/AI%20(artificial%20intelligence)/AI%20engineer%20working%20on%20laptop%20by%20ART%20STOCK%20CREATIVE%20via%20Shutterstock.jpg)

When investors think of artificial intelligence (AI), headline-grabbing chipmakers like Nvidia (NVDA) and AMD (AMD) dominate the conversation. But behind the scenes, another semiconductor manufacturer, Marvell Technology (MRVL), is quietly driving the AI revolution. Marvell’s chips are at the heart of AI data centers, 5G networks, and next-generation automotive systems, providing the critical infrastructure that enables huge AI workloads.

With the company shifting its focus to custom AI silicon and data center networking, the question remains if this hidden AI stock is ready for its next big run.

Marvel's Strategic Refocus on AI and Data Centers

In the second quarter of fiscal 2026, total revenue climbed by 58% year-on-year (YoY) to $2.01 billion. Marvell's successful transition to the semiconductor industry's fastest-growing segment resulted in a 69% increase in data center revenue to $1.5 billion. Data center sales comprised about 74% of the total revenue. Data center now dominates the company’s top line, growing from accounting for 34% of revenue in fiscal 2024 to a commanding 74% in fiscal 2026.

Profitability also surged in Q2, with adjusted earnings per share (EPS) rising 123% YoY to $0.67, more than double the rate of revenue growth. Adjusted gross margin landed at 59.4%, compared to 46.1% in the year-ago quarter. Marvell's growth is being driven by its increasing presence in custom AI silicon. Management noted that its AI design engagements are at an all-time high, with hyperscale customers becoming increasingly interested in its distinctive technology. Its electro-optics franchises continue to experience high demand, particularly for current and next-generation solutions that enable quicker, more efficient transfer of data across large-scale AI systems. Meanwhile, Marvell's scale-out switching systems, which are crucial for connecting AI clusters, are also expected to make significant progress.

Resilient Non-Data Center Segments

Marvell generates 26% of total sales from enterprise networking, carrier infrastructure, consumer, and industrial segments, which have also begun to recover. The combined enterprise networking and carrier infrastructure markets have recovered dramatically, with the third-quarter forecast assuming an annualized revenue run rate of approximately $1.7 billion, nearly doubling the low point of $900 million recorded in fiscal 2025.

Beginning next quarter, Marvell will simplify its financial reporting to reflect its new focus. The company intends to report only two revenue categories: Data Center and Communications & Other. Further down the line, Marvell forecasts these two businesses to generate approximately $2 billion in annual revenue, supported by renewed product portfolios based on advanced process nodes. The company also anticipates $300 million in annual consumer revenue and $100 million from industrial customers.

Financial Discipline Allows Returns to Shareholders

Marvell continues to return capital to shareholders, paying out $52 million in dividends and repurchasing $300 million of stock in the second quarter. Additionally, the company entered a $1 billion accelerated share repurchase (ASR) agreement. More recently, Marvell launched a $5 billion stock repurchase program. This reflects Marvell's confidence in its business fundamentals and future potential, especially as it grows into accelerated infrastructure for AI. The company expects this market will drive its next phase of revenue growth.

Aside from the top-line and bottom-line momentum, Marvell’s balance sheet continues to strengthen. Marvell ended Q2 with $1.2 billion in cash and equivalents and total debt of $4.5 billion. The company completed a $1 billion public offering of notes, using most of the proceeds to pay down existing debt.

This year, Marvell divested its automotive Ethernet business in a $2.5 billion all-cash transaction. While that segment contributed around $35 million in annual revenue, the sale allows Marvell to sharpen its focus on its AI-driven data center and networking businesses. Marvell believes these areas will see far greater long-term potential. With proceeds of $2.5 billion, Marvell can now accelerate stock buybacks, boost key AI technology investments, and pursue new growth possibilities.

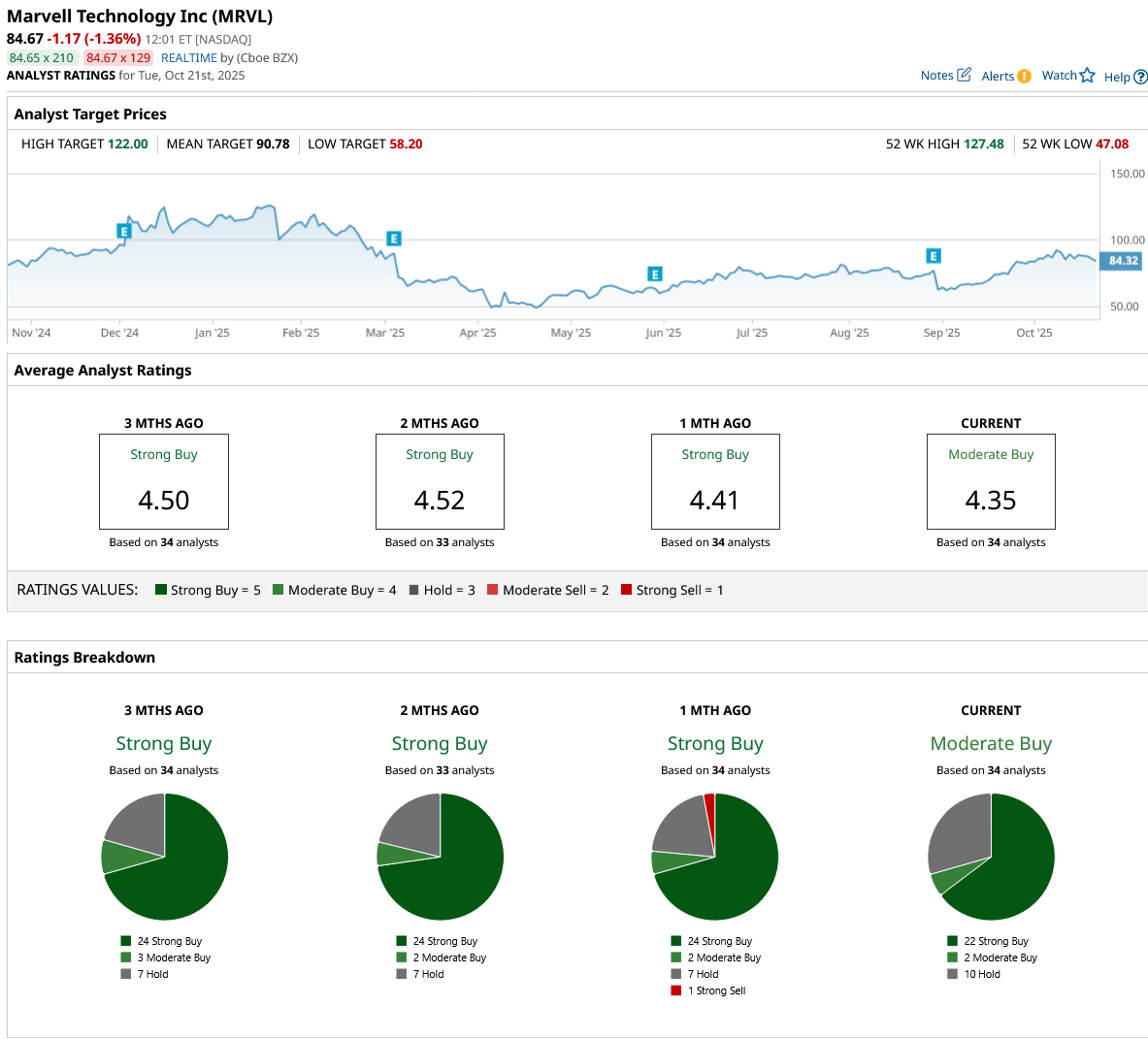

What Are Analysts Saying About MRVL Stock?

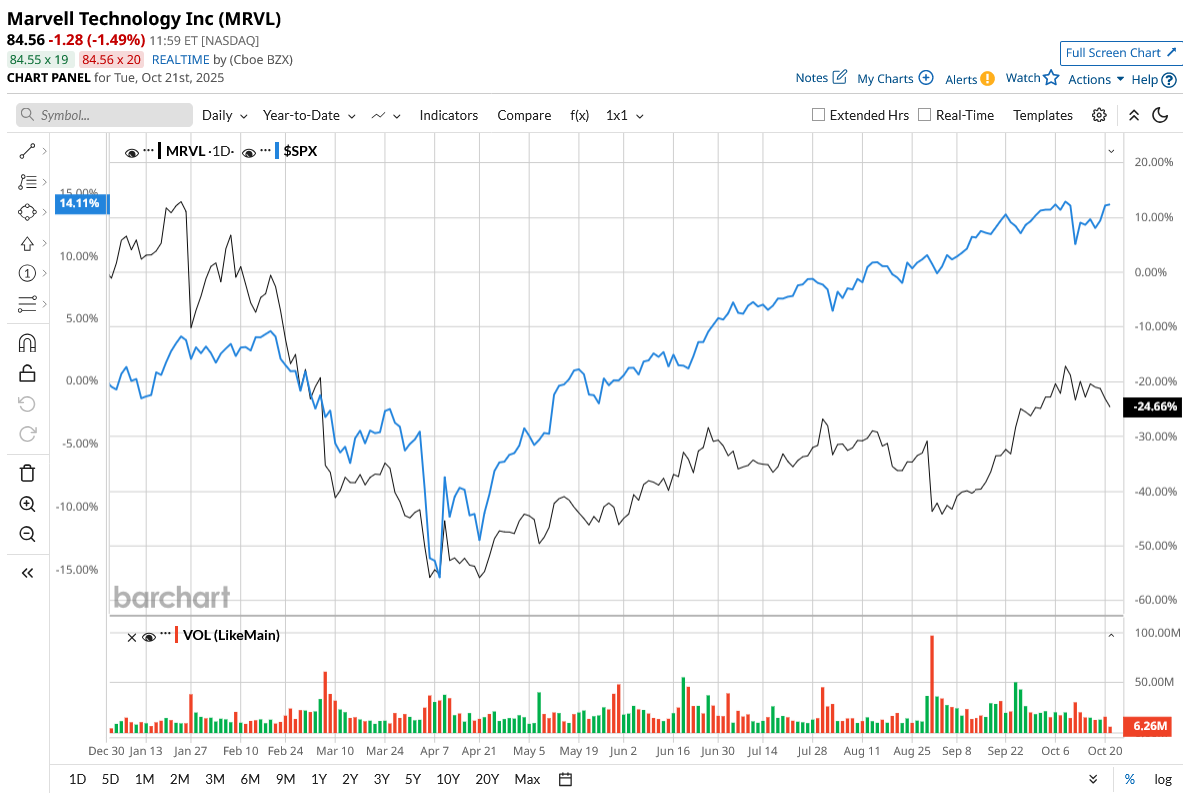

While MRVL stock has dropped 23.7% year-to-date (YTD), Wall Street sees more upside. The average price target for MRVL stock is $90.78, which implies a potential upside of 5.7% from current levels. Additionally, its high target price of $122 implies a potential upside of 42.1% in the next 12 months.

Overall, analysts remain strongly bullish about MRVL stock. Out of the 34 analysts covering it, 22 have rated MRVL a “Strong Buy,” two have a “Moderate Buy” recommendation, and 10 suggest a “Hold.”

The Bottom Line on MRVL Stock

With expanding margins, accelerating earnings, and a sharpened focus on AI infrastructure, Marvell is poised for sustained growth. Its financial discipline, including debt reduction and share repurchases, provides it the flexibility to invest in next-generation technologies. For investors seeking exposure to the AI hardware buildout beyond the obvious GPU names, Marvell Technology might just be the hidden gem ready for its next big run.