Ardelyx (ARDX) has quietly established itself as one of the most fascinating biotech stories, trading at under $10. With two FDA-approved therapies on the market, IBSRELA and XPHOZAH, delivering consistent growth, Ardelyx is not just another speculative clinical-stage biotech. It is building a sustainable commercial business in specialty medicine.

The company’s second-quarter results showed a kind of momentum rarely seen in small-cap biotech.

Valued at $1.5 billion, ARDX stock has returned 422% over the past three years and 21.5% year-to-date (YTD). Nonetheless, Wall Street feels this under-$10 stock has the potential to increase 141% from its current levels.

Strong Financial Momentum

Ardelyx is a biotech company focused on discovering, developing, and commercializing first-in-class medicines that target cardiovascular and kidney diseases. It presently has two commercially available products and is developing others. IBSRELA (tenapanor) is used to treat adults with irritable bowel syndrome with constipation (IBS-C). Meanwhile, XPHOZAH (tenapanor) is used to treat patients with chronic kidney disease (CKD) who require dialysis and have hyperphosphatemia (high phosphate levels).

In the second quarter, Ardelyx reported total revenue of $97.7 million, up 33% from $73.2 million in the year-ago quarter. This growth was fueled mostly by IBSRELA sales and product supply revenue from international partners. Collaboration and supply sales generated more than $6 million, diversifying the top line.

Notably, IBSRELA net product sales reached $65 million, up 84% year-on-year (YoY). Patient demand remains consistent, and prescription pull-through has improved. Based on this momentum, Ardelyx boosted its full-year 2025 sales projection to $250 million to $260 million, a significant step toward meeting peak sales expectations of more than $1 billion. Meanwhile, XPHOZAH sales fell to $25 million in Q2 from $37.1 million in the same period last year, owing to the loss of Medicare coverage, but increased by 7% sequentially. However, management sees encouraging signs that XPHOZAH's market strategy is gaining traction, with peak sales potential estimated at $750 million.

In the quarter, Ardelyx's chief finance and operations officer, Justin Renz, revealed that he will leave the company later this year after a long tenure of five years. While leadership transitions can sometimes unsettle investors, the tone here is different. Renz noted that Ardelyx is in a solid position and well-prepared for the next stage of growth.

Ardelyx is still in the growth stage, which is why it is still unprofitable. Net loss, however, narrowed significantly, improving from $41 million in Q1 to $19.1 million in Q2, versus a loss of $16.5 million a year earlier.

Outlook: A $1.75 Billion Opportunity

Ardelyx remains focused on unlocking the full potential of its two approved therapies. With IBSRELA on course for blockbuster status and XPHOZAH regaining traction despite reimbursement challenges, the business expects combined peak net sales to exceed $1.75 billion. Ardelyx ended Q2 with $238.5 million in cash, equivalents, and short-term investments, with a solid cushion to fund growth. Its outstanding debt currently stands at $200 million, with the option to borrow an additional $100 million in two $50 million tranches next year, providing the company with more flexibility. This strengthened financial position provides the runway needed to scale its commercial assets while continuing to invest in growth opportunities.

What Does Wall Street Say About ARDX Stock?

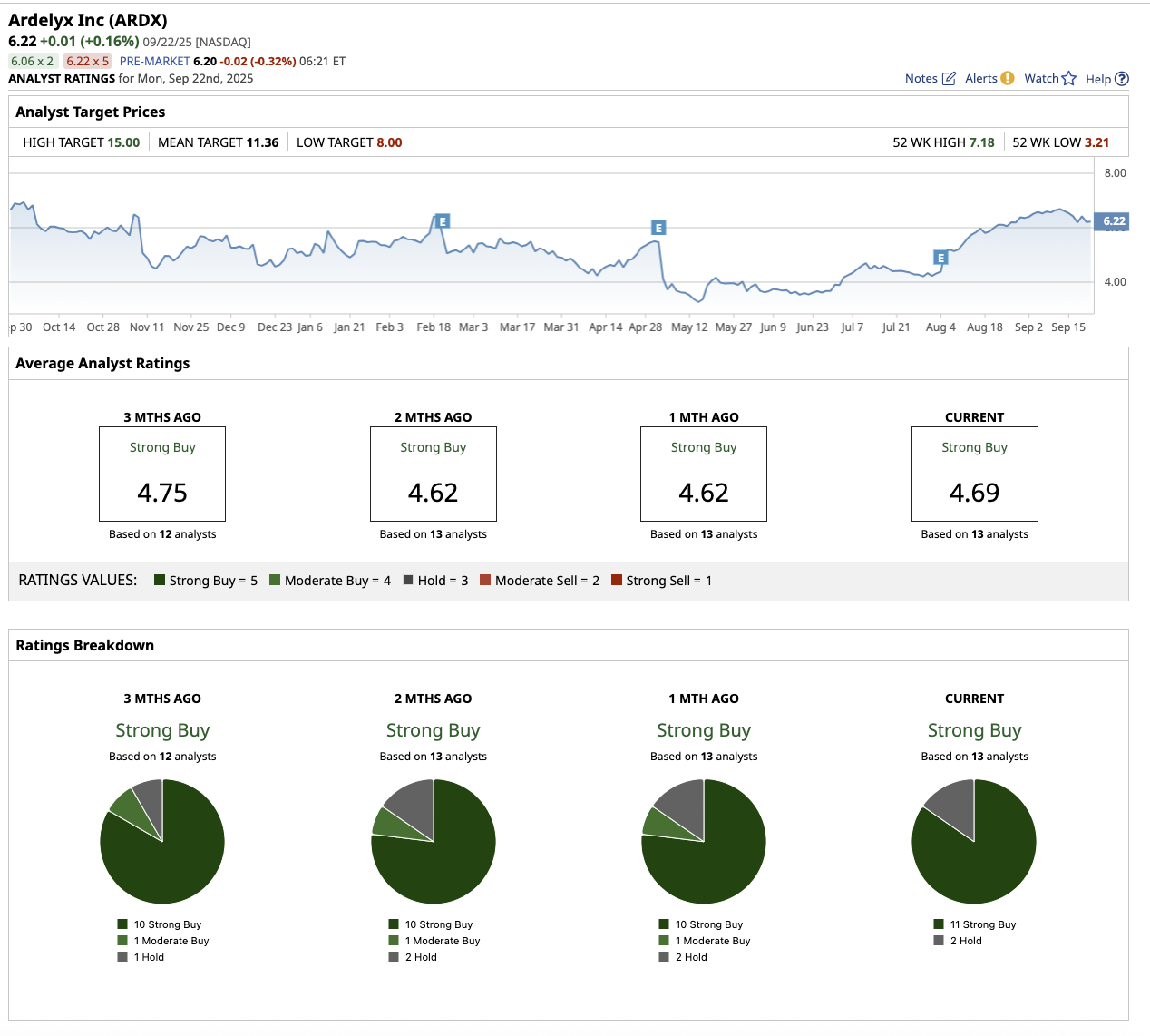

Following a strong Q2, analysts at Citi, H.C. Wainwright, Wedbush, Scotiabank, and many others maintained their “Buy” rating for ARDX stock. Separately, Raymond James analyst Christopher Raymond upgraded the stock to “Strong Buy” from “Outperform,” raising the price target to $14 from $12. Raymond described Ardelyx as a "strong commercial execution story." He noted that the company could ultimately break out of its range-bound trading pattern as momentum rises under the new management team and the growth of its kidney disease treatment, XPHOZAH, picks up.

Overall, Wall Street rates Ardelyx stock a consensus “Strong Buy.” Out of the 13 analysts who cover ARDX, 11 recommend a “Strong Buy,” and two recommend a “Hold.” The average analyst price target of $11.36 represents a potential 82.6% increase from current levels.

While analysts expect the stock to soar 141% over the next 12 months, based on its high target price of $15, I believe ARDX is a better buy-and-hold biotech opportunity for the long term. With two differentiated therapies already commercialized, accelerating revenue growth, improved margins, and a clear path to profitability, Ardelyx is building a foundation for long-term success.