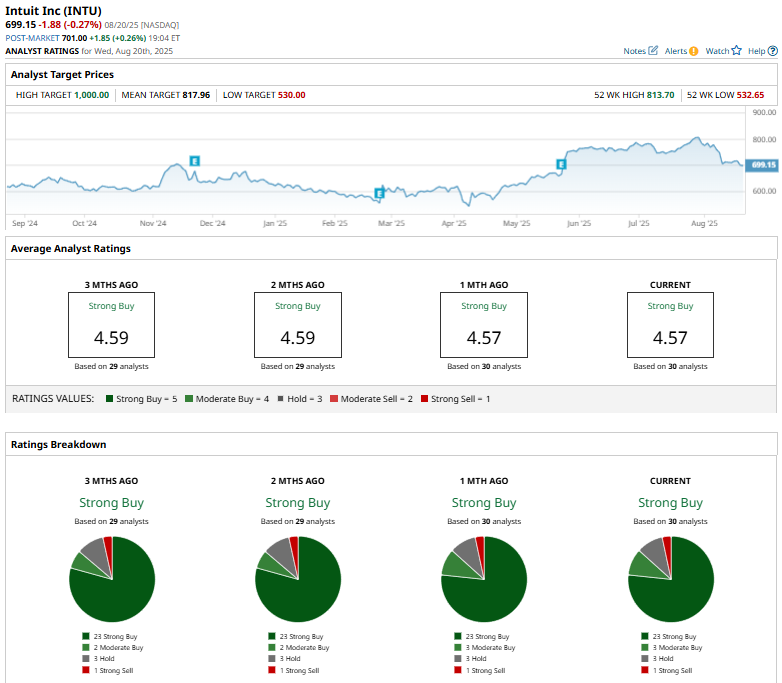

Among the 30 analysts covering INTU stock, the consensus is a “Strong Buy.” That’s based on 23 “Strong Buy” ratings, three “Moderate Buy,” three “Holds,” and one “Strong Sell.”

This configuration has been consistent over the past months.

On Aug. 15, Citigroup analyst Steven Enders reaffirmed a “Buy” rating on Intuit and raised the price target from $789 to $815, a 3.3% increase, signaling sustained confidence in the company’s market performance.

The mean price target of $817.96 represents a 17% premium to INTU’s current price levels. The Street-high price target of $1000 suggests an upside potential of 43%.