/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

The artificial intelligence trade is in full force, as enterprises across a range of industries worldwide recognize that AI not only increases productivity, but also boosts profitability. And if there is one company that defines the AI megatrend, it is Nvidia (NVDA). The California-based chipmaker powers the AI revolution globally, and with a mammoth market cap of $4.3 trillion, it is the world’s most valuable company now.

Thus, any association with the Jensen Huang-led company is always looked upon as a positive development, rewarded by the market with a share price appreciation. That is exactly what happened with the shares of ON Semiconductor (ON), which witnessed a jump of about 3% in yesterday’s pre-market trade following an announcement that it will be partnering with Nvidia to accelerate the adoption of 800-Volt Direct Current power solutions for next-generation artificial intelligence data centers.

About ON Semiconductor

Founded in 1999 as a spinoff of Motorola’s Semiconductor Components Group, ON Semiconductor designs and manufactures intelligent power and sensing technologies. Essentially, it builds chips and modules that help in power management, environment sensing, and automation enablement. It also licenses technology, provides design support, and offers long-term supply agreements.

Valued at a market cap of $24.4 billion, ON stock is down 9% on a YTD basis.

On Reports Decent Q1 Results

ON’s results for the most recent quarter were marked by a beat on both the revenue and earnings front, even after reporting a YOY decline. In fact, over the past nine quarters, ON’s bottom line has missed expectations on just one occasion.

In Q1 2025, ON’s revenues were at $1.4 billion, which denoted a yearly fall of 22.4%. All revenue segments witnessed a drop from the previous year, with the PSG, AMG, and ISG segments reporting revenues of $645.1 million (-26% YOY), $566.4 million (-19% YOY), and $234.2 million (-20% YOY), respectively. Earnings for the quarter came in at $0.55 per share, lower than the prior year’s figure of $1.08 but higher than the consensus estimate of $0.50 per share.

Overall, over the past 10 years, ON’s revenue and earnings have clocked compound annual growth rates (CAGRs) of 7.20% and 12.72%, respectively.

Coming to cash flows, the picture here is a bit better for ON. Net cash from operating activities in Q1 2025 stood at $602.3 million, higher than the $498.7 million reported in the year-ago period. Free cash flow increased as well to $454.7 million from $264.8 million in Q1 2024. Overall, the company closed the quarter with a cash and equivalents balance of about $3 billion, exceeding its short-term debt levels of $496.6 million.

For Q2 2025, ON is projecting revenues to be in the range of $1.4 billion to $1.5 billion and earnings to be between $0.48 and $0.58 per share. ON will report its Q2 figures on Aug. 4.

Strategic Drivers (With Some Headwinds)

ON’s products quietly power a broad array of systems encompassing electric vehicles, smart industrial equipment, advanced computing platforms, and energy infrastructure. This spread across industries helps insulate it from the sharp swings seen in any single market.

Notably, its strength lies in a few distinct areas. One of them is intelligent sensing, where ON is pushing forward with radar and lidar technologies for vehicles and factory automation. Another major segment is power management, chips that regulate and distribute energy efficiently. This business, in fact, brings in nearly half of ON’s revenue. Then there’s its analog and mixed-signal division, contributing around 37% to the top line. These chips serve critical roles in harsh environments, like auto systems or manufacturing setups, where reliability is non-negotiable. Overall, the focus is on long-cycle, high-dependability products that offer steady, recurring demand.

Meanwhile, ON has also made a big bet on silicon carbide (SiC). These chips are built to handle higher voltages and temperatures than standard silicon, making them ideal for electric vehicles. As the EV space scales up, SiC adoption is picking up momentum. ON has already landed several notable design wins and is gaining traction with automakers, especially in the rapidly growing Chinese market.

Then, the company’s M&A moves also reflect strategic agility. Its $115 million acquisition of United Silicon Carbide subsidiary from Qorvo (QRVO) underscores how serious ON is about becoming a major player in this emerging field. That acquisition came not long after Qorvo itself had absorbed the same unit in 2021.

However, headwinds remain. First up, the company’s automotive segment, a key revenue contributor, saw sales dip in the last quarter, and leadership has hinted that more softness could follow. ON’s manufacturing footprint also presents some geopolitical concerns, especially since much of it relies on Taiwan. Moreover, the specialized gases and materials it needs, many of which are sourced from China or Ukraine, could be at risk due to political instability or supply chain issues.

Analyst Opinions on ON Stock

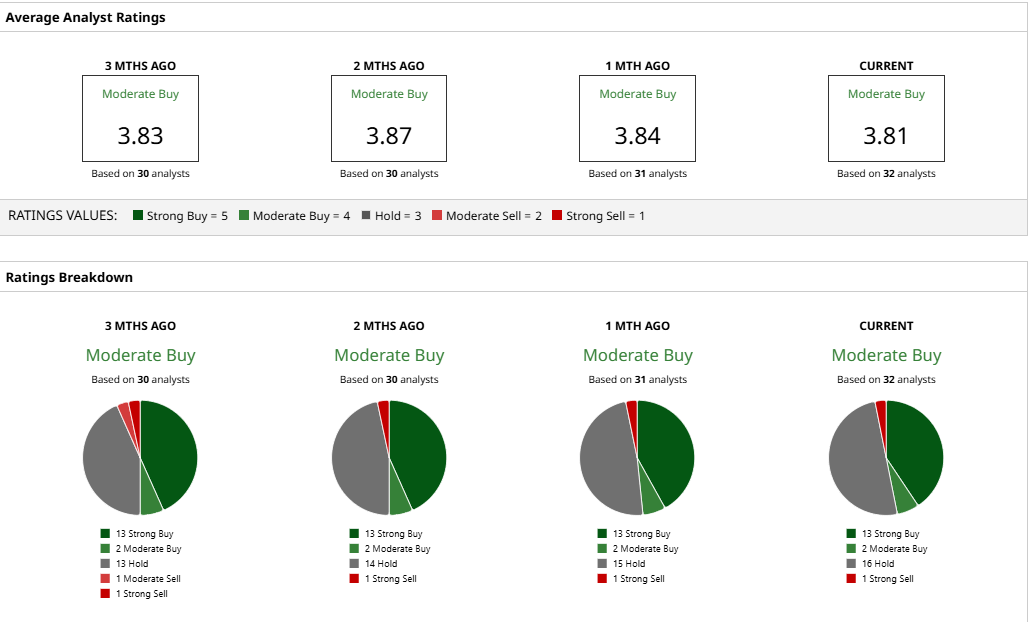

Considering all of this, analysts have deemed ON stock a “Moderate Buy,” with a mean target price of $57.52 that has already been surpassed. The high target price of $75 indicates upside potential of 29% from current levels. Out of 32 analysts covering the stock, 13 have a “Strong Buy” rating, two have a “Moderate Buy” rating, 16 have a “Hold” rating, and one has a “Strong Sell” rating.