Valued at a market cap of $32.7 billion, The Estée Lauder Companies Inc. (EL) is a global leader in prestige beauty, offering skincare, makeup, fragrance, and hair care products. The New-York based company’s portfolio includes iconic brands like Estée Lauder, MAC, Clinique, La Mer, and Jo Malone London. It operates through a mix of department stores, specialty retailers, e-commerce, and travel retail channels across over 150 countries.

EL shares have struggled to keep up with the broader market over the past 52 weeks. Shares of EL have dropped 3.5% over this time frame, while the broader S&P 500 Index ($SPX) has soared 21.1%. However, on a YTD basis, the stock has surged 20.2%, compared to SPX’s 7.9% rise.

Narrowing the focus, EL has also trailed the Consumer Staples Select Sector SPDR Fund’s (XLP) 4.3% uptick over the past 52 weeks but has surpassed the ETF’s 3.8% rise on a YTD basis.

On May 29, Estée Lauder shares rose over 3%, following the announcement of Lisa Sequino’s appointment as president of its makeup brand cluster. With a strong track record as former CEO of Supergoop! and JLo Beauty & Lifestyle, Sequino’s hiring was seen as a strategic move that bolstered investor confidence and lifted the stock.

For the fiscal year that ended in June, analysts expect EL’s EPS to decline 42.1% year over year to $1.50. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

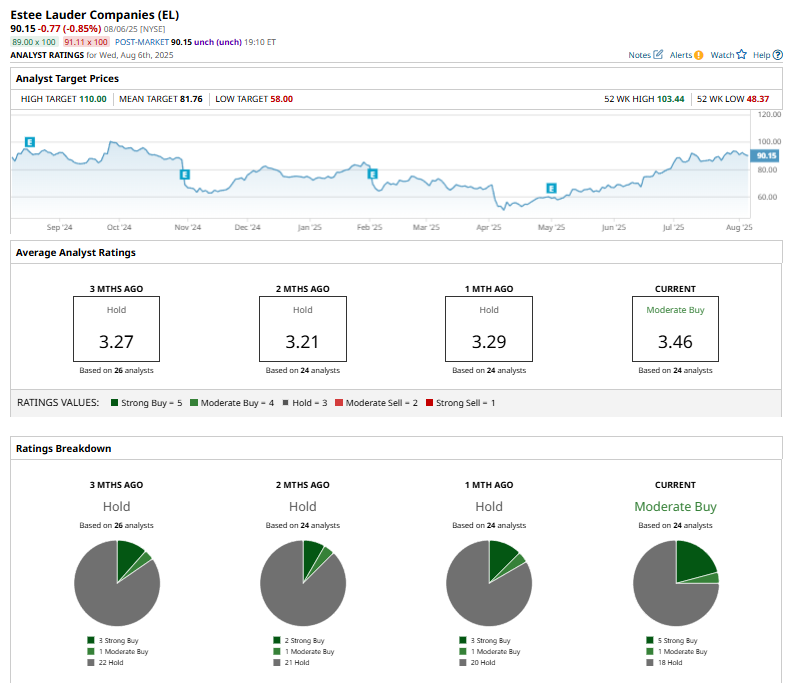

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy” which is based on five “Strong Buy,” one “Moderate Buy,” and 18 “Hold” ratings.

This configuration is more bullish than a month ago, with three analysts suggesting a “Strong Buy” rating.

On July 25, JPMorgan Chase & Co. (JPM) upgraded Estée Lauder from "Neutral" to "Overweight" and raised its price target from $62 to $101, reflecting growing confidence in the company’s near-term growth and market potential.

While EL currently trades above its mean price target of $81.76, the Street-high price target of $110 suggests an upside potential of 22% from the current market prices.