/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

The race to dominate space is no longer limited to just exploration, but is also about securing tomorrow’s infrastructure and defense systems.

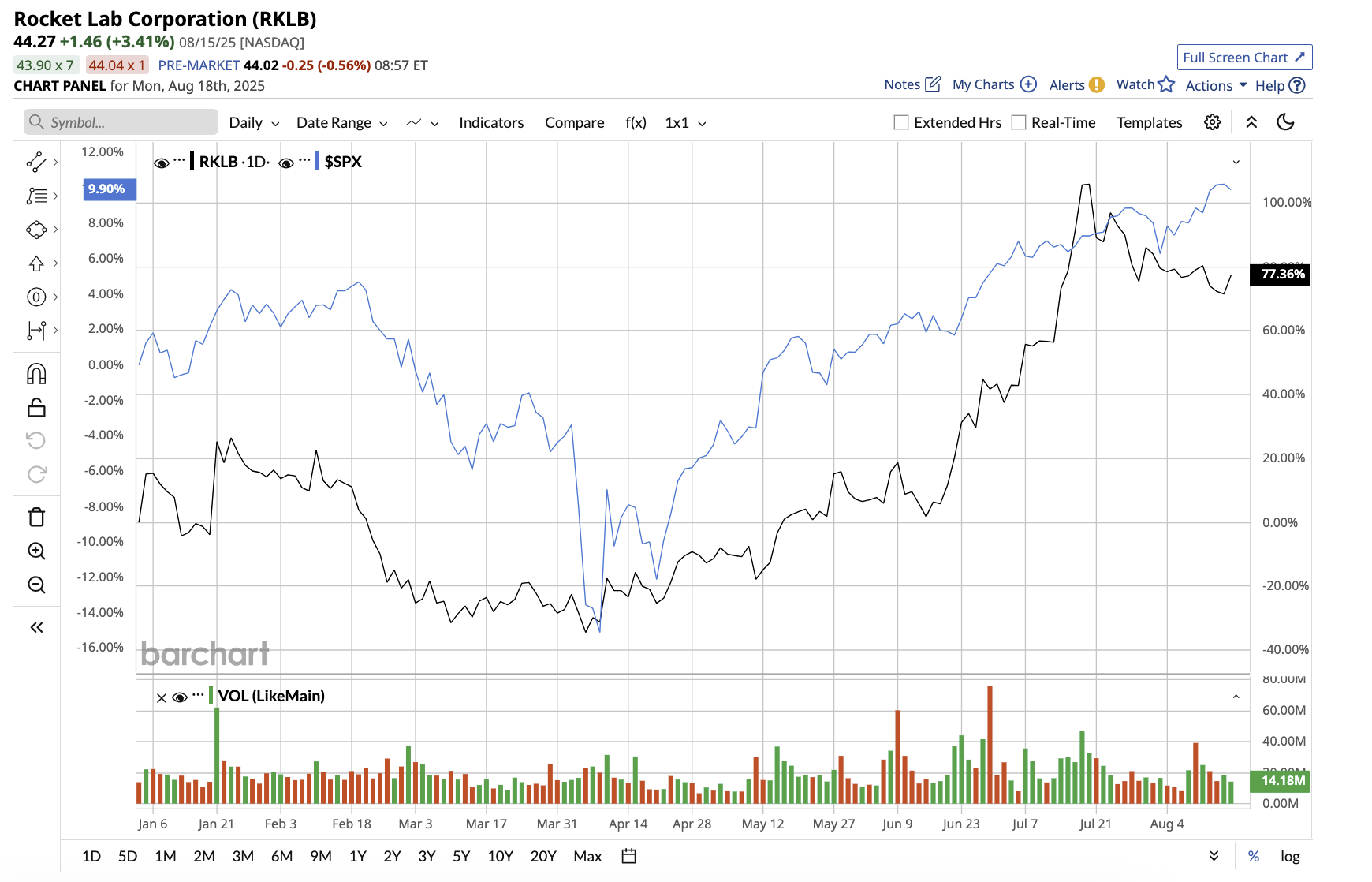

Among the most ambitious players, Rocket Lab (RKLB) is emerging as one of the most compelling space companies. Rocket Lab stock has soared 604.6% over the past year. So far this year, the stock has captured attention, rising 81.5%, wildly outperforming the broader market gain.

The global space economy is estimated to be worth $1.8 trillion by 2035. With record revenues, expanding contracts with space agencies and the U.S. Department of Defense, and its upcoming Neutron rocket program, the company is making a strong case that it could be a leading player in the next trillion-dollar opportunity in space. Let’s find out if RKLB stock is a buy now.

About Rocket Labs

Valued at $20.4 billion, Rocket Lab specializes in launch services, spacecraft manufacturing, and satellite solutions. The company is best known for its Electron rocket, a small-lift launch vehicle used to place small satellites in orbit. It has a lifting capacity of about 300 kilograms. Electron is one of the most frequently launched U.S. rockets after Elon Musk-owned SpaceX’s Falcon 9, mainly serving the small satellite market. To compete more directly with SpaceX, the company is developing Neutron, a larger rocket designed for medium-class payloads and potentially reusable launch systems.

The company also manufactures spacecraft platforms and components, which are not only used in Rocket Lab missions, but also sold to other aerospace and defense firms. This diversification is critical because the satellite market and defense-related contracts generate recurring, high-margin revenue streams in contrast to the capital-intensive launch business.

Rocket Lab Is Soaring High

In the second quarter, total revenue came in at $144.5 million, a 36% year-over-year increase. Space Systems delivered $97.9 million in revenue driven by rising demand for satellite components and manufacturing. Launch Services generated $66.6 million, indicating strong demand for Electron launches and early pipeline momentum for Neutron and the hypersonic-testing HASTE program. Importantly, Rocket Lab ended Q2 with $1 billion in backlog, demonstrating its robust order pipeline. Management anticipates that approximately 58% of this backlog will be converted to revenue within the next 12 months, providing the company with visibility into near-term growth. With 70 launches completed, Electron has shown dependability that competitors in the small-launch market struggle to match. While Electron is Rocket Lab’s present, Neutron is its future.

Neutron, designed as a reusable medium-lift rocket, will compete directly with SpaceX’s Falcon 9 for commercial and national security missions. The company anticipates receiving Neutron’s first launch license by the end of this year.

During the Q2 earnings call, management emphasized that Rocket Lab is not simply building one rocket. Instead, it is investing in scalable infrastructure to accommodate multiple Neutron flights each year. The company intends to produce three Neutrons per year beginning next year, thanks to automated composite manufacturing and long-lead equipment orders. If successful, Neutron could help Rocket Lab capture a much larger share of the more than $100 billion global launch services market.

Furthermore, one of Rocket Lab’s boldest moves this year has been the acquisition of GEOST, a leading manufacturer of space-based missile tracking satellites. This agreement solidifies Rocket Lab’s strategy of vertical integration, from launch to spacecraft and now payloads. This establishes the company as a one-stop shop for national security operations.

Rocket Lab’s ambitions go far beyond Earth orbit. The company has been heavily involved in Mars exploration, providing components for missions such as NASA’s InSight lander, the Perseverance rover’s cruise stage, and the Ingenuity helicopter.

The company remains unprofitable due to high R&D costs. Net losses came in at $0.13 per share, while adjusted EBITDA losses reached $27.6 million. At the end of the second quarter, liquidity remained strong at $754 million in cash, cash equivalents, restricted cash, and marketable securities.

Despite the tremendous opportunities, risks persist. A slip in Neutron’s launch schedule could dampen momentum and test investor patience. Rocket Lab must deliver on time, at scale, and with unwavering reliability.

Looking ahead, management anticipates Q3 revenue to be between $145 million and $155 million. Adjusted gross margins could reach 39% to 41%, indicating improved launch economics and overhead absorption. Adjusted EBITDA loss is expected to narrow to between $21 million and $23 million, highlighting the company’s progress toward profitability as R&D spending shifts from development to recurring flight operations.

Analysts covering Rocket Lab stock predict that revenue will increase by 34.6% in 2025, followed by a 52.6% increase in 2026. Analysts anticipate that losses will gradually decrease by next year. Trading at 36 times forward sales, Rocket Lab’s stock is steep, but it reflects investors’ high expectations.

What Does Wall Street Say About Rocket Lab Stock?

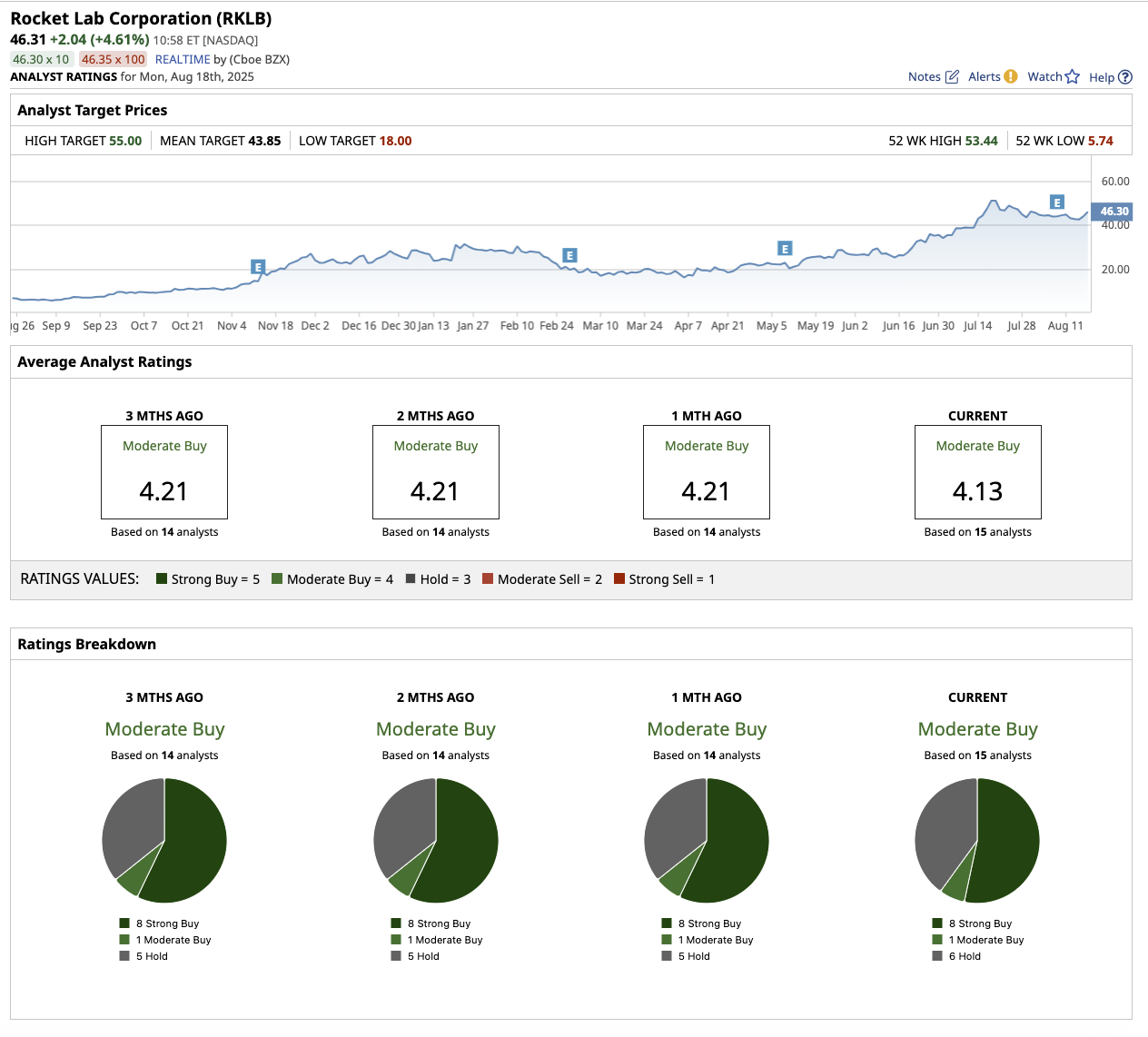

Overall, Wall Street rates Rocket Lab stock a “Moderate Buy.” Of the 15 analysts who cover the stock, eight rate it as a “Strong Buy,” one says it is a “Moderate Buy,” while the remaining six rate it a “Hold.” The stock has surpassed its average target price of $43.85. But its high target price of $55 implies a 22% increase from current levels.

The Key Takeaway

Given the financial momentum, a billion-dollar backlog, and strong liquidity, if Rocket Lab executes on its strategy, it could emerge as a key player in the next wave of the space industry, which could be worth trillions within the next decade.

While Rocket Lab is an intriguing growth stock, risk-averse investors may want to wait until the company generates a profit before making any investment decisions.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.